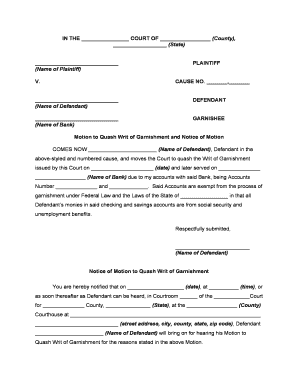

Motion Garnishment Form

Understanding the Motion Garnishment

A motion garnishment is a legal request made to a court to retrieve funds owed to a creditor through garnishment of a debtor's wages or bank accounts. This process is often initiated when a creditor seeks to enforce a judgment against a debtor who has failed to pay a debt. The motion outlines the specifics of the debt, the amount owed, and the reason for the garnishment. Understanding the implications of a motion garnishment is essential for both creditors and debtors, as it can significantly impact financial stability.

Steps to Complete the Motion Garnishment

Completing a motion garnishment involves several key steps:

- Gather Required Information: Collect all necessary details, including the debtor's name, address, and the amount owed.

- Draft the Motion: Prepare the motion garnishment document, ensuring it includes all relevant information and complies with local court rules.

- File the Motion: Submit the completed motion to the appropriate court, along with any required filing fees.

- Serve the Debtor: Ensure the debtor receives a copy of the motion, as they have the right to contest the garnishment.

- Attend the Hearing: If a hearing is scheduled, be prepared to present your case to the judge.

Legal Use of the Motion Garnishment

The legal use of a motion garnishment is governed by state laws, which dictate how and when garnishment can occur. It is crucial for creditors to follow these laws to avoid potential legal repercussions. For instance, certain types of income, such as social security benefits, may be exempt from garnishment. Understanding these legal frameworks helps ensure that the garnishment process is conducted fairly and within the law.

Required Documents for Motion Garnishment

When filing a motion garnishment, specific documents are typically required:

- Proof of Debt: Documentation showing the amount owed, such as a judgment or invoice.

- Motion Garnishment Form: The official form that must be completed and filed with the court.

- Service of Process Documentation: Evidence that the debtor has been properly notified of the motion.

Eligibility Criteria for Motion Garnishment

To initiate a motion garnishment, certain eligibility criteria must be met. Generally, a creditor must have a valid judgment against the debtor, demonstrating that the debtor owes a specific amount. Additionally, the creditor must ensure that the garnishment does not violate any exemptions set by state law. These exemptions may include limits on the amount that can be garnished from wages or certain protected income types.

Filing Deadlines for Motion Garnishment

Filing deadlines for a motion garnishment can vary by state and court. It is essential to be aware of these deadlines to ensure that the motion is filed in a timely manner. Typically, creditors must file the motion within a specific period after obtaining a judgment, often within a few years. Missing these deadlines can result in the loss of the right to collect the debt through garnishment.

Quick guide on how to complete motion garnishment

Complete Motion Garnishment effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Motion Garnishment on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Motion Garnishment with ease

- Find Motion Garnishment and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Alter and eSign Motion Garnishment to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a motion quash writ and why is it important?

A motion quash writ is a formal request to a court to nullify or suppress a court order or proceeding. Understanding how to properly file a motion quash writ can help you protect your legal rights and avoid unfavorable judgments. With airSlate SignNow, you can efficiently prepare and eSign your legal documents related to this process.

-

How does airSlate SignNow assist with filing a motion quash writ?

airSlate SignNow streamlines the process of preparing a motion quash writ by providing customizable templates and an easy-to-use interface. You can quickly fill out all required information, ensuring accuracy in your filings. Additionally, eSigning features make it simple to gather signatures from all necessary parties.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different user needs, including individual and business subscriptions. Each plan provides access to features suitable for managing documents such as motion quash writs. Check our website for the most competitive pricing and features that fit your requirements.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more. This allows you to streamline your workflow when handling documents related to a motion quash writ. Integrations enhance your ability to manage files seamlessly across various platforms.

-

What features does airSlate SignNow offer for secure document management?

airSlate SignNow includes robust security features, such as encryption, audit trails, and compliance with legal standards. These features ensure that your motion quash writ and other sensitive documents are protected throughout the signing process. You can have peace of mind knowing your data is secure.

-

How can airSlate SignNow improve the efficiency of my document processes?

By using airSlate SignNow for preparing documents like a motion quash writ, you simplify and speed up the signing process. Automated workflows and reminders help keep all parties informed and on track. This increased efficiency allows you to focus more on your legal strategies rather than paperwork.

-

Is there a mobile app for using airSlate SignNow?

Yes, airSlate SignNow offers a mobile app enabling users to create, edit, and eSign documents on the go. This feature is essential for busy professionals who may need to handle a motion quash writ while away from their desks. The app ensures you have access to your important documents anytime, anywhere.

Get more for Motion Garnishment

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property colorado form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497299919 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property colorado form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential colorado form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property colorado form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497299923 form

- Co lien claim form

- Agreed written termination of lease by landlord and tenant colorado form

Find out other Motion Garnishment

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free