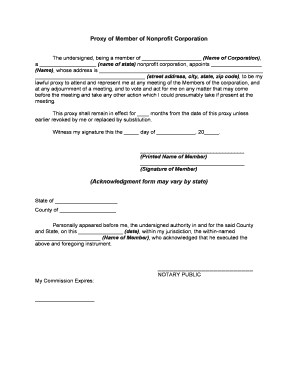

Nonprofit Form

What is the nonprofit form?

The nonprofit form is a legal document required for organizations seeking to establish themselves as nonprofit entities. This form typically includes essential information about the organization, such as its name, purpose, and structure. It serves as a declaration to the state and the IRS that the organization intends to operate for charitable, educational, or social purposes rather than for profit. Completing this form is a crucial step in obtaining tax-exempt status, which allows nonprofits to operate without paying federal income tax and enables donors to make tax-deductible contributions.

Key elements of the nonprofit form

When filling out a nonprofit form, several key elements must be included to ensure compliance and clarity. These elements typically include:

- Organization name: The legal name of the nonprofit, which must be unique and not already in use.

- Mission statement: A clear description of the organization's purpose and goals.

- Board of directors: Information about the individuals who will oversee the organization, including their names and roles.

- Registered agent: A designated person or entity responsible for receiving legal documents on behalf of the nonprofit.

- Financial information: Estimated budget, funding sources, and how funds will be used to support the nonprofit's mission.

Steps to complete the nonprofit form

Completing the nonprofit form involves several steps to ensure accuracy and compliance with state and federal regulations. Here are the general steps to follow:

- Gather necessary information about your organization, including its mission, structure, and financial projections.

- Visit your state’s Secretary of State website to access the specific nonprofit form required for your state.

- Fill out the form completely, ensuring all required fields are addressed.

- Review the form for accuracy and completeness, checking for any missing information or errors.

- Submit the completed form along with any required fees to the appropriate state agency.

Legal use of the nonprofit form

The nonprofit form must be completed and submitted in accordance with state laws to be considered legally binding. Once filed, the organization is recognized as a legal entity, which provides certain protections and responsibilities. It is essential to comply with all legal requirements, including maintaining accurate records and adhering to regulations governing nonprofit operations. Failure to do so can result in penalties, including loss of tax-exempt status or legal action.

How to obtain the nonprofit form

To obtain the nonprofit form, individuals can follow these steps:

- Visit the official website of the Secretary of State for your specific state.

- Navigate to the section dedicated to business filings or nonprofit organizations.

- Download the nonprofit form in the required format, usually available in PDF or online submission formats.

- Review any accompanying instructions or guidelines provided to ensure proper completion.

Form submission methods

Nonprofit forms can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission: Many states offer an online portal for submitting nonprofit forms, allowing for quicker processing.

- Mail: Organizations can print the completed form and send it via postal mail to the appropriate state office.

- In-person submission: Some states allow individuals to submit forms in person at designated state offices.

Quick guide on how to complete nonprofit form 481378465

Effortlessly Prepare Nonprofit Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, adjust, and electronically sign your documents promptly without any hold-ups. Manage Nonprofit Form on any platform via the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to Adjust and Electronically Sign Nonprofit Form with Ease

- Locate Nonprofit Form and then click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Finish button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to missing or lost files, cumbersome form searching, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Nonprofit Form to ensure superior communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a nonprofit form sample and why is it important?

A nonprofit form sample is a template that organizations use to streamline their documentation processes. These samples help ensure compliance with legal requirements while saving time and effort in creating documents from scratch. Utilizing a nonprofit form sample can enhance the efficiency of your operations, allowing you to focus more on your mission.

-

How does airSlate SignNow help with nonprofit form samples?

airSlate SignNow provides customizable nonprofit form samples that can be easily adapted to meet your specific needs. With our platform, you can effortlessly create, edit, and manage your documents to ensure they are comprehensive and compliant. This capability not only simplifies your workflow but also enhances collaboration among your team members.

-

What features does airSlate SignNow offer for nonprofits?

airSlate SignNow offers a variety of features tailored for nonprofits, including customizable document templates, real-time collaboration, and secure eSignature functionality. These features ensure that any nonprofit form sample you use can be efficiently executed and stored. Additionally, our platform supports integrations with other tools to streamline your operations further.

-

Is airSlate SignNow affordable for nonprofits?

Yes, airSlate SignNow provides cost-effective solutions specifically for nonprofits. We recognize the importance of affordable tools for nonprofit organizations, which is why we offer flexible pricing plans. Utilizing our services can help you save money while improving the efficiency of your document processes, particularly when working with nonprofit form samples.

-

Can I integrate airSlate SignNow with other software used by nonprofits?

Absolutely! airSlate SignNow offers seamless integrations with various applications commonly used by nonprofits. Whether you’re using CRM, project management, or data management software, our platform ensures that your nonprofit form samples and workflows can be easily connected. This connectivity streamlines your operations and enhances overall productivity.

-

How secure is airSlate SignNow for handling nonprofit form samples?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption and data protection measures to ensure that your nonprofit form samples and sensitive information remain safe. Additionally, our platform complies with legal requirements, providing peace of mind for organizations handling critical documentation.

-

What benefits can nonprofits expect from using airSlate SignNow?

Nonprofits can expect several benefits from using airSlate SignNow, including increased efficiency in document management and enhanced collaboration among team members. By using nonprofit form samples on our platform, organizations can save time, reduce paperwork, and ensure legal compliance, which ultimately allows them to focus their energy on their core mission.

Get more for Nonprofit Form

Find out other Nonprofit Form

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement