Collection Agency's Return of Claim as Uncollectible Form

What is the Collection Agency's Return Of Claim As Uncollectible

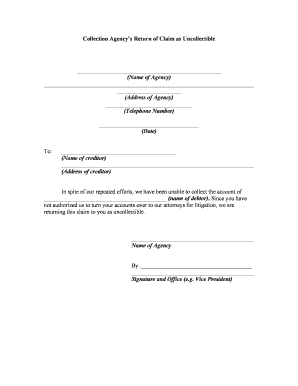

The Collection Agency's Return Of Claim As Uncollectible is a formal document used by collection agencies to report debts that they have been unable to collect. This form indicates that the agency has exhausted all reasonable efforts to recover the owed amount and considers the claim uncollectible. This process is essential for maintaining accurate financial records and can have implications for both the agency and the debtor.

How to use the Collection Agency's Return Of Claim As Uncollectible

To use the Collection Agency's Return Of Claim As Uncollectible, the agency must first ensure that all collection efforts have been made. This includes sending reminders, making phone calls, and possibly negotiating payment plans. Once these steps are completed, the agency fills out the form, providing details about the debtor, the amount owed, and the efforts made to collect the debt. The completed form is then submitted to the appropriate parties, such as creditors or regulatory bodies, to officially document the claim's status.

Key elements of the Collection Agency's Return Of Claim As Uncollectible

Several key elements must be included in the Collection Agency's Return Of Claim As Uncollectible to ensure its validity:

- Debtor Information: Full name, address, and contact details of the debtor.

- Debt Details: Amount owed, original creditor, and any relevant account numbers.

- Collection Efforts: A detailed account of the actions taken to collect the debt, including dates and methods used.

- Agency Information: Name, address, and contact information of the collection agency.

- Signature: An authorized representative of the agency must sign the form to validate it.

Steps to complete the Collection Agency's Return Of Claim As Uncollectible

Completing the Collection Agency's Return Of Claim As Uncollectible involves several steps:

- Gather all relevant information about the debtor and the debt.

- Document all collection efforts made, including dates and communication methods.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness.

- Obtain the necessary signature from an authorized representative of the agency.

- Submit the completed form to the appropriate parties.

Legal use of the Collection Agency's Return Of Claim As Uncollectible

The legal use of the Collection Agency's Return Of Claim As Uncollectible is governed by federal and state laws regarding debt collection practices. It is crucial for agencies to comply with the Fair Debt Collection Practices Act (FDCPA) and other relevant regulations. Proper use of this form helps protect the agency from potential legal repercussions and ensures that the debtor's rights are respected throughout the collection process.

Examples of using the Collection Agency's Return Of Claim As Uncollectible

Examples of using the Collection Agency's Return Of Claim As Uncollectible include situations where a debtor has consistently failed to respond to collection efforts or where the debtor has filed for bankruptcy. In these cases, the collection agency would document their attempts to collect the debt and submit the form to formally classify the claim as uncollectible. This documentation can be important for the agency's records and may impact future collection strategies.

Quick guide on how to complete collection agencys return of claim as uncollectible

Complete Collection Agency's Return Of Claim As Uncollectible effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Collection Agency's Return Of Claim As Uncollectible on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign Collection Agency's Return Of Claim As Uncollectible with ease

- Find Collection Agency's Return Of Claim As Uncollectible and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form: by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign Collection Agency's Return Of Claim As Uncollectible and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Collection Agency's Return Of Claim As Uncollectible?

A Collection Agency's Return Of Claim As Uncollectible refers to a situation where debts that have been pursued by a collection agency are deemed uncollectible and are returned to the original creditor. This often occurs when the debtor cannot be located or lacks the financial resources to repay the debt. Understanding this process is essential for businesses that wish to manage their accounts receivable effectively.

-

How does airSlate SignNow assist in documenting a Collection Agency's Return Of Claim As Uncollectible?

airSlate SignNow provides an efficient platform for documenting a Collection Agency's Return Of Claim As Uncollectible by allowing users to create, send, and eSign necessary documents quickly. With our templates and easy-to-use interface, you can ensure that all relevant documentation is accurate and legally binding. This helps streamline your collections process, saving you time and reducing errors.

-

What features are included in airSlate SignNow for managing collections?

airSlate SignNow includes features such as document templates, eSignature capabilities, and workflow automation that cater specifically to managing collections. These features help you handle a Collection Agency's Return Of Claim As Uncollectible efficiently. You can also track the status of documents in real time, ensuring you stay informed throughout the collection process.

-

Is there a cost associated with using airSlate SignNow for claims management?

Yes, there are pricing plans available for airSlate SignNow that cater to various business sizes and needs. These plans are designed to be cost-effective while providing all necessary features for handling tasks such as a Collection Agency's Return Of Claim As Uncollectible. You can choose a plan that best fits your budget and requirements for managing collections.

-

Can I integrate airSlate SignNow with other software for collections?

Absolutely! airSlate SignNow allows integration with various platforms that you may already use for collections. This includes popular CRM and accounting software to streamline the process of documenting a Collection Agency's Return Of Claim As Uncollectible. Integrating your tools ensures a seamless flow of information, helping enhance your overall collections strategy.

-

What benefits does eSigning offer in the context of collections?

Using eSigning in the context of collections provides enhanced speed and efficiency, as documents can be signed quickly and remotely. This is particularly beneficial for matters like a Collection Agency's Return Of Claim As Uncollectible, as it allows for faster resolution and avoids unnecessary delays. Additionally, electronic signatures are legally binding and provide a secure method for finalizing agreements.

-

How secure is airSlate SignNow for managing sensitive collection documents?

airSlate SignNow prioritizes security by implementing robust encryption and compliance with industry standards. Your documents related to a Collection Agency's Return Of Claim As Uncollectible are stored safely and can only be accessed by authorized users. This ensures that sensitive information is well-protected against unauthorized access and bsignNowes.

Get more for Collection Agency's Return Of Claim As Uncollectible

- Legal last will and testament form for domestic partner with adult and minor children hawaii

- Legal last will and testament form for civil union partner with adult and minor children hawaii

- Mutual wills package with last wills and testaments for married couple with adult and minor children hawaii form

- Legal last will and testament form for a widow or widower with adult children hawaii

- Legal last will and testament form for widow or widower with minor children hawaii

- Legal last will form for a widow or widower with no children hawaii

- Legal last will and testament form for a widow or widower with adult and minor children hawaii

- Legal last will and testament form for divorced and remarried person with mine yours and ours children hawaii

Find out other Collection Agency's Return Of Claim As Uncollectible

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement