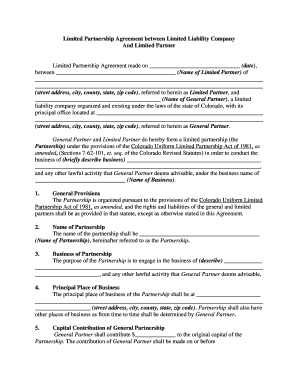

Limited Partner Form

What is the Limited Partner

A limited partner is an individual or entity that invests in a partnership but has limited liability regarding the debts and obligations of that partnership. In a Colorado partnership LLC, limited partners typically do not participate in the day-to-day management of the business, which protects their personal assets from being used to satisfy business debts. This structure allows investors to contribute capital while minimizing their risk exposure.

Key Elements of the Limited Partner

Understanding the key elements of a limited partner is essential for anyone involved in a Colorado partnership. Limited partners must:

- Contribute capital to the partnership, which can be in the form of cash, property, or services.

- Remain passive in the management of the business to maintain their limited liability status.

- Sign a partnership agreement that outlines their rights, responsibilities, and the terms of their investment.

- Be aware of the tax implications, as income generated by the partnership typically passes through to the partners.

Steps to Complete the Limited Partner

Completing the necessary documentation for a limited partner in a Colorado partnership LLC involves several steps:

- Draft a partnership agreement that specifies the roles of limited and general partners.

- Determine the amount of capital each limited partner will contribute.

- Ensure compliance with Colorado state laws regarding partnership formation.

- File necessary documents with the Colorado Secretary of State to officially establish the partnership.

Legal Use of the Limited Partner

The legal use of a limited partner in a Colorado partnership LLC is governed by state laws and the partnership agreement. Limited partners must adhere to specific regulations to maintain their limited liability status. This includes refraining from participating in management decisions and ensuring that their contributions are documented correctly. Legal protections for limited partners help to safeguard their investments while providing a framework for resolving disputes.

Filing Deadlines / Important Dates

When establishing a Colorado partnership LLC, it is crucial to be aware of filing deadlines and important dates. Key timelines include:

- Initial registration with the Colorado Secretary of State, which should be completed within a specific timeframe after forming the partnership.

- Annual report filings that are typically due on the anniversary of the partnership's formation.

- Tax filing deadlines that align with federal and state requirements for partnerships.

Required Documents

To establish a limited partner in a Colorado partnership LLC, several documents are necessary:

- A partnership agreement that outlines the roles and responsibilities of all partners.

- Registration forms filed with the Colorado Secretary of State.

- Any additional documentation required for tax purposes, such as IRS forms for partnership income reporting.

Quick guide on how to complete limited partner

Effortlessly complete Limited Partner on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hindrances. Manage Limited Partner on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to edit and eSign Limited Partner effortlessly

- Obtain Limited Partner and select Get Form to begin.

- Make use of the provided tools to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Limited Partner and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is limited partnership liability?

Limited partnership liability refers to the legal protection that limits the financial obligations of limited partners in a business. Unlike general partners, limited partners are only responsible for the debts of the partnership up to the amount they have invested. Understanding this concept is crucial for those considering a limited partnership, as it affects their financial risk.

-

How does airSlate SignNow assist with limited partnership agreements?

airSlate SignNow provides a seamless platform to create, send, and eSign limited partnership agreements. This ensures that all parties involved can securely sign documents online, which helps in formalizing limited partnership liability easily and efficiently. The user-friendly interface simplifies the entire process, making it accessible for all users.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit the needs of different businesses, whether you're just starting out or you're an established firm. Each plan provides features that help manage documents effectively, including dealing with limited partnership liability, ensuring business agreements are executed flawlessly. You can choose a plan that fits your budget and business requirements.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integration with various applications, enhancing its functionality for managing limited partnership liability and other legal documents. This allows you to streamline your workflows by connecting with popular tools like CRM systems and cloud storage solutions. Such integrations are crucial for businesses looking to create a cohesive digital ecosystem.

-

What features does airSlate SignNow offer to protect limited partnership liability?

airSlate SignNow includes advanced security features such as encryption and audit trails, which are vital for protecting documents related to limited partnership liability. Additionally, the platform offers customizable templates and secure storage solutions to ensure that sensitive information remains confidential. These features help businesses mitigate risks associated with legal documentation.

-

Is airSlate SignNow easy to use for new users managing limited partnership liability?

Absolutely! airSlate SignNow is designed with an intuitive interface, making it easy for new users to navigate and manage documents related to limited partnership liability. The platform also provides helpful resources, including tutorials and customer support, to assist new users in quickly becoming proficient. This user-centric approach ensures that everyone can effectively utilize the service.

-

What are the benefits of using airSlate SignNow for limited partnerships?

Using airSlate SignNow for limited partnerships offers signNow benefits, including time savings through streamlined document workflows and enhanced compliance through legally binding eSignatures. By simplifying the management of limited partnership liability agreements, businesses can focus more on growth and less on administrative tasks. Furthermore, its cost-effective pricing structure makes it an attractive option for partnerships.

Get more for Limited Partner

- Legal last will and testament for married person with minor children from prior marriage district of columbia form

- Legal last will and testament for domestic partner with minor children from prior marriage district of columbia form

- Legal last will and testament form for married person with adult children from prior marriage district of columbia

- Legal last will and testament form for divorced person not remarried with adult children district of columbia

- Dc domestic partner form

- Legal last will and testament form for divorced person not remarried with no children district of columbia

- Legal last will and testament form for divorced person not remarried with minor children district of columbia

- Legal last will and testament form for married person with adult children district of columbia

Find out other Limited Partner

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form