Assignment of Mortgage Form

What is the Assignment of Mortgage

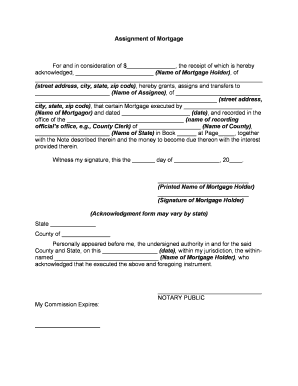

The assignment of mortgage is a legal document that transfers the rights and obligations of a mortgage from one party to another. This process is essential when a mortgage lender sells or transfers its interest in a mortgage loan to another lender or investor. The assignment of mortgage document ensures that the new lender has the legal authority to collect payments and enforce the terms of the mortgage. It is particularly relevant in situations where a home is in default, as it outlines the responsibilities of the new mortgage holder.

Key Elements of the Assignment of Mortgage

Several critical components make up the assignment of mortgage document. These include:

- Parties Involved: The document must clearly identify the original lender (assignor) and the new lender (assignee).

- Property Description: A detailed description of the property secured by the mortgage is necessary to establish the subject of the assignment.

- Effective Date: The date on which the assignment takes effect must be specified, ensuring clarity on when the new lender assumes control.

- Signatures: The document must be signed by the assignor, and in some cases, notarization may be required to validate the assignment.

Steps to Complete the Assignment of Mortgage

Completing an assignment of mortgage involves several steps to ensure it is legally binding and effective. Follow these steps:

- Gather necessary documents, including the original mortgage agreement and any related paperwork.

- Draft the assignment of mortgage document, ensuring all key elements are included.

- Have the assignor sign the document, and if required, obtain notarization.

- File the completed assignment with the appropriate county recorder's office to make it public record.

Legal Use of the Assignment of Mortgage

The assignment of mortgage must comply with various legal requirements to be enforceable. It is essential that the document is executed in accordance with state laws, which may vary. The assignment must also adhere to federal regulations, such as the Real Estate Settlement Procedures Act (RESPA), which governs the transfer of mortgage loans. Failure to comply with these legal standards can result in disputes over the validity of the assignment.

How to Obtain the Assignment of Mortgage

To obtain an assignment of mortgage, the new lender typically requests it from the original lender. If you are the borrower, you may need to contact your mortgage servicer for information regarding the assignment. Additionally, you can often find a template for the assignment of mortgage online, which can be customized to fit your specific situation. Ensure that any template used complies with state laws and includes all necessary information.

Examples of Using the Assignment of Mortgage

There are various scenarios in which an assignment of mortgage may be utilized:

- When a lender sells a mortgage to another financial institution as part of a larger portfolio sale.

- In cases where a borrower refinances their mortgage, resulting in a new lender taking over the existing loan.

- When a mortgage is assigned to a third party as part of a loan modification or workout agreement.

Quick guide on how to complete assignment of mortgage

Effortlessly Prepare Assignment Of Mortgage on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Assignment Of Mortgage on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign Assignment Of Mortgage with Ease

- Find Assignment Of Mortgage and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Assignment Of Mortgage and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment of mortgage?

An assignment of mortgage is a legal document that transfers the rights and benefits of a mortgage from one lender to another. This process is crucial when the original lender sells or transfers the mortgage to another entity, allowing the new lender to manage the loan. Understanding the assignment of mortgage is essential for both lenders and borrowers to ensure the proper handling of mortgage obligations.

-

How does airSlate SignNow simplify the assignment of mortgage process?

airSlate SignNow streamlines the assignment of mortgage by providing an intuitive platform for electronic signatures and document management. Users can easily send, sign, and store mortgage assignments online, reducing paperwork and administrative delays. This efficient approach saves time and ensures that all parties can quickly access and manage their documentation.

-

What are the costs associated with using airSlate SignNow for assignment of mortgage documents?

The pricing for using airSlate SignNow for assignment of mortgage documents is cost-effective and flexible, with various plans to suit different business needs. Users can select from subscription models that offer essential features and unlimited document signing at competitive rates. This way, businesses can manage their assignment of mortgage workflows without incurring excessive costs.

-

Can I integrate airSlate SignNow with other tools for managing assignments of mortgage?

Yes, airSlate SignNow offers seamless integrations with many popular business tools, including CRM and project management platforms. This allows users to automate their workflows associated with the assignment of mortgage, improving collaboration and efficiency. Integrating these tools can enhance the overall management of documents and communication.

-

What are the benefits of using airSlate SignNow for the assignment of mortgage?

Using airSlate SignNow for the assignment of mortgage provides numerous benefits, including enhanced security, compliance, and ease of use. The platform ensures that all documents are securely signed and stored, providing a reliable audit trail. Additionally, its user-friendly interface helps streamline the process, allowing users to handle multiple assignments efficiently.

-

Is airSlate SignNow compliant with legal standards for mortgage assignments?

Yes, airSlate SignNow complies with all relevant legal standards regarding electronic signatures and document management, making it a reliable choice for the assignment of mortgage. The platform adheres to regulations such as the ESIGN Act and UETA, ensuring that all electronically signed documents hold the same weight as traditional paper documents. This compliance helps businesses avoid legal complications.

-

What features does airSlate SignNow offer for managing assignment of mortgage documents?

airSlate SignNow provides a variety of features tailored for managing assignment of mortgage documents, including customizable templates, automated workflows, and real-time tracking. These capabilities allow users to create, send, and track documents effortlessly. The platform's robust tools ensure that all assignments are processed quickly and efficiently.

Get more for Assignment Of Mortgage

Find out other Assignment Of Mortgage

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document