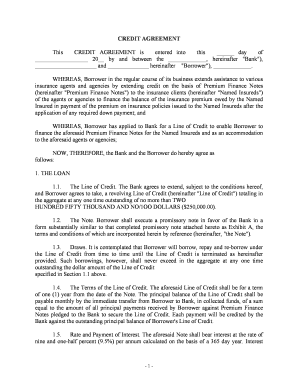

Credit Agreement Form

What is the Credit Agreement

A credit agreement is a legally binding document between a lender and a borrower outlining the terms of a loan. It specifies the amount borrowed, interest rates, repayment schedule, and any collateral involved. This agreement serves to protect both parties by clearly stating their rights and obligations. In the context of credit agreements, understanding the terms is crucial, as they can vary significantly based on the lender's policies and the borrower's creditworthiness.

Key Elements of the Credit Agreement

When reviewing a credit agreement, several key elements should be noted:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage of the principal.

- Repayment Terms: The schedule for repayment, including due dates and amounts.

- Fees: Any additional charges, such as late fees or origination fees.

- Default Terms: Conditions under which the borrower may default on the loan.

- Collateral: Any assets pledged to secure the loan.

Steps to Complete the Credit Agreement

Completing a credit agreement involves several important steps:

- Review the credit agreement thoroughly to understand all terms and conditions.

- Gather necessary documentation, such as identification and financial statements.

- Fill out the credit agreement form accurately, ensuring all information is correct.

- Sign the agreement, either electronically or in print, as per the lender's requirements.

- Submit the completed agreement to the lender for processing.

Legal Use of the Credit Agreement

Credit agreements must comply with federal and state regulations to be legally enforceable. In the United States, laws such as the Truth in Lending Act (TILA) require lenders to disclose key terms and costs associated with borrowing. Additionally, both parties must have the legal capacity to enter into a contract, meaning they must be of legal age and sound mind. Understanding these legal requirements is essential for ensuring the validity of the credit agreement.

How to Obtain the Credit Agreement

Obtaining a credit agreement typically involves applying for a loan through a financial institution. This process can be initiated online, over the phone, or in person. Once the application is submitted and approved, the lender will provide a credit agreement for the borrower to review and sign. It is advisable to compare offers from multiple lenders to ensure favorable terms.

Examples of Using the Credit Agreement

Credit agreements are commonly used in various financial scenarios, including:

- Personal loans for debt consolidation or major purchases.

- Business loans to finance operations or expansion.

- Mortgages for purchasing real estate.

- Credit card agreements outlining terms for revolving credit.

Quick guide on how to complete credit agreement

Complete Credit Agreement effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Handle Credit Agreement on any device with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and electronically sign Credit Agreement with ease

- Locate Credit Agreement and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Credit Agreement to ensure smooth communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit agreement?

A credit agreement is a legally binding document outlining the terms between a lender and a borrower. It details the loan amount, interest rates, repayment terms, and other essential provisions. Understanding these terms is crucial for both parties to avoid any future disputes.

-

How can airSlate SignNow help with credit agreements?

airSlate SignNow provides businesses with a streamlined solution to create, send, and eSign credit agreements. The platform simplifies the document workflow, ensuring that all parties can review and sign necessary agreements quickly and securely. This efficiency can enhance your overall business operations and reduce delays.

-

What features does airSlate SignNow offer for credit agreements?

airSlate SignNow includes key features such as customizable templates for credit agreements, secure eSigning, and real-time tracking of document status. Additionally, you can integrate with popular applications to simplify the process. These features ensure that your credit agreements are handled efficiently and professionally.

-

Is airSlate SignNow cost-effective for managing credit agreements?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing credit agreements. By reducing the time and resources spent on manual paperwork, businesses can save signNowly on administrative costs. The pricing plans are flexible, catering to different business sizes and needs.

-

Can airSlate SignNow integrate with other tools for credit agreement management?

Absolutely! airSlate SignNow offers seamless integrations with various CRM, financial, and project management tools. This means you can easily connect your existing systems to manage credit agreements without the need for extensive setup. Integration simplifies data transfer and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for credit agreements?

Using airSlate SignNow for credit agreements offers numerous benefits, including enhanced security, quicker turnaround times, and easy compliance with legal requirements. The platform’s user-friendly interface allows all parties to sign documents from anywhere, facilitating a faster agreement process. These advantages ultimately contribute to more seamless business transactions.

-

Is it easy to create a credit agreement with airSlate SignNow?

Creating a credit agreement with airSlate SignNow is incredibly easy. You can use customizable templates or create your documents from scratch using the intuitive editor. This ease of use allows you to focus on the specifics of your credit terms rather than getting bogged down by complex formatting.

Get more for Credit Agreement

- Ohio general warranty deed from husband and wife to husband and wife form

- Ohio general warranty deed from husband and wife to an individual form

- Deed life estate form

- Ohio trust form

- Designation affidavit form

- Ohio quitclaim deed 481377511 form

- Ohio llc notices resolutions and other operations forms package

- Ok llc company form

Find out other Credit Agreement

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will