Non Responsibility Form

Understanding the Non Responsibility

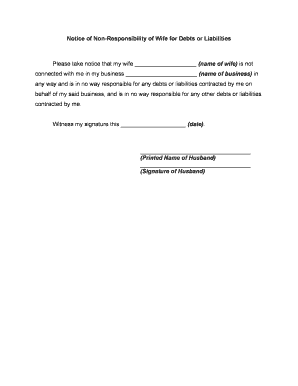

The non responsibility form is a legal document used to clarify that one party is not accountable for certain debts or obligations incurred by another party. This form is particularly relevant in situations where a spouse may have debts that the other spouse does not wish to be held responsible for. By completing this form, individuals can protect themselves from potential financial liabilities that could arise from their partner's financial decisions.

Steps to Complete the Non Responsibility

Completing the non responsibility form involves several clear steps to ensure it is legally binding and effective. First, gather all necessary information, including the names of both parties involved and details about the debts in question. Next, accurately fill out the form, ensuring that all information is correct and complete. After filling out the form, both parties should sign it, ideally in the presence of a notary public to add an extra layer of legal validity. Finally, retain copies of the signed form for your records and consider filing it with relevant financial institutions if necessary.

Legal Use of the Non Responsibility

The legal use of the non responsibility form is critical in protecting individuals from being held liable for debts incurred by their spouse. This form can be particularly useful in divorce proceedings or when one spouse has significant financial obligations. It is important to understand that while this form can provide a level of protection, it may not absolve one from all responsibilities, especially if the debts are joint or if the creditors do not recognize the form. Always consult with a legal professional to ensure that the form meets all necessary legal requirements in your state.

Key Elements of the Non Responsibility

Several key elements must be included in the non responsibility form to ensure its effectiveness. These elements typically include:

- Identification of Parties: Clearly state the names and addresses of both parties involved.

- Description of Debts: Provide a detailed account of the debts for which one party is claiming non responsibility.

- Signatures: Both parties must sign the form to indicate their agreement to the terms.

- Date: Include the date of signing to establish a timeline of the agreement.

State-Specific Rules for the Non Responsibility

State-specific rules regarding the non responsibility form can vary significantly. Some states may have particular requirements for the form's format, while others may require additional documentation or notarization. It is essential to research the specific laws in your state to ensure compliance. Consulting with a legal expert familiar with local regulations can help you navigate these requirements effectively.

Examples of Using the Non Responsibility

There are various scenarios in which the non responsibility form can be beneficial. For instance, if one spouse has accumulated significant credit card debt before marriage, the other spouse may wish to complete this form to avoid being held liable for that debt. Another example could involve a business partnership where one partner is taking on a loan independently; the other partner may use this form to clarify their non liability for that loan. Each situation is unique, and it is advisable to tailor the form to fit specific circumstances.

Quick guide on how to complete non responsibility 481378457

Arrange Non Responsibility effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without hold-ups. Handle Non Responsibility on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Non Responsibility without hassle

- Locate Non Responsibility and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Non Responsibility and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's approach to managing wife debts?

airSlate SignNow provides an easy and efficient way to manage documents related to wife debts. With our eSigning solution, you can swiftly send and sign agreements, making the process smoother for all parties involved. Our platform ensures that all documents are securely stored and easily accessible.

-

How can airSlate SignNow help with legal agreements regarding wife debts?

Using airSlate SignNow, you can quickly create, send, and sign legal agreements related to wife debts. The platform simplifies the documentation process, ensuring that all agreements are legally binding while being easy to track. This helps in maintaining transparency and accountability.

-

What are the pricing options for airSlate SignNow when dealing with wife debts?

airSlate SignNow offers flexible pricing plans suitable for various business needs, particularly when managing wife debts. Our competitive rates ensure that you receive the best value for your eSigning needs. Contact our sales team for tailored pricing based on your volume and requirements.

-

Does airSlate SignNow integrate with other tools to manage wife debts?

Yes, airSlate SignNow integrates seamlessly with several business tools that can aid in managing wife debts. Whether it’s CRM systems or financial software, our integration capabilities allow you to streamline document management and enhance your workflow. This connectivity minimizes errors and maximizes efficiency.

-

What are the primary features of airSlate SignNow in relation to wife debts?

Key features of airSlate SignNow include user-friendly eSigning, document templates, and cloud storage—all beneficial for managing wife debts. Additionally, our platform offers audit trails, ensuring every step of the signing process is documented, thus enhancing security and accountability for your agreements.

-

Can I track the status of documents related to wife debts with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of documents related to wife debts in real-time. You will be notified when a document is viewed, signed, or completed, giving you peace of mind and ensuring timely follow-ups. This feature is essential for keeping all parties informed.

-

Is there customer support available for airSlate SignNow users handling wife debts?

Yes, airSlate SignNow provides robust customer support for all users, especially those dealing with wife debts. Our dedicated support team is available to assist with any questions regarding document management and signing processes. You can signNow out via chat, email, or phone for assistance.

Get more for Non Responsibility

- Alabama affidavit for quiet title form

- General sales contract form

- Alabama mortgage form 481379012

- Notice right cure form

- Alabama residential rental lease application form

- Alabama complaint for slip and fall form

- Alabama defendants motion to dismiss form

- Alabama general answer to tort complaints form

Find out other Non Responsibility

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template