BD510 Bingo Duty Promoters Monthly Return Use This Form to Submit Your Promoters Monthly Return Hmrc Gov 2011-2026

Understanding the BD510 Bingo Duty Promoters Monthly Return

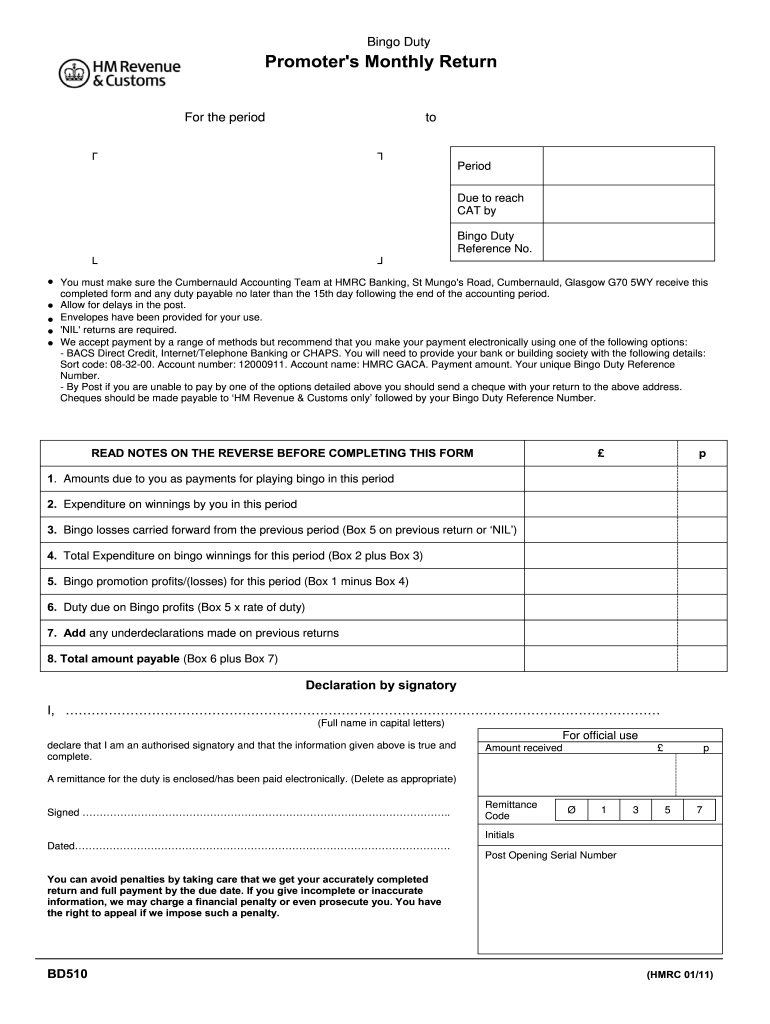

The BD510 Bingo Duty form is essential for promoters in the bingo industry to report their monthly earnings and activities. This form is used to ensure compliance with tax regulations and to provide necessary information to the relevant authorities. It captures details about the bingo games conducted, including the total amount raised and the duty owed. Completing this form accurately is crucial for maintaining legal standing and avoiding penalties.

Steps to Complete the BD510 Bingo Duty Form

Filling out the BD510 Bingo Duty form involves several key steps to ensure all required information is accurately reported. Begin by gathering all relevant financial data from the bingo activities for the month. This includes total receipts, expenses, and any other pertinent details. Next, follow these steps:

- Enter your promoter details, including name, address, and registration number.

- Report the total amount raised from bingo games during the month.

- Calculate the bingo duty owed based on the reported earnings.

- Review all entries for accuracy before submission.

Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance requirements.

Legal Considerations for the BD510 Bingo Duty Form

Using the BD510 Bingo Duty form correctly is not just a matter of compliance; it is also a legal obligation. Failing to submit accurate information can lead to severe penalties, including fines or legal action. It is important to understand the legal framework surrounding bingo operations, including local and federal regulations. Ensure that all data entered is truthful and complete to avoid any legal repercussions.

Submission Methods for the BD510 Bingo Duty Form

The BD510 Bingo Duty form can be submitted in various ways to accommodate different preferences. The primary methods include:

- Online Submission: Many promoters prefer to submit the form electronically for convenience and speed.

- Mail Submission: If preferred, the form can be printed and sent via postal service to the relevant authority.

- In-Person Submission: Some may choose to deliver the form directly to the local office for immediate processing.

Each method has its own set of guidelines, so it is advisable to check the specific requirements based on the chosen submission method.

Key Elements of the BD510 Bingo Duty Form

Understanding the key elements of the BD510 Bingo Duty form is essential for accurate completion. The form typically includes:

- Promoter Information: Name, address, and registration details.

- Financial Data: Total income from bingo activities and any applicable deductions.

- Bingo Duty Calculation: The amount of duty owed based on the reported income.

- Signature: A declaration confirming the accuracy of the information provided.

Each section must be filled out with care to ensure compliance and avoid issues with authorities.

Consequences of Non-Compliance with the BD510 Bingo Duty Form

Non-compliance with the BD510 Bingo Duty form can lead to significant consequences. Failing to submit the form on time or providing inaccurate information can result in:

- Fines: Financial penalties can be imposed for late or incorrect submissions.

- Legal Action: In severe cases, promoters may face legal repercussions for failure to comply with tax regulations.

- Loss of License: Continued non-compliance may jeopardize the ability to operate legally in the bingo industry.

It is crucial for promoters to remain diligent in their reporting to avoid these potential issues.

Quick guide on how to complete bd510 bingo duty promoters monthly return use this form to submit your promoters monthly return hmrc gov

A concise tutorial on preparing your BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov

Finding the correct template can present a difficulty when you need to submit formal international documents. Even if you possess the required form, it might be tedious to swiftly complete it in accordance with all the stipulations if you rely on printed copies instead of managing everything digitally. airSlate SignNow is the web-based eSignature tool that assists you in overcoming all of those hurdles. It enables you to obtain your BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov and promptly fill it out and sign it on-site without reprinting documents in the event of an error.

Follow these steps to prepare your BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov using airSlate SignNow:

- Click the Get Form button to instantly upload your document to our editor.

- Begin with the first blank field, input your information, and move on with the Next option.

- Populate the empty fields using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line features to emphasize key information.

- Click on Image and upload one if your BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov necessitates it.

- Make use of the right-side panel to add additional fields for you or others to complete if required.

- Review your entries and confirm the document by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the document modifications by clicking the Done button and choosing your file-sharing preferences.

Once your BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov is prepared, you can distribute it as you wish - send it to your recipients via email, text message, fax, or even print it directly from the editor. You can also securely store all your finished documents in your account, neatly organized in folders based on your preferences. Don’t squander time on manual document preparation; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

In which particular month do we need to fill out an IT return?

The lat date of filing return of income in India is 31 st July, therefire genertsky peoples files their return of income in the month of July.

-

How can I fill my GST return for September when I am filling out the GST monthly by an accountant but now, I’m trying it myself?

Hi You can use the tool like SCIGST to file your GST Returns on time and with accuracy along with reconciliation facility with GSTR 2A (Data Uploaded by your supplier)SCIGST Provide you an import facility of your account data from all popular accounting packages , and helps you upload your correct retuns on GST Portalvisit SCIGST for more details and contact

-

Is it compulsory to fill out the GST return every month with no sale done in an e-Commerce business?

It is good news for you , if you did not fill the GST return from July 2017 to September 2018 than government already waive off the penalty. Now you can file return without penalty for this time period.If you are not doing any business than also you have to fill the return ,it is call NULL return where the value of return is zero because you do not have any sale and purchase.The government has launched a one-time scheme to waive late fee for delayed furnishing of filing the goods and services tax (GST) return-1 form for the period July 2017 to September 2018, to encourage taxpayers to furnish the returns.The waiver, which will be effective till 31 October 2018, provides a lot of relief to businesses and traders, who have to file a summary of the transactions made every month in the GST return-3B form and a filed a detailed return of the sales in the GST return-1 form.“Non-furnishing of GST return-1 is liable to late fee and penalty as per law. In order to encourage taxpayers to furnish GST return-1, a one-time scheme to waive off late fee payable for delayed furnishing of GST return-1 for the period from July 2017 to September 2018 till 31 October 2018 has been launched,” said the finance ministry.Ref- LivemintYou can fill GST return by yourself or you can hire professional services. If you go for any local service provider for GST return filling than they charge following amountRegular GST :-NULL GST Return Fill charges- 1000/- to 2000/- rs per monthGST Accounting and Return filling - 2500/- to 5000/- per monthComposition GST:-NULL GST Return Fill charges- 1000/- to 2000/- rs per QuarterGST Accounting and Return filling -4000/- to 7000/- per QuarterWhereas I recommend an online service provider Affordable GST Accounting and Return Filling Services , they are very reliable and fast service provider. They charge very less compare to other service provider. For reference I give you the chargesRegular GST :-NULL GST Return Fill charges- 399/- per monthGST Return Filling - 500/- per monthGST Accounting and Return filling - 1500/-to 2500/- Per monthComposition GST:-NULL GST Return Fill charges- 500/- rs per QuarterGST Return Filling - 750/- rs per QuarterGST Accounting and Return filling -3000/- per QuarterFirst I also hesitate to take online services, but they did it for me , Actually I want accounting service as well and not understanding how will I send my all sell and purchase bill to them but they send me cloud software where I have to enter my all sell and purchase info and than automatically they fill return, it is very easy process and fast one. I highly recommend them.To get the service you can call them on 7568890985 or whats app them , support team will help you and response back to you.

-

I am doing an export but my turnover will be less than 1.5 crore. Will I have to fill out the GST return monthly or quarterly?

Taxpayers with an annual aggregate turnover up to Rs 1.5 crore in the previous financial year or anticipated in the current financial year can avail the option of filing GSTR1 quarterly.It is optional, user can file monthly or quarterly up to 1.5 Cr.Now govt has proposed new return format :RET-1RET-2 (sahaj), only for B2Cs supplyRET-3 (sugam)Small taxpayers having turnover up to Rs. 5 Cr. have the option to file one of 3 forms, namely – Quarterly return (RET-1), Sahaj (RET-2) or Sugam (RET-3).

-

Can anyone share a link on how to fill out the GST and GST annual return?

The deadline for filing GST Return for the year 17–18 is fast approaching .To file the GST annual return you need to reconcile the data appearing in your returns with the data in your financial books.You can watch the below video to have a basic idea about filing GST annual returnEnglish :Hindi :

Create this form in 5 minutes!

How to create an eSignature for the bd510 bingo duty promoters monthly return use this form to submit your promoters monthly return hmrc gov

How to make an eSignature for your Bd510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov online

How to make an electronic signature for the Bd510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov in Google Chrome

How to create an eSignature for putting it on the Bd510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov in Gmail

How to generate an eSignature for the Bd510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov straight from your smartphone

How to make an eSignature for the Bd510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov on iOS devices

How to generate an electronic signature for the Bd510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov on Android

People also ask

-

What is a bingo duty return?

A bingo duty return is an essential document for organizations that host bingo games, detailing the revenue generated and taxes owed. Understanding how to complete a bingo duty return accurately is crucial for compliance with tax regulations. airSlate SignNow makes it easier to prepare and eSign these documents efficiently.

-

How can airSlate SignNow assist with filing a bingo duty return?

airSlate SignNow streamlines the process of creating and submitting a bingo duty return by providing customizable templates and eSigning capabilities. Users can easily fill out required fields, sign documents digitally, and send them for approval in one platform. This not only saves time but also reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for bingo duty returns?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting with a free trial to explore its features. For organizations specifically handling bingo duty returns, these plans provide value with tools designed for efficiency and compliance. Check the pricing page for detailed options and find a plan that meets your requirements.

-

Are there any key features that help with managing bingo duty returns?

Yes, airSlate SignNow includes several key features beneficial for managing bingo duty returns. Notable features include document templates, automated reminders, and secure data storage. These functionalities ensure that all necessary information is captured accurately and deadlines are met, enhancing your workflow.

-

Can I integrate airSlate SignNow with other tools for better handling of bingo duty returns?

Absolutely! airSlate SignNow offers integrations with various third-party applications like CRM systems and accounting software. By integrating with these tools, users can automate data transfers and streamline their workflow further in managing bingo duty returns, making the process even more efficient.

-

What benefits does eSigning provide for bingo duty returns?

eSigning through airSlate SignNow offers numerous benefits for bingo duty returns, including faster document turnaround and enhanced security. Signatures are legally binding, ensuring compliance and valid submissions. Furthermore, eSigning eliminates the need for paper, promoting sustainability and cost savings.

-

Is airSlate SignNow secure for handling sensitive bingo duty return information?

Yes, airSlate SignNow prioritizes security and utilizes advanced encryption protocols to protect sensitive data, including bingo duty return information. The platform is compliant with industry standards, ensuring that all transactions and documents are stored securely. Users can trust that their information will remain confidential.

Get more for BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov

Find out other BD510 Bingo Duty Promoters Monthly Return Use This Form To Submit Your Promoters Monthly Return Hmrc Gov

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF