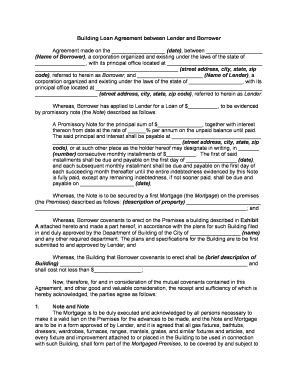

Building Loan Agreement Form

What is the Building Loan Agreement

A building loan agreement is a legally binding document between a borrower and a lender that outlines the terms and conditions for financing a construction project. This agreement specifies the amount of money being borrowed, the interest rate, repayment schedule, and other essential details related to the loan. It serves as a safeguard for both parties, ensuring clarity on the obligations and rights involved in the financing arrangement.

Key Elements of the Building Loan Agreement

Understanding the key elements of a building loan agreement is crucial for both borrowers and lenders. Essential components typically include:

- Loan Amount: The total amount being borrowed for the construction project.

- Interest Rate: The rate at which interest will be charged on the borrowed amount.

- Repayment Terms: A detailed schedule outlining how and when the borrower will repay the loan.

- Collateral: Any assets pledged as security for the loan, which the lender may claim if the borrower defaults.

- Default Conditions: Specific circumstances under which the lender may consider the loan in default.

Steps to Complete the Building Loan Agreement

Completing a building loan agreement involves several important steps to ensure that all necessary information is accurately captured. Here is a straightforward process to follow:

- Gather all required documentation, including financial statements and project plans.

- Clearly outline the terms of the loan, including the amount, interest rate, and repayment schedule.

- Review the agreement with legal counsel to ensure compliance with applicable laws.

- Both parties should sign the agreement, ideally in the presence of a notary public to validate the signatures.

- Keep a copy of the signed agreement for future reference and compliance.

Legal Use of the Building Loan Agreement

The legal use of a building loan agreement is paramount in protecting the interests of both the borrower and lender. To ensure that the agreement is enforceable, it must comply with state and federal laws governing loan agreements. This includes adherence to regulations regarding interest rates, disclosure requirements, and borrower rights. It is advisable for both parties to seek legal advice to navigate these complexities effectively.

How to Obtain the Building Loan Agreement

Obtaining a building loan agreement typically involves working with financial institutions, such as banks or credit unions, that offer construction loans. Borrowers can request a template or draft of the agreement from their lender, which may also include specific terms tailored to the project. Additionally, legal professionals can provide customized agreements that meet the unique needs of the borrower and lender.

Examples of Using the Building Loan Agreement

Building loan agreements are commonly used in various scenarios, including:

- Financing the construction of residential homes.

- Funding commercial property development projects.

- Renovating existing structures where additional funding is required.

Each example highlights the versatility of the building loan agreement in facilitating construction and renovation projects across different sectors.

Quick guide on how to complete building loan agreement

Effortlessly prepare Building Loan Agreement on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct version and store it safely online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Building Loan Agreement on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Building Loan Agreement with ease

- Locate Building Loan Agreement and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or improperly filed documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Building Loan Agreement to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement between borrower, and why is it important?

An agreement between borrower outlines the terms of a loan or credit agreement, detailing repayment schedules, interest rates, and obligations. Understanding this document is essential for both borrowers and lenders to ensure clarity and enforceability in financial transactions.

-

How does airSlate SignNow facilitate the signing of an agreement between borrower?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning agreements between borrower and lender. With its user-friendly interface, users can quickly generate documents and obtain legally binding signatures, enhancing efficiency in the lending process.

-

What features does airSlate SignNow offer for managing agreements between borrower?

airSlate SignNow offers features such as customizable templates, real-time tracking, and automatic reminders for agreements between borrower. These tools help manage the entire signing process, ensuring that contracts are executed promptly and efficiently.

-

Is there a cost associated with using airSlate SignNow for agreements between borrower?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features essential for managing agreements between borrower, allowing businesses to choose an option that best fits their budget.

-

Can I integrate airSlate SignNow with other software for my agreements between borrower?

Absolutely! airSlate SignNow seamlessly integrates with a variety of CRM, accounting, and productivity tools. This ensures that your agreements between borrower can be managed efficiently within your existing workflows.

-

What are the benefits of using airSlate SignNow for my agreements between borrower?

Using airSlate SignNow for agreements between borrower provides numerous advantages, including reduced turnaround time, improved accuracy, and enhanced security. It simplifies the signing process and empowers businesses to focus on their core activities without the hassle of manual paperwork.

-

How secure is the signing process for agreements between borrower on airSlate SignNow?

The signing process for agreements between borrower on airSlate SignNow is highly secure, featuring bank-level encryption and advanced authentication methods. This ensures that all documents are protected and can only be accessed by authorized parties, maintaining confidentiality.

Get more for Building Loan Agreement

Find out other Building Loan Agreement

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation