Alabama Mortgage Form

What is the Alabama Mortgage Form

The Alabama mortgage form is a legal document used in the state of Alabama to secure a loan against real property. This form outlines the terms of the mortgage agreement between the borrower and the lender, detailing the amount borrowed, interest rates, repayment terms, and the obligations of both parties. It serves as a binding contract that protects the lender's interest in the property while providing the borrower with the necessary funds to purchase or refinance real estate.

How to use the Alabama Mortgage Form

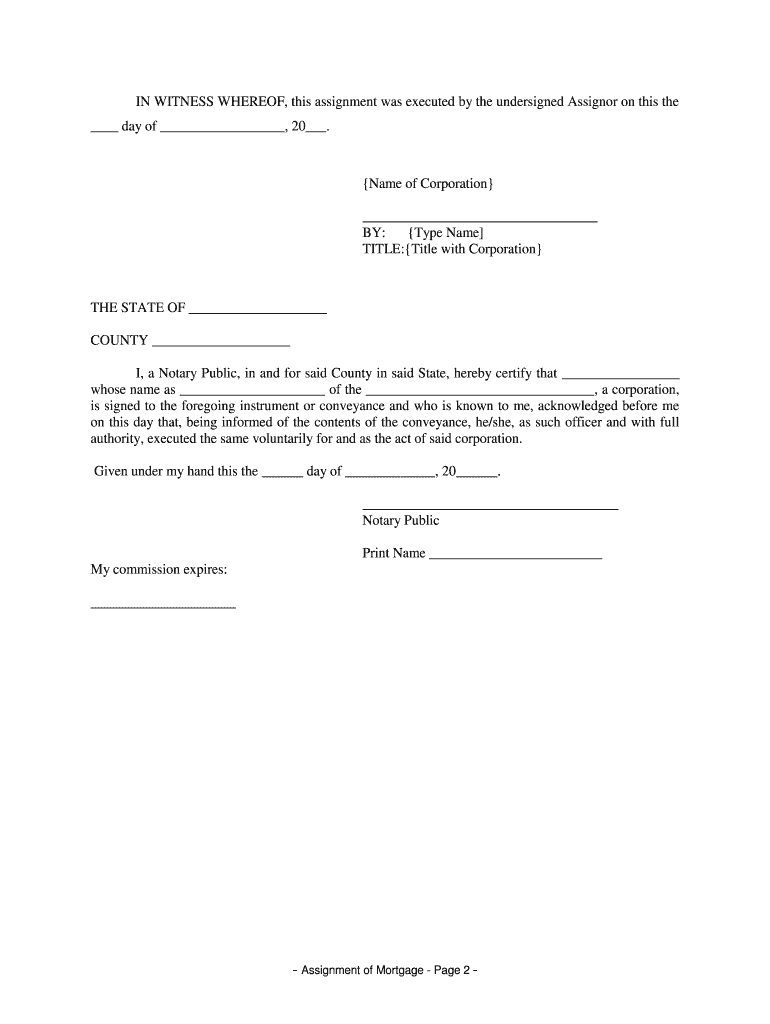

Using the Alabama mortgage form involves several key steps. First, ensure you have the correct version of the form, which can be obtained from official sources or legal professionals. Next, fill out the form accurately, providing all required information such as borrower details, property description, and loan terms. Once completed, both parties must sign the document, and it may need to be notarized to ensure its legal validity. After signing, the form should be filed with the appropriate county office to officially record the mortgage.

Steps to complete the Alabama Mortgage Form

Completing the Alabama mortgage form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Alabama mortgage form from a reliable source.

- Fill in the borrower's name, address, and contact information.

- Provide details about the property being mortgaged, including its legal description.

- Specify the loan amount, interest rate, and repayment schedule.

- Review the terms and conditions carefully to ensure understanding.

- Sign the form in the presence of a notary public, if required.

- Submit the completed form to the local county office for recording.

Legal use of the Alabama Mortgage Form

The Alabama mortgage form is legally binding when executed properly. To ensure its legal use, it must meet specific requirements set forth by Alabama law. This includes proper execution, which typically involves signatures from all parties and, in some cases, notarization. Additionally, the form must be filed with the appropriate county office to be enforceable against third parties. Understanding these legal standards is crucial for both borrowers and lenders to protect their rights and interests.

Key elements of the Alabama Mortgage Form

Several key elements must be included in the Alabama mortgage form to ensure its effectiveness:

- Borrower Information: Names and addresses of all borrowers.

- Lender Information: Name and address of the lending institution.

- Property Description: Detailed legal description of the property being mortgaged.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: Schedule outlining how and when payments will be made.

- Signatures: Signatures of all parties involved, along with notarization if required.

How to obtain the Alabama Mortgage Form

The Alabama mortgage form can be obtained through various means. It is available at local county offices, where property transactions are recorded. Additionally, legal professionals and online legal document services may provide access to the form. It is important to ensure that the version obtained is the most current and compliant with Alabama state laws to avoid any issues during the mortgage process.

Quick guide on how to complete alabama mortgage form 481379012

Complete Alabama Mortgage Form effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, alter, and eSign your documents quickly without delays. Manage Alabama Mortgage Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Alabama Mortgage Form without hassle

- Locate Alabama Mortgage Form and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from your preferred device. Edit and eSign Alabama Mortgage Form and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Alabama mortgage form?

The Alabama mortgage form is a legal document used to secure a loan against property in the state of Alabama. This form outlines the terms of the mortgage agreement, including payment details and the rights of both the borrower and lender. With airSlate SignNow, you can easily create and eSign your Alabama mortgage form online, streamlining the process.

-

How do I fill out an Alabama mortgage form using airSlate SignNow?

Filling out an Alabama mortgage form with airSlate SignNow is simple. First, access our platform and choose the Alabama mortgage form template. Then, fill in the required fields, and once completed, you can eSign the document, ensuring a fast and efficient process.

-

What features does airSlate SignNow offer for Alabama mortgage forms?

airSlate SignNow offers several features to enhance the processing of Alabama mortgage forms, including customizable templates, workflow automation, and secure cloud storage. Additionally, the platform supports team collaboration, allowing multiple parties to eSign and review the mortgage form seamlessly.

-

Is airSlate SignNow compliant with Alabama mortgage form regulations?

Yes, airSlate SignNow is fully compliant with Alabama mortgage form regulations. Our platform adheres to industry standards, ensuring that all electronically signed documents, including Alabama mortgage forms, are legally binding and accepted in all relevant jurisdictions.

-

What is the cost of using airSlate SignNow for Alabama mortgage forms?

airSlate SignNow offers competitive pricing plans to cater to various business needs. You can choose a plan that aligns with your volume of Alabama mortgage forms, ensuring a cost-effective solution for sending and eSigning documents. Monthly and annual subscriptions are available, providing flexibility.

-

Can I integrate airSlate SignNow with other tools for my Alabama mortgage form needs?

Absolutely! airSlate SignNow offers integrations with many popular applications such as Salesforce, Google Drive, and Dropbox. This seamless connectivity allows you to manage your Alabama mortgage forms alongside your other business tools for enhanced efficiency and organization.

-

What are the benefits of using airSlate SignNow for Alabama mortgage forms?

Using airSlate SignNow for Alabama mortgage forms provides numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The ability to eSign documents online lowers the risk of errors while providing a secure and legally recognized method for handling important agreements.

Get more for Alabama Mortgage Form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession indiana form

- Letter from tenant to landlord about illegal entry by landlord indiana form

- Letter from landlord to tenant about time of intent to enter premises indiana form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent indiana form

- Letter from tenant to landlord about sexual harassment indiana form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children indiana form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure indiana form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497306865 form

Find out other Alabama Mortgage Form

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation