Agreement Buy Sell Form

What is the Agreement Buy Sell

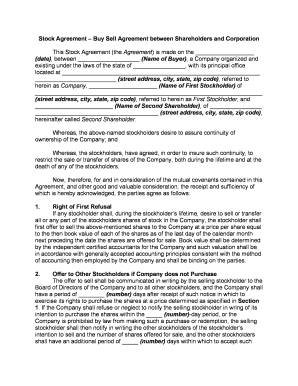

The agreement buy sell is a legally binding document that outlines the terms and conditions under which shareholders can buy or sell their shares in a corporation. This agreement serves as a protective measure for all parties involved, ensuring that the transfer of ownership is conducted smoothly and in accordance with established guidelines. It typically includes details such as the valuation of shares, payment terms, and the rights and obligations of each shareholder.

Key elements of the Agreement Buy Sell

Several crucial elements must be present in an agreement buy sell to ensure its effectiveness and legal standing. These elements include:

- Valuation Method: A clear description of how the shares will be valued, whether through a predetermined formula or an independent appraisal.

- Purchase Price: The specific price at which shares will be bought or sold, including any adjustments based on the company's performance.

- Payment Terms: Detailed terms regarding how and when payment will be made, including any installment plans or deadlines.

- Transfer Restrictions: Conditions under which shares can be transferred, including any rights of first refusal for existing shareholders.

- Disability Clause: Provisions that outline what happens if a shareholder becomes disabled or incapacitated.

Steps to complete the Agreement Buy Sell

Completing an agreement buy sell involves several important steps to ensure compliance and clarity. Here is a straightforward process to follow:

- Draft the Agreement: Begin by drafting the agreement, incorporating all key elements and ensuring clarity in language.

- Review and Revise: Have all parties review the document for accuracy and completeness, making necessary revisions.

- Obtain Signatures: Ensure that all shareholders sign the agreement, which may require witnessing or notarization depending on state laws.

- Distribute Copies: Provide each party with a copy of the signed agreement for their records.

- File with Relevant Authorities: If required, file the agreement with state or local authorities to formalize the transaction.

Legal use of the Agreement Buy Sell

The legal use of an agreement buy sell is essential for protecting the interests of shareholders and ensuring compliance with corporate governance. This document must adhere to relevant state laws and regulations, which can vary significantly across jurisdictions. It is advisable to consult with legal counsel to ensure that the agreement meets all legal requirements and adequately protects the rights of all parties involved.

How to obtain the Agreement Buy Sell

Obtaining an agreement buy sell can be accomplished through various means. Shareholders can draft their own agreement using templates available online, or they can seek assistance from legal professionals who specialize in corporate law. Many law firms offer customizable templates that can be tailored to the specific needs of a business. Additionally, online platforms may provide resources that simplify the process of creating a legally sound agreement.

Examples of using the Agreement Buy Sell

Understanding practical applications of an agreement buy sell can enhance its effectiveness. Here are a few examples:

- A shareholder wishes to retire and sell their shares to remaining partners, requiring a structured buy sell agreement to facilitate the transaction.

- A business experiences a sudden change in ownership due to a shareholder's unexpected death, prompting the need for the agreement to ensure a smooth transition.

- Two partners in a startup agree to a buy sell arrangement to protect against future disputes and ensure business continuity.

Quick guide on how to complete agreement buy sell

Prepare Agreement Buy Sell seamlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Agreement Buy Sell on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest way to alter and eSign Agreement Buy Sell effortlessly

- Find Agreement Buy Sell and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it onto your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Agreement Buy Sell to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement buy shareholders?

An agreement buy shareholders is a legal document that outlines the terms under which a business owner may buy shares from a shareholder. This type of agreement protects existing shareholders and provides a clear framework for share transactions. With airSlate SignNow, you can easily create and eSign this document securely.

-

How does airSlate SignNow facilitate agreement buy shareholders?

airSlate SignNow streamlines the process of generating and signing your agreement buy shareholders by allowing you to customize templates and manage documents efficiently. The platform’s intuitive interface ensures that all parties can collaborate effortlessly. Plus, with electronic signatures, you save time and reduce paperwork.

-

What are the pricing plans for airSlate SignNow regarding share agreements?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those for managing agreement buy shareholders. Each plan provides various features such as unlimited documents and advanced security. You can choose the plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for managing agreements?

Yes, airSlate SignNow provides seamless integration with popular business tools like CRM systems and cloud storage services. This allows you to manage your agreement buy shareholders alongside other business processes, enhancing overall efficiency. Integrating your workflows can help you streamline document management even further.

-

What are the benefits of using airSlate SignNow for share buy agreements?

Using airSlate SignNow for your agreement buy shareholders offers numerous benefits, including faster turnaround times, enhanced security, and signNow cost savings. The platform provides an easy way to track document status and ensures compliance with legal standards. These features make managing share agreements straightforward and efficient.

-

Is eSigning legally binding in agreement buy shareholders with airSlate SignNow?

Yes, eSigning through airSlate SignNow is legally binding and complies with regulatory standards. The platform uses advanced encryption and authentication features to ensure document integrity. This gives you confidence that your agreement buy shareholders will be upheld in a court of law.

-

How can I ensure the security of my agreement buy shareholders using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents with industry-leading measures, including encryption and compliance with data protection regulations. You can also set access controls and monitor document activity for added transparency. This makes the platform ideal for securely handling sensitive agreements like buy-sell contracts.

Get more for Agreement Buy Sell

Find out other Agreement Buy Sell

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document