Accounts Receivable Guaranty Form

What is the Accounts Receivable Guaranty

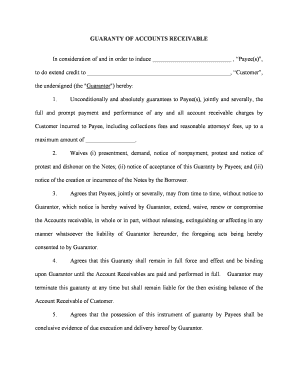

The Accounts Receivable Guaranty is a legal document that ensures the payment of outstanding debts owed to a business. This form serves as a promise from a guarantor to cover the liabilities of a debtor if they fail to meet their financial obligations. It is commonly used in various industries, particularly where credit is extended to clients or customers. By having this guaranty in place, businesses can mitigate risks associated with non-payment and enhance their cash flow management.

Key elements of the Accounts Receivable Guaranty

Several critical components make up an effective Accounts Receivable Guaranty. These include:

- Parties Involved: Identification of the creditor, debtor, and guarantor.

- Amount Guaranteed: Specification of the total debt amount that the guarantor is responsible for.

- Terms and Conditions: Clear stipulations regarding the obligations of the guarantor and the circumstances under which the guaranty is enforceable.

- Duration: The time frame for which the guaranty remains valid.

- Signatures: Required signatures of all parties involved to validate the document.

Steps to complete the Accounts Receivable Guaranty

Completing the Accounts Receivable Guaranty involves several straightforward steps:

- Gather necessary information about the debtor, creditor, and guarantor.

- Clearly outline the amount of debt being guaranteed.

- Draft the terms and conditions of the guaranty, ensuring clarity and mutual understanding.

- Review the document with all parties to confirm agreement.

- Obtain signatures from the creditor, debtor, and guarantor.

- Store the completed document securely, ensuring it is accessible if needed in the future.

Legal use of the Accounts Receivable Guaranty

The legal validity of the Accounts Receivable Guaranty hinges on compliance with applicable laws and regulations. In the United States, eSignatures are recognized as legally binding under the ESIGN Act and UETA, provided that certain criteria are met. This means that businesses can execute the guaranty electronically, enhancing efficiency while ensuring legal compliance. It is essential to ensure that the document is properly signed and stored to uphold its enforceability in a court of law.

How to use the Accounts Receivable Guaranty

To effectively utilize the Accounts Receivable Guaranty, businesses should follow these guidelines:

- Assess the creditworthiness of the debtor before entering into a guaranty arrangement.

- Use the guaranty as a tool to secure payment when extending credit to new clients.

- Maintain open communication with the guarantor regarding any changes in the debtor's financial situation.

- Regularly review outstanding accounts receivable and follow up on payments as necessary.

Examples of using the Accounts Receivable Guaranty

There are various scenarios in which an Accounts Receivable Guaranty can be beneficial:

- A supplier extends credit to a new retail client, requiring a guaranty from the business owner’s personal assets.

- A service provider offers extended payment terms to a client, backed by a guaranty from a parent company.

- A construction firm requires a guaranty from a subcontractor to ensure payment for materials supplied.

Quick guide on how to complete accounts receivable guaranty

Complete Accounts Receivable Guaranty effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Accounts Receivable Guaranty on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Accounts Receivable Guaranty without effort

- Locate Accounts Receivable Guaranty and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or hide sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Accounts Receivable Guaranty and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Accounts Receivable Guaranty?

Accounts Receivable Guaranty is a financial assurance that protects businesses from non-payment by customers. It ensures that, in case of default, the accounts receivable are still guaranteed, providing peace of mind and financial stability. This can be crucial for maintaining cash flow in your business operations.

-

How can airSlate SignNow help with Accounts Receivable Guaranty?

airSlate SignNow streamlines the documentation process related to Accounts Receivable Guaranty by enabling businesses to send and eSign essential documents efficiently. With our user-friendly platform, you can quickly manage agreements and ensure that all necessary contracts are securely signed, reducing the risk of payment issues. This helps safeguard your receivables effectively.

-

What are the pricing options for using airSlate SignNow with Accounts Receivable Guaranty?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes looking to manage Accounts Receivable Guaranty effectively. Our plans are tailored to provide value while meeting your specific needs, ensuring you only pay for the features you utilize. Contact our sales team for a personalized quote based on your requirements.

-

What features does airSlate SignNow provide for managing Accounts Receivable Guaranty?

The key features of airSlate SignNow include eSigning, document tracking, and automated workflows specifically designed for managing Accounts Receivable Guaranty. Our platform allows users to create, send, and manage important financial documents seamlessly while ensuring compliance. This enables better oversight and timely follow-ups on outstanding receivables.

-

What are the benefits of using airSlate SignNow for Accounts Receivable Guaranty?

Using airSlate SignNow for your Accounts Receivable Guaranty signNowly enhances your operational efficiency and reduces manual errors. With faster signing processes and centralized document management, you'll find it easier to monitor your accounts, ensuring that you receive payments promptly. Your team's productivity will also improve as they spend less time on paperwork.

-

Can I integrate airSlate SignNow with my existing accounting software for Accounts Receivable Guaranty?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions to optimize your Accounts Receivable Guaranty processes. This integration allows you to manage financial documents and approvals without having to switch between platforms. It's a great way to streamline workflows and enhance visibility into your accounts.

-

Is airSlate SignNow compliant with financial regulations for Accounts Receivable Guaranty?

Absolutely! airSlate SignNow adheres to all relevant financial regulations to ensure that your use of Accounts Receivable Guaranty remains compliant and secure. We utilize advanced security measures and signature authentication processes to protect your documents, providing you with a reliable solution that meets industry standards.

Get more for Accounts Receivable Guaranty

- Letter from tenant to landlord about landlord using unlawful self help to gain possession georgia form

- Letter from tenant to landlord about illegal entry by landlord georgia form

- Ga intent form

- Letter tenant rent 497303717 form

- Harassment 497303718 form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children georgia form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure georgia form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497303721 form

Find out other Accounts Receivable Guaranty

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document