Delaware Corporations Form

What is the Delaware Corporations

The Delaware corporations are legal entities formed under the laws of the state of Delaware. They are recognized for their flexibility in management and strong legal protections for shareholders. Many businesses choose to incorporate in Delaware due to its business-friendly laws and established legal precedent. This makes Delaware a popular choice for both small startups and large corporations looking to benefit from a favorable corporate environment.

How to obtain the Delaware Corporations

To obtain a Delaware corporation, businesses must file a Certificate of Incorporation with the Delaware Division of Corporations. This document outlines the basic information about the corporation, including its name, registered agent, and purpose. The filing can be completed online, by mail, or in person. It is important to ensure that the chosen name complies with Delaware naming requirements and is not already in use by another entity.

Steps to complete the Delaware Corporations

Completing the process of forming a Delaware corporation involves several key steps:

- Choose a unique name for the corporation that complies with Delaware regulations.

- Select a registered agent who will be responsible for receiving legal documents on behalf of the corporation.

- Prepare and file the Certificate of Incorporation with the Delaware Division of Corporations.

- Pay the required filing fee, which varies based on the type of corporation and the number of shares issued.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

Legal use of the Delaware Corporations

Delaware corporations are legally binding entities that provide limited liability protection to their owners. This means that the personal assets of shareholders are generally protected from the corporation's debts and liabilities. To maintain this legal status, corporations must adhere to state laws, including holding annual meetings, keeping accurate records, and filing necessary reports with the state.

Required Documents

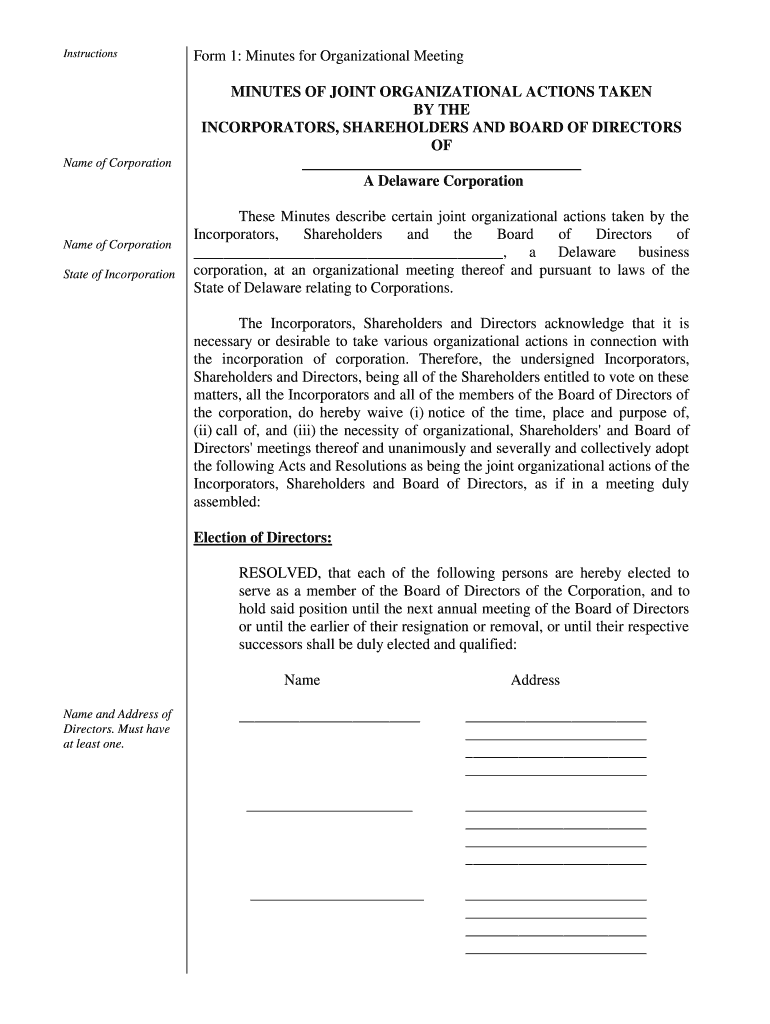

When forming a Delaware corporation, several documents are required:

- Certificate of Incorporation: This is the primary document that establishes the corporation.

- Bylaws: These outline the internal rules and procedures for managing the corporation.

- Meeting minutes: Records of board and shareholder meetings must be maintained.

- Stock certificates: If applicable, these documents represent ownership in the corporation.

Form Submission Methods (Online / Mail / In-Person)

Filing for a Delaware corporation can be done through various methods:

- Online: The Delaware Division of Corporations offers an online filing system for convenience.

- Mail: Businesses can send their completed forms and payment via postal service.

- In-Person: Filings can also be submitted in person at the Division of Corporations office in Dover, Delaware.

Quick guide on how to complete delaware corporations

Complete Delaware Corporations effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the right form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Delaware Corporations on any gadget using airSlate SignNow Android or iOS applications and simplify any document-centered task today.

The easiest way to modify and eSign Delaware Corporations seamlessly

- Locate Delaware Corporations and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from your chosen device. Modify and eSign Delaware Corporations and ensure effective communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of a Delaware corporations search?

A Delaware corporations search is crucial for verifying the legitimacy and status of a business registered in Delaware. Conducting this search helps ensure that a corporation is active, compliant with state laws, and may offer insights into its operational history. This is especially important for businesses considering partnerships or investments.

-

How can airSlate SignNow assist with a Delaware corporations search?

airSlate SignNow provides an efficient platform for businesses to manage their document signing needs while conducting a Delaware corporations search. With our solution, you can seamlessly send and eSign documents related to your search results. This enhances your workflow and ensures all your legal documents are properly executed.

-

What features should I look for in a Delaware corporations search tool?

When selecting a Delaware corporations search tool, look for features that include comprehensive search capabilities, user-friendly interface, and integration with document management systems like airSlate SignNow. Additionally, ensure it provides up-to-date information and easy access to vital company data, which can expedite your decision-making process.

-

Is conducting a Delaware corporations search cost-effective?

Yes, conducting a Delaware corporations search is generally cost-effective, especially when utilizing online tools and services. Using platforms like airSlate SignNow not only provides value through efficient document handling but also saves time and resources, allowing you to focus on your core business activities instead of drowning in paperwork.

-

Can I integrate my Delaware corporations search with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily integrate your Delaware corporations search results into your document workflows. This integration allows you to send, sign, and manage all necessary documents in one place, making the entire process smoother and more organized for your business.

-

What benefits do I gain from a Delaware corporations search?

A Delaware corporations search offers numerous benefits, including confirming the existence of a business, ensuring compliance with state regulations, and understanding ownership details. This knowledge protects your interests and provides peace of mind whether you are entering a business relationship or investing in a Delaware corporation.

-

How often should I conduct a Delaware corporations search?

It is advisable to conduct a Delaware corporations search whenever you engage in business transactions involving Delaware companies. Regular checks, especially before signing contracts or agreements, can help you stay informed about any changes in a corporation's status, thereby safeguarding your business interests.

Get more for Delaware Corporations

- North carolina assignment of deed of trust by individual mortgage holder form

- Nc deed form

- North carolina notice of dishonored check civil 1st notice keywords bad check bounced check form

- North carolina office lease agreement form

- Nc sublease form

- Nc application form pdf

- North carolina residential rental lease application form

- Nc trust form

Find out other Delaware Corporations

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online