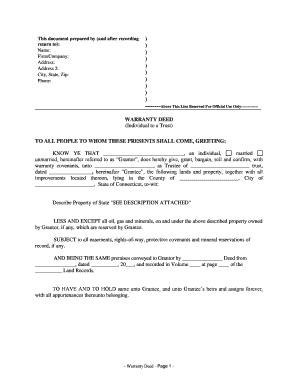

Ct Trust Form

What is the Connecticut Trust?

The Connecticut Trust, often referred to as a ct trust, is a legal arrangement that allows individuals to manage and protect their assets during their lifetime and after their death. This type of trust can be particularly beneficial for estate planning, as it provides a structured way to distribute assets according to the grantor's wishes. A Connecticut Trust can help avoid probate, maintain privacy, and potentially reduce estate taxes. It is essential for individuals to understand the specific provisions and benefits associated with establishing a ct trust to ensure their financial goals are met.

How to Use the Connecticut Trust

Utilizing a Connecticut Trust involves several key steps. First, the grantor must clearly outline their intentions regarding asset management and distribution. This includes specifying beneficiaries and determining how assets will be handled during the grantor's lifetime and after their passing. Next, the trust document must be drafted, often with the assistance of a legal professional, to ensure compliance with Connecticut laws. Once established, the grantor can transfer assets into the trust, which will then be managed according to the terms set forth in the trust document. Regular reviews and updates may be necessary to reflect changes in circumstances or laws.

Steps to Complete the Connecticut Trust

Completing a Connecticut Trust involves a series of organized steps:

- Define the Purpose: Determine the goals of the trust, such as asset protection or estate planning.

- Select a Trustee: Choose a reliable individual or institution to manage the trust assets.

- Draft the Trust Document: Work with an attorney to create a legally binding document that outlines the trust's terms.

- Fund the Trust: Transfer ownership of assets into the trust, which may include real estate, bank accounts, and investments.

- Review and Revise: Regularly assess the trust to ensure it aligns with current laws and personal circumstances.

Legal Use of the Connecticut Trust

The legal use of a Connecticut Trust is governed by state laws that dictate how trusts are created, managed, and enforced. It is vital for the trust to be established in accordance with Connecticut statutes to ensure its validity. This includes adhering to requirements for trust documentation, trustee responsibilities, and beneficiary rights. Legal compliance helps protect the interests of all parties involved and ensures that the trust can effectively serve its intended purpose. Consulting with a legal expert familiar with Connecticut trust laws can provide guidance throughout the process.

Key Elements of the Connecticut Trust

Several key elements define a Connecticut Trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust Document: The legal document that outlines the terms and conditions of the trust.

- Assets: Property or financial resources placed into the trust for management and distribution.

State-Specific Rules for the Connecticut Trust

Connecticut has specific rules governing the establishment and operation of trusts. These include regulations on the validity of trust documents, the rights of beneficiaries, and the responsibilities of trustees. It is crucial to adhere to these state-specific guidelines to avoid legal complications. For instance, Connecticut law requires that trusts be executed in writing and signed by the grantor. Additionally, the state has provisions regarding the modification and termination of trusts, which can impact how assets are managed over time. Understanding these rules is essential for effective trust management.

Quick guide on how to complete ct trust

Effortlessly prepare Ct Trust on any device

Digi document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ct Trust on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Ct Trust with ease

- Obtain Ct Trust and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Alter and eSign Ct Trust and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut warranty and how does it work?

A Connecticut warranty is a legal agreement that provides assurance regarding the repair or replacement of your home’s systems and appliances. It typically covers issues that arise due to normal wear and tear. By investing in a Connecticut warranty, homeowners can gain peace of mind knowing that unexpected repairs won’t break the bank.

-

How much does a Connecticut warranty typically cost?

The cost of a Connecticut warranty can vary based on the level of coverage and the provider. Most warranties range from $300 to $600 annually, depending on which systems and appliances are included. It's essential to compare different plans to find the one that best fits your needs and budget.

-

What features should I look for in a Connecticut warranty?

When evaluating a Connecticut warranty, look for comprehensive coverage options, including major appliances, HVAC systems, and plumbing. It's also important to ensure the warranty includes a repair guarantee and allows for a wide range of service providers. Reviewing customer reviews and service response times can also help in making a decision.

-

What benefits does a Connecticut warranty offer to homeowners?

A Connecticut warranty provides several benefits, including financial protection against costly repairs and the convenience of having a single point of contact for maintenance. It can signNowly reduce the stress of unexpected home repairs, allowing homeowners to budget more effectively. Additionally, many warranties increase property value by presenting a well-maintained home.

-

Are there any exclusions in a Connecticut warranty?

Yes, most Connecticut warranties will include specific exclusions, such as pre-existing conditions, lack of maintenance, and certain types of damage. It’s crucial to read the fine print to understand what is covered and what is not. This will help you avoid surprises when you actually need to use the warranty.

-

How can I file a claim with my Connecticut warranty?

Filing a claim with your Connecticut warranty company is typically a straightforward process. Most companies allow you to file a claim online or over the phone. You’ll need to provide details about the issue, and then a service technician will be dispatched to assess the problem and determine if it’s covered under your warranty.

-

What happens if my claim is denied?

If your claim is denied under your Connecticut warranty, you will receive a detailed explanation from the warranty provider. Common reasons for denial include coverage exclusions or failure to maintain collateral systems. If you believe the denial was unjustified, you can often appeal the decision by providing additional evidence or documentation.

Get more for Ct Trust

- Date by person acknowledging title or form

- Preliminary notice utah state construction registry scr form

- Bill of sale form virginia quitclaim deed form templates

- Partial denial of claim form

- Inherent risks of equine activities pursuant to utah code ann form

- Contractors guide utah state construction registry form

- Small claims utah courts utah state courts form

- Subcontractors request for notice of preliminary notice received corporation form

Find out other Ct Trust

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed