Default Sell Form

What is the Default Sell

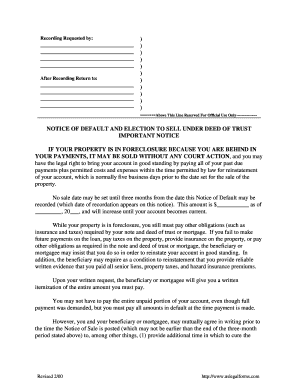

The Default Sell refers to a legal process in California where a lender can sell a property after a borrower has failed to meet the terms of a loan agreement. This typically occurs when a borrower defaults on their mortgage payments. The Default Sell allows lenders to recover their losses by selling the property at a public auction or through other means. Understanding the Default Sell is crucial for both borrowers and lenders, as it outlines the rights and responsibilities involved in the process.

How to Use the Default Sell

Utilizing the Default Sell involves several steps that must be followed to ensure compliance with California law. First, the lender must issue a Notice of Default to the borrower, informing them of their delinquency. After a specified period, if the borrower does not remedy the default, the lender can proceed with the sale of the property. It is essential for both parties to understand their rights during this process, including the borrower's opportunity to resolve the default before the sale occurs.

Steps to Complete the Default Sell

Completing a Default Sell involves a series of structured steps:

- Issue a Notice of Default to the borrower.

- Wait for the statutory period, typically 90 days, allowing the borrower to cure the default.

- If unresolved, schedule a foreclosure sale.

- Conduct the sale, often through a public auction.

- Transfer ownership to the highest bidder.

Each step must be executed in accordance with California law to ensure the sale is valid and enforceable.

Legal Use of the Default Sell

The Default Sell must adhere to legal requirements set forth by California law. This includes proper notification to the borrower and compliance with timelines established by the state. Failure to follow these legal protocols can result in the sale being challenged in court. It is advisable for lenders to consult legal counsel to navigate the complexities of the Default Sell process effectively.

Key Elements of the Default Sell

Several key elements define the Default Sell process:

- Notice of Default: A formal notification to the borrower regarding their delinquency.

- Foreclosure Sale: The public auction where the property is sold to recover the outstanding debt.

- Redemption Period: The timeframe during which the borrower can reclaim the property after the sale, if applicable.

- Legal Compliance: Adherence to state laws governing the foreclosure process.

Understanding these elements is vital for both borrowers and lenders to navigate the Default Sell process effectively.

Required Documents

To initiate a Default Sell, several documents are necessary:

- Notice of Default: This document outlines the borrower's failure to meet payment obligations.

- Loan Agreement: The original contract detailing the terms of the loan.

- Proof of Ownership: Documentation proving the lender's right to sell the property.

- Sale Notice: A formal announcement of the scheduled sale date and time.

Gathering these documents is essential for a smooth Default Sell process.

Quick guide on how to complete default sell

Effortlessly Prepare Default Sell on Any Device

Digital document management has gained immense traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Default Sell on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Alter and Electronically Sign Default Sell with Ease

- Locate Default Sell and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you'd like to share your form, via email, SMS, or link invitation, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Default Sell to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the impact of a california default on my business?

A california default can signNowly affect your business by impacting your creditworthiness and ability to secure financing. It's important to address any defaults promptly to mitigate long-term consequences. Utilizing tools like airSlate SignNow can help streamline document processes and ensure compliance in handling defaults effectively.

-

How can airSlate SignNow help me manage california defaults?

airSlate SignNow offers an efficient platform to manage and sign important documents related to california defaults. By providing a streamlined eSigning process, you can quickly resolve issues and keep track of important actions. This ensures that you remain compliant and can respond to defaults proactively.

-

What features does airSlate SignNow offer for handling legal documents related to california defaults?

airSlate SignNow features robust document management capabilities specifically designed for legal processes, including those involving california defaults. These features include customizable templates, secure storage, and detailed tracking, which can facilitate quicker resolutions in case of defaults. This makes it easier for you to focus on your business.

-

Is there a pricing plan for airSlate SignNow that fits small businesses dealing with california defaults?

Yes, airSlate SignNow offers flexible pricing plans that cater to small businesses managing california defaults. The cost-effective solutions ensure that you can access all necessary features without overspending. Our various tiers allow you to choose a plan that aligns with your business size and document needs.

-

Can I integrate airSlate SignNow with other software to manage defaults?

Absolutely! airSlate SignNow provides seamless integrations with popular software tools that can assist you in managing california defaults effectively. This ensures that you can create a unified workflow by combining eSigning services with your existing systems, such as CRM and document management platforms.

-

How does airSlate SignNow ensure the security of documents related to california defaults?

airSlate SignNow prioritizes the security of your documents, especially those related to california defaults. We employ advanced encryption standards and secure cloud storage to keep sensitive information safe from unauthorized access. You can trust that your documents are reliable and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for california defaults?

The benefits of using airSlate SignNow for california defaults include streamlined document management, improved efficiency, and enhanced compliance. By utilizing our platform, you reduce the time required to handle paperwork, allowing you to focus on more critical aspects of your business. This not only helps resolve defaults faster but also minimizes the risk of future occurrences.

Get more for Default Sell

- Limited power of attorney for stock transactions and corporate powers indiana form

- Special durable power of attorney for bank account matters indiana form

- Indiana small business startup package indiana form

- Indiana property management package indiana form

- Sample annual minutes for an indiana professional corporation indiana form

- Indiana bylaws form

- In corporation form

- Sample organizational minutes for an indiana professional corporation indiana form

Find out other Default Sell

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself