Transfer Stock Form

What is the Transfer Stock Form

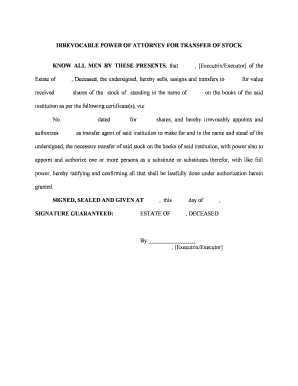

The transfer stock form is a legal document used to transfer ownership of shares from one party to another. This form is essential for maintaining accurate records of stock ownership and ensuring that the transfer is recognized by the issuing company. The form typically includes details such as the names of the current and new shareholders, the number of shares being transferred, and any specific terms related to the transfer. Understanding this form is crucial for anyone looking to manage their stock effectively.

How to Use the Transfer Stock Form

Using the transfer stock form involves several steps to ensure a smooth and legally binding transaction. First, gather all necessary information, including the names of the parties involved and the number of shares to be transferred. Next, fill out the form accurately, ensuring that all details are correct. Both the current owner and the new owner must sign the form to validate the transfer. Once completed, submit the form to the relevant company or entity for processing. This process ensures that the transfer of ownership is recorded and recognized.

Steps to Complete the Transfer Stock Form

Completing the transfer stock form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the correct transfer stock form from the issuing company or authorized source.

- Fill in the names and addresses of both the current owner and the new owner.

- Specify the number of shares being transferred and any conditions related to the transfer.

- Ensure both parties sign the form, and include the date of the transaction.

- Submit the completed form to the issuing company, either online or via mail, as per their guidelines.

Legal Use of the Transfer Stock Form

The transfer stock form is legally binding when completed correctly. To ensure its legality, it must comply with relevant regulations, such as those outlined by the Securities and Exchange Commission (SEC). The form should be signed by both parties, and any required documentation, such as proof of identity, should accompany it. Adhering to these legal requirements helps prevent disputes and ensures that the transfer is recognized by all parties involved.

Key Elements of the Transfer Stock Form

Several key elements must be included in the transfer stock form to ensure its validity. These elements typically include:

- Names and addresses of the current and new shareholders.

- The number of shares being transferred.

- Signature of the current owner and the new owner.

- Date of the transfer.

- Any specific conditions or terms related to the transfer.

Required Documents

When completing the transfer stock form, certain documents may be required to support the transaction. These documents can include:

- Proof of identity for both the current and new owners, such as a driver's license or passport.

- Any previous stock certificates that may need to be surrendered.

- Additional forms or documentation as required by the issuing company.

Quick guide on how to complete transfer stock form

Prepare Transfer Stock Form effortlessly on any device

Online document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Transfer Stock Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Transfer Stock Form with ease

- Locate Transfer Stock Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you'd like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Transfer Stock Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow to transfer my stock forms?

Using airSlate SignNow to transfer my stock forms offers numerous benefits, including the ability to streamline the signing process and reduce paperwork. The platform ensures secure document handling and provides easy access to all signed agreements, enhancing efficiency and saving time for your business.

-

How do I start the process to transfer my stock forms with airSlate SignNow?

To begin the process to transfer my stock forms with airSlate SignNow, simply create an account and upload your documents. After that, you can customize the fields for signatures and initiate the sending process to your recipients. The user-friendly interface allows for a quick setup, making it easy to get started.

-

Is there a cost associated with transferring my stock forms using airSlate SignNow?

Yes, there are pricing plans for airSlate SignNow, which vary based on features and usage. However, the solution is designed to be cost-effective, providing signNow value by reducing the need for paper documents and speeding up transaction times when you transfer your stock forms.

-

What features does airSlate SignNow offer to enhance the transfer of my stock forms?

airSlate SignNow offers a variety of features to enhance the transfer of my stock forms, including customizable templates, real-time tracking of document status, and secure electronic signatures. These features allow for greater flexibility and control over your documents as they move through the signing process.

-

Can I integrate airSlate SignNow with other applications when I transfer my stock forms?

Absolutely! airSlate SignNow supports integration with various applications such as CRM systems, cloud storage, and productivity tools. These integrations allow you to efficiently manage your workflow and simplify the process when you transfer your stock forms.

-

What types of documents can I use when I transfer my stock forms?

You can use a wide variety of document types when you transfer my stock forms, including PDFs, Word documents, and images. airSlate SignNow is versatile and accepts these formats to ensure your stock forms are accurately processed and signed, no matter the file type.

-

Is airSlate SignNow compliant with legal standards when I transfer my stock forms?

Yes, airSlate SignNow complies with various legal standards for electronic signatures, ensuring that your documents are legally binding. This compliance is critical when you transfer your stock forms, providing peace of mind that your electronic transactions adhere to applicable laws and regulations.

Get more for Transfer Stock Form

- Quitclaim deed for two individuals or husband and wife to three individuals as joint tenants with the right of survivorship form

- Fl warranty deed 497303488 form

- Warranty deed from two individuals to two individuals as joint tenants with the right of survivorship with retained life form

- Quitclaim deed two individuals to three individuals florida form

- Quitclaim deed three individuals to husband and wife as joint tenants florida form

- Quitclaim deed four individuals to husband and wife as joint tenants florida form

- 3 1 form

- Florida warranty deed 497303494 form

Find out other Transfer Stock Form

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself