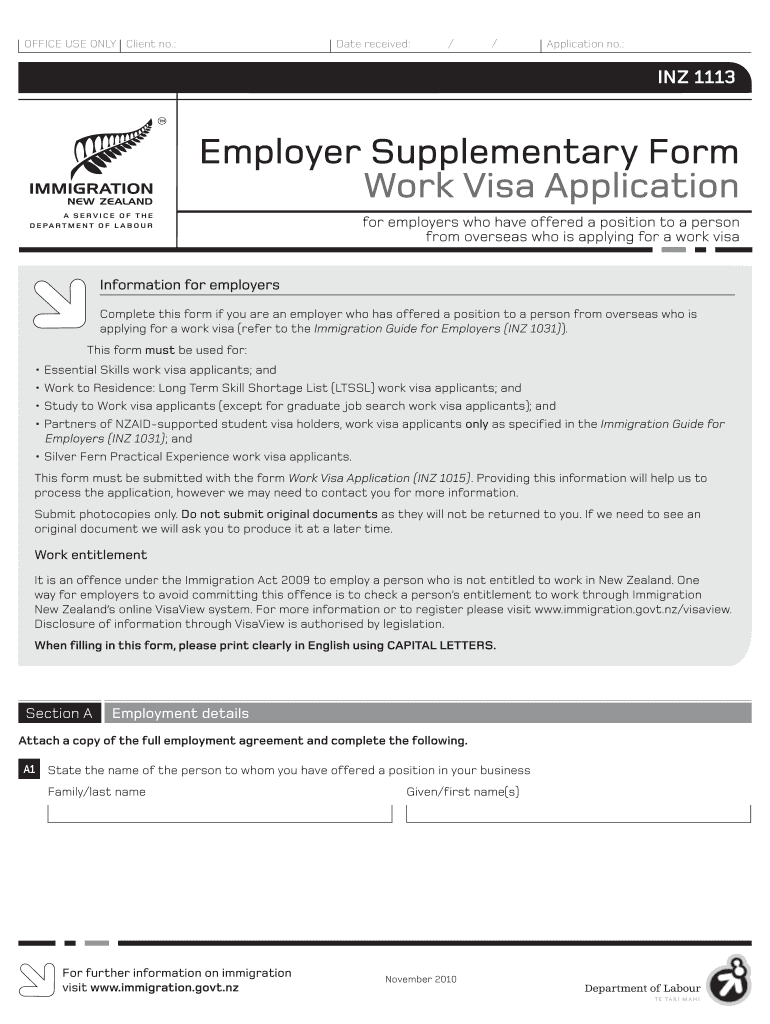

Employer Supplementary Form

What is the Employer Supplementary Form

The employer supplementary form is a crucial document used in various employment-related processes, particularly when applying for certain visas or residency statuses in the United States. This form collects essential information about the employee's role, salary, and employment conditions. It is often required to demonstrate the employer's commitment to the employee's application and to provide necessary details that support the application process.

How to Use the Employer Supplementary Form

To effectively use the employer supplementary form, follow these steps:

- Gather all necessary information about the employee, including job title, salary, and employment duration.

- Ensure that the form is filled out accurately and completely to avoid delays in processing.

- Review the completed form with legal or HR professionals if needed, especially for complex cases.

- Submit the form through the appropriate channels as specified by the governing body or organization requesting it.

Steps to Complete the Employer Supplementary Form

Completing the employer supplementary form involves several key steps:

- Begin by downloading the latest version of the form, ensuring it is the correct variant for your needs.

- Fill in the employee's personal information, including full name, address, and contact details.

- Provide comprehensive details about the employment, such as job description, salary, and start date.

- Include any additional documentation that may be required, such as proof of employment or company registration.

- Double-check all entries for accuracy before finalizing the form.

Legal Use of the Employer Supplementary Form

The employer supplementary form must be used in compliance with relevant laws and regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. The form serves as a formal declaration of the employment relationship and may be subject to review by immigration authorities or other regulatory bodies.

Key Elements of the Employer Supplementary Form

Several key elements are essential in the employer supplementary form:

- Employee Information: Full name, contact details, and position within the company.

- Employer Information: Company name, address, and contact details.

- Employment Details: Job title, salary, and employment start date.

- Supporting Documentation: Any additional documents that validate the employment status.

Form Submission Methods

The employer supplementary form can be submitted through various methods, depending on the requirements of the requesting authority. Common submission methods include:

- Online Submission: Many organizations allow electronic submissions through secure portals.

- Mail: The form can be printed and mailed to the designated address.

- In-Person: Some situations may require the form to be submitted in person, particularly for sensitive applications.

Quick guide on how to complete employer supplementary form inz 1113

Effortlessly Prepare Employer Supplementary Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, adjust, and electronically sign your documents quickly without delays. Handle Employer Supplementary Form on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Adjust and Electronically Sign Employer Supplementary Form Easily

- Locate Employer Supplementary Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form—via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and electronically sign Employer Supplementary Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

Create this form in 5 minutes!

How to create an eSignature for the employer supplementary form inz 1113

How to make an electronic signature for your Employer Supplementary Form Inz 1113 online

How to make an electronic signature for the Employer Supplementary Form Inz 1113 in Google Chrome

How to create an electronic signature for putting it on the Employer Supplementary Form Inz 1113 in Gmail

How to create an eSignature for the Employer Supplementary Form Inz 1113 right from your smart phone

How to make an eSignature for the Employer Supplementary Form Inz 1113 on iOS

How to make an eSignature for the Employer Supplementary Form Inz 1113 on Android

People also ask

-

What is an employer supplementary form?

An employer supplementary form is a document that provides additional information requested by an employer. It is often used in conjunction with other employment forms, particularly for benefits or contractual obligations, ensuring all necessary details are captured effectively.

-

How can airSlate SignNow help with employer supplementary forms?

airSlate SignNow simplifies the process of creating, sending, and eSigning employer supplementary forms. Our platform allows you to easily customize these forms, ensuring compliance and enhancing the employee onboarding experience, all while maintaining high security standards.

-

Is there a cost associated with using airSlate SignNow for employer supplementary forms?

Yes, using airSlate SignNow comes at a competitive pricing model that varies depending on your business size and needs. We offer affordable plans that encompass a wide range of features, including seamless handling of employer supplementary forms, enhancing your overall workflow efficiency.

-

What features does airSlate SignNow provide for processing employer supplementary forms?

airSlate SignNow offers robust features such as customizable templates, electronic signatures, secure document storage, and real-time tracking for employer supplementary forms. These features ensure that your documents are processed quickly and securely, improving your overall productivity.

-

Are there any integrations available for employer supplementary forms?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Salesforce, and other CRM tools, making it easy to manage your employer supplementary forms within your existing workflows. This connectivity enhances your document management processes signNowly.

-

Can I track the status of my employer supplementary forms with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including employer supplementary forms. You can easily see who has viewed, signed, or completed any steps in the process, ensuring you stay informed at every stage.

-

What are the benefits of using airSlate SignNow for employer supplementary forms?

Using airSlate SignNow for employer supplementary forms streamlines the documentation process, reduces paperwork, and enhances compliance. Additionally, it provides a user-friendly interface that helps improve the overall experience for both employers and employees.

Get more for Employer Supplementary Form

- Tennessee durable power of attorney for health care statute form

- Control number tn p017 pkg form

- Control number tn p019 pkg form

- Control number tn p020 pkg form

- How to form a tennessee partnershiplegalzoomcom

- Tennessee code annotated 32 11 106 form

- Chapter 2108 ohio revised code form

- Nevada uniform anatomical gift act donor network west

Find out other Employer Supplementary Form

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney