From Sales of Employers Securities Form

What is the From Sales of Employers Securities

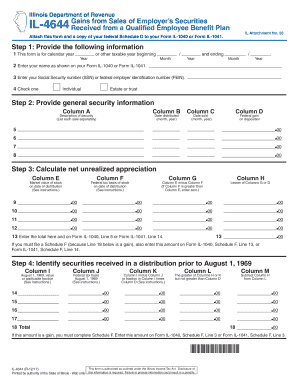

The From Sales of Employers Securities, commonly referred to as the il 4644 rsu, is a tax form utilized in the United States to report the sale of stock acquired through an employer's stock option or similar plan. This form is essential for employees who have received shares as part of their compensation package, allowing them to accurately report any gains or losses from the sale of these securities. The il 4644 serves to ensure compliance with IRS regulations and helps in calculating the net unrealized appreciation, which is crucial for tax purposes.

Steps to Complete the From Sales of Employers Securities

Completing the From Sales of Employers Securities involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the stock sale, including purchase dates, sale dates, and the number of shares sold. Next, determine the cost basis of the shares, which is typically the price paid for the stock plus any commissions. Then, calculate the proceeds from the sale by multiplying the number of shares sold by the sale price. Finally, report these figures on the form, ensuring that all calculations are accurate and that any applicable deductions are included.

Legal Use of the From Sales of Employers Securities

The legal use of the From Sales of Employers Securities is governed by IRS regulations, which stipulate that accurate reporting of stock sales is mandatory for tax compliance. This form must be filed in conjunction with other tax documents and is subject to audit by the IRS. Proper use of the il 4644 ensures that taxpayers can substantiate their reported income and any claims for deductions related to stock sales, thereby minimizing the risk of penalties or legal issues.

IRS Guidelines

IRS guidelines for the From Sales of Employers Securities outline the requirements for reporting stock sales accurately. Taxpayers must adhere to specific instructions regarding the timing of the form submission, the information required, and the calculation of gains or losses. It is crucial to stay updated on any changes to these guidelines, as they can affect how the form is completed and submitted. Consulting the IRS website or a tax professional can provide additional clarity on these guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the From Sales of Employers Securities are typically aligned with the annual tax filing deadline, which is April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to keep track of any specific deadlines related to the il 4644 to avoid late filing penalties. Additionally, taxpayers should be aware of any changes in deadlines that may arise due to legislative updates or IRS announcements.

Required Documents

To complete the From Sales of Employers Securities, several documents are required. These include records of the stock purchase and sale, such as transaction confirmations, brokerage statements, and any relevant tax documents that detail the cost basis and sale proceeds. Having these documents organized and readily available can streamline the completion process and ensure that all necessary information is accurately reported on the form.

Quick guide on how to complete il 4644 rsu

Complete il 4644 rsu seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage il 4644 rsu on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign il 4644 with ease

- Obtain net unrealized appreciation and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about missing or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign form il 4644 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs form il 4644

-

What are telltale signs that you're working at a "sinking ship" company?

Leo Tolstoy's Anna Karenina Principle states, "Happy families are all alike, but every unhappy family is unhappy in its own way." He saw that unhappy families were each doomed by unique problems of their own making, while happy families were those who steered clear of such problems.The corporate world suffers from the reverse of the Anna Karenina Principle. Successful companies each seem to invent their own unique paths to success. But failing companies follow predictable death spirals that have been followed by many other companies preceding them.Often these "sinking ship" companies can seem to be doing just fine, especially to employees who don't have the experience to recognize the obvious signs. This is handy guide of what to look out for.If you work at a big company, look for:New opportunities are evaluated and shot down based on their impact to the old legacy businesses. (See The Innovator's Dilemma).Managers are paid for making quarterly and annual targets, so they avoid investments that pay off in the future since they detract from their bonus numbers. As the business declines, they simply negotiate lower bonus targets each year.You benchmark your performance against your direct, legacy competitors instead of the new disruptive entrants in your market. You think you are doing well vs. your competitors without being aware that you are competing in the equivalents of the Seniors Tour.Mediocre employees are not fired since their managers know they can't recruit better ones anyway.When asked "why do you like working here?" your employees talk about the dental plan.Your managers roll their eyes when you point out that how new technologies like Apple Watches, Twitter, and Amazon Web Services will impact your business. They call them "toys" and say, "our customers will never trust their businesses to those!"Your co-workers use Blackberries from 2009. They say, "I already know how to use it, and I don't need that distracting new stuff."You spend the first week of the quarter talking about long-term strategic planning. You then forget about it and spend the next twelve weeks scrambling to make the quarter.Instead of firing bad leaders, you create cross-functional committees to solve the problems those bad leaders created. When those problems persist, you disband the committees and bring in consultants to solve the problems the bad leaders (then the committees) created.All conversations about new grown end with reluctant middle management saying, "only if you give me more budget!" The budget never comes, and you all go back to what you were doing.You integrate acquired companies so quickly that you destroy their businesses and their best people leave.Or, instead of integrating the acquired companies, you keep them as independent business units and get no synergies. You integrate them in a hurry a year later during a cost-cutting exercise. The best people leave.Your CFO spends 5% of her time talking about innovation and revenue growth and 95% talking about cutting costs. She says, "that's my role here."The HR department thinks their job is administration, compliance, and keeping employees from suing, not ensuring the company wins in the market by having the best team.To pay $9.99 for an Evernote subscription, you need to wait a year for the "Information Technology Steering Committee" to approve Evernote as a vendor.You have a Chief Strategy Officer. People say, "I don't know what he does all day." He disappears and is not replaced.You don't target the best companies and try to hire their best people. Instead, you put three-page job descriptions on your website and wait for candidates to find them, fill out a form, and apply.People argue over offices. They all use the same excuse: "I'm on the phone a lot."You launch "innovation projects." When it looks like you'll miss earnings by a penny a share a few quarters later, those projects are cut. After those risky but innovative projects are cancelled, the people working on them are laid off, getting richly punished for their risk taking. No one ever signs up for an "innovation project" again."Succession planning" has become a euphemism for, "when the boss quits, just promote someone on her team so we don't need to pay for a search."You have five CEOs in five years. The board then announces the company is getting broken up and sold. They act like that was the plan all along, then lay off you and half of your co-workers.You ask your laid-off co-workers why they joined the company in the first place. Their answer: "job security."If you work at a startup:You never hear how much cash you have in the bank or hear what was discussed in the board meeting. When you ask questions, your executives say, "I need you to stay focused on your work."When you get your stock option offer, no one will tell you how many shares are outstanding or that the last round of funding came with a 5x liquidation preference.People never talk, coordinate, or even leave their desk because they "hate meeetings." (They actually hate each other).You "rehearse" for board meetings and spend a week on board meeting slideshows that are prettier than your customer slides.You have more MBAs on the team than engineers. They all do "business development" since sales is beneath them.You have a Chief Strategy Officer. No one knows what he does. He disappears one day and is not replaced.Your CTO just came out of a PhD program and wants to "commercialize his research."You have a raucous launch party that is attended by no customers, only your friends.When the product doesn't sell, you complain about how the customers "just don't get it" and aren't "visionary."You've fired three VPs of Sales because each one told you, "the customers don't want the product."Your CEO has a "great" customer meeting that he says is sure to lead to a closed deal before the quarter ends this Friday. All he needs to do is meet with procurement, negotiate price, win the deal, agrees on terms, write up up contracts, negotiate them, sign them, and invoice the customer. The deal closes 175 days later.You add features because board members want them. Your CEO calls himself a "visionary" in his bio.The CEO keeps everything secret because, "that is how Apple does it."The CEO approves all of the design decisions because, "that is how Apple does it."The technical co-founder is a bad manager so agrees to hire a VP of Engineering to replace him. He thinks that VP will report to him since he is the "visionary'".Your site is going to be ad-supported, and you have 1500 users.You get free lunch but have no customers.Your free lunch is taken away.Your boss renegotiates your salary and asks you, "how much do you really need to live on?"He offers you more stock options. He still doesn't tell you how many shares are outstanding.You get laid off and become a creditor to the company because they didn't reimburse your last five expense reports.The liquidation yields five Aeron chairs and a Nespresso machine, and Ashton Kutcher's stock is senior to yours.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Why do ex-employers refuse to fill out the VA form 21-4192 for a vet?

VA Form 21–4192 is an application for disability benefits and like similar state benefits, it must be filled out by the veteran or by his or her qualified representative. This is a private, sensitive, legal document and every dot or dash in it can be critical, so must be accurate and verifiable.Employers have zero responsibility to fill out this form or furnish information for it, however, Social Security would have all the information required that the Department of Defense did not have. The veteran’s DD-214 is likely required, but does not furnish all the information required on the form.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Related searches to il 4644 rsu

Create this form in 5 minutes!

How to create an eSignature for the il 4644

How to generate an electronic signature for the From Sales Of Employers Securities online

How to make an eSignature for your From Sales Of Employers Securities in Chrome

How to make an eSignature for putting it on the From Sales Of Employers Securities in Gmail

How to make an electronic signature for the From Sales Of Employers Securities right from your mobile device

How to make an eSignature for the From Sales Of Employers Securities on iOS devices

How to make an eSignature for the From Sales Of Employers Securities on Android devices

People also ask form il 4644

-

What is form il 4644 and how can airSlate SignNow help?

Form il 4644 is a crucial document for Illinois businesses regarding tax compliance. With airSlate SignNow, you can easily fill, sign, and send form il 4644 digitally, ensuring a streamlined process that saves time and reduces paperwork.

-

Is airSlate SignNow compatible with form il 4644?

Yes, airSlate SignNow is fully compatible with form il 4644. Our platform allows users to upload, edit, and eSign the form, providing a seamless experience for handling this important document.

-

What features does airSlate SignNow offer for managing form il 4644?

airSlate SignNow offers various features such as document templates, secure cloud storage, and electronic signatures to manage form il 4644 effectively. These tools ensure you can prepare and distribute the form efficiently without any hassle.

-

How much does it cost to use airSlate SignNow for form il 4644?

Pricing for airSlate SignNow varies based on the plan you choose, starting at a competitive rate that accommodates all business sizes. By opting for our services, you ensure a cost-effective solution to manage form il 4644 and other document needs.

-

Can I integrate airSlate SignNow with my existing software to manage form il 4644?

Absolutely! airSlate SignNow offers integrations with popular platforms like Google Drive and Salesforce, allowing you to easily manage form il 4644 alongside your existing workflows. This flexibility enhances productivity and collaboration across your team.

-

What are the benefits of using airSlate SignNow for form il 4644?

Using airSlate SignNow for form il 4644 provides numerous benefits, including faster processing times, reduced errors, and improved compliance. With a user-friendly interface, it allows teams to work efficiently and complete important tasks seamlessly.

-

Is it secure to send and sign form il 4644 using airSlate SignNow?

Yes, when sending and signing form il 4644 with airSlate SignNow, your documents are protected by top-notch security measures. We use advanced encryption and authentication protocols to ensure your data is safe throughout the process.

Get more for il 4644 rsu

Find out other il 4644

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement