Note Deed Trust Form

What is the adjustable rate rider form?

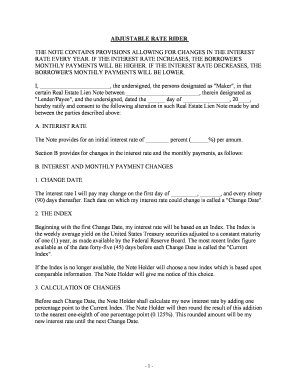

The adjustable rate rider form is a key document in the mortgage process, specifically designed to outline the terms of an adjustable-rate mortgage (ARM). This form supplements the primary mortgage agreement, detailing how interest rates may change over time. Typically, it includes information about the initial interest rate, adjustment periods, and the maximum rate increase allowed over the life of the loan. Understanding this form is crucial for borrowers, as it directly impacts monthly payments and overall financial planning.

How to use the adjustable rate rider form

Using the adjustable rate rider form involves several steps. First, borrowers should review the terms of their primary mortgage agreement to ensure they understand how the adjustable rate rider integrates with it. Next, fill out the form with accurate information, including personal details and loan specifics. It is essential to double-check all entries for accuracy, as errors can lead to complications during the mortgage process. Once completed, the form must be signed by all parties involved, ensuring that everyone agrees to the terms outlined in the document.

Steps to complete the adjustable rate rider form

Completing the adjustable rate rider form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including your primary mortgage agreement and identification.

- Fill out the borrower’s information, ensuring that names and addresses match those on the primary mortgage.

- Specify the loan amount and the initial interest rate as stated in the mortgage agreement.

- Indicate the adjustment frequency, such as annually or biannually, and the maximum interest rate cap.

- Review the completed form for accuracy and completeness.

- Sign the form along with any co-borrowers to validate the agreement.

Legal use of the adjustable rate rider form

The adjustable rate rider form has legal significance in the context of mortgage agreements. It serves as a binding document that outlines the terms under which the interest rate on a mortgage may fluctuate. To ensure its legal enforceability, the form must comply with federal and state regulations governing mortgage lending. This includes adherence to the Truth in Lending Act, which mandates clear disclosure of loan terms, including the adjustable rate features. Failure to comply with these regulations can result in legal disputes or penalties.

Key elements of the adjustable rate rider form

Several key elements are essential to include in the adjustable rate rider form to ensure clarity and compliance. These elements typically encompass:

- Initial interest rate: The starting rate that will apply to the mortgage.

- Adjustment intervals: How often the interest rate can change, such as every year or every five years.

- Maximum rate increase: The highest rate the borrower may face over the life of the loan.

- Index and margin: The financial index used to determine rate adjustments and the margin added to it.

- Payment caps: Limits on how much monthly payments can increase during each adjustment period.

Who issues the adjustable rate rider form?

The adjustable rate rider form is typically issued by lenders or mortgage companies as part of the mortgage documentation process. When a borrower applies for an adjustable-rate mortgage, the lender provides this form to outline the specific terms associated with the adjustable rate. It is essential for borrowers to receive this form from a reputable lender to ensure that the information is accurate and compliant with applicable laws and regulations.

Quick guide on how to complete note deed trust

Effortlessly prepare Note Deed Trust on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Note Deed Trust on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-related task today.

How to modify and eSign Note Deed Trust effortlessly

- Obtain Note Deed Trust and then select Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important areas of your documents or redact sensitive information using the tools available from airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Note Deed Trust and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an adjustable rate rider form?

An adjustable rate rider form is a document that outlines the specifics of an adjustable-rate mortgage, detailing how the interest rate may change over time. It is essential for borrowers to understand the implications of an adjustable rate rider to make informed decisions about their mortgage options.

-

How can I create an adjustable rate rider form using airSlate SignNow?

Creating an adjustable rate rider form with airSlate SignNow is straightforward. Simply choose a template or customize your own, fill in the necessary details, and use our intuitive platform to eSign and send the document securely. Our user-friendly interface ensures you can get started in minutes.

-

Are there any costs associated with using the adjustable rate rider form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that accommodate various business needs, including features for creating and managing an adjustable rate rider form. You can choose from a range of subscription options, ensuring you get the best value for your requirements while keeping costs manageable.

-

What benefits does using the adjustable rate rider form offer?

Using the adjustable rate rider form allows for clear communication between lenders and borrowers regarding the terms of adjustable-rate mortgages. This clarity helps borrowers understand potential risks and advantages, enabling better financial planning and decision-making.

-

Can I integrate the adjustable rate rider form into other applications?

Yes, airSlate SignNow provides various integrations with popular applications that allow seamless use of the adjustable rate rider form. Whether you need to sync with CRM systems or document storage solutions, our platform can enhance your workflow efficiency.

-

Is the adjustable rate rider form secure on airSlate SignNow?

Absolutely! The adjustable rate rider form is protected with advanced security measures on airSlate SignNow. We ensure that all documents are stored securely and data is encrypted, providing peace of mind that your sensitive information is safe.

-

Can multiple parties sign the adjustable rate rider form using airSlate SignNow?

Yes, airSlate SignNow supports multiple signers for the adjustable rate rider form. You can add as many recipients as needed and send the document for signature, simplifying the collaboration process and expediting transactions.

Get more for Note Deed Trust

- Commercial lease assignment from tenant to new tenant hawaii form

- Tenant consent to background and reference check hawaii form

- Residential lease or rental agreement for month to month hawaii form

- Residential rental lease agreement hawaii form

- Hawaii tenant 497304520 form

- Warning of default on commercial lease hawaii form

- Warning of default on residential lease hawaii form

- Landlord tenant closing statement to reconcile security deposit hawaii form

Find out other Note Deed Trust

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF