Connecticut Assignment of Mortgage by Corporate Mortgage Holder Form

What is the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

The Connecticut Assignment Of Mortgage By Corporate Mortgage Holder is a legal document used to transfer the rights and obligations of a mortgage from one corporate entity to another. This form is essential for maintaining accurate records of mortgage ownership and ensuring that the new holder has the authority to collect payments and enforce the terms of the mortgage. It typically includes information about the original mortgage, the parties involved, and the specific terms of the assignment.

How to use the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

To use the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder, the corporate mortgage holder must complete the form with accurate details regarding the mortgage being assigned. This includes identifying the original mortgage, the parties involved, and any relevant loan numbers. Once filled out, the document must be signed by authorized representatives of the corporate entities involved. It is advisable to retain copies for record-keeping and to ensure compliance with state regulations.

Steps to complete the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

Completing the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder involves several key steps:

- Gather necessary information about the original mortgage, including the loan number and property details.

- Fill out the assignment form, ensuring all fields are completed accurately.

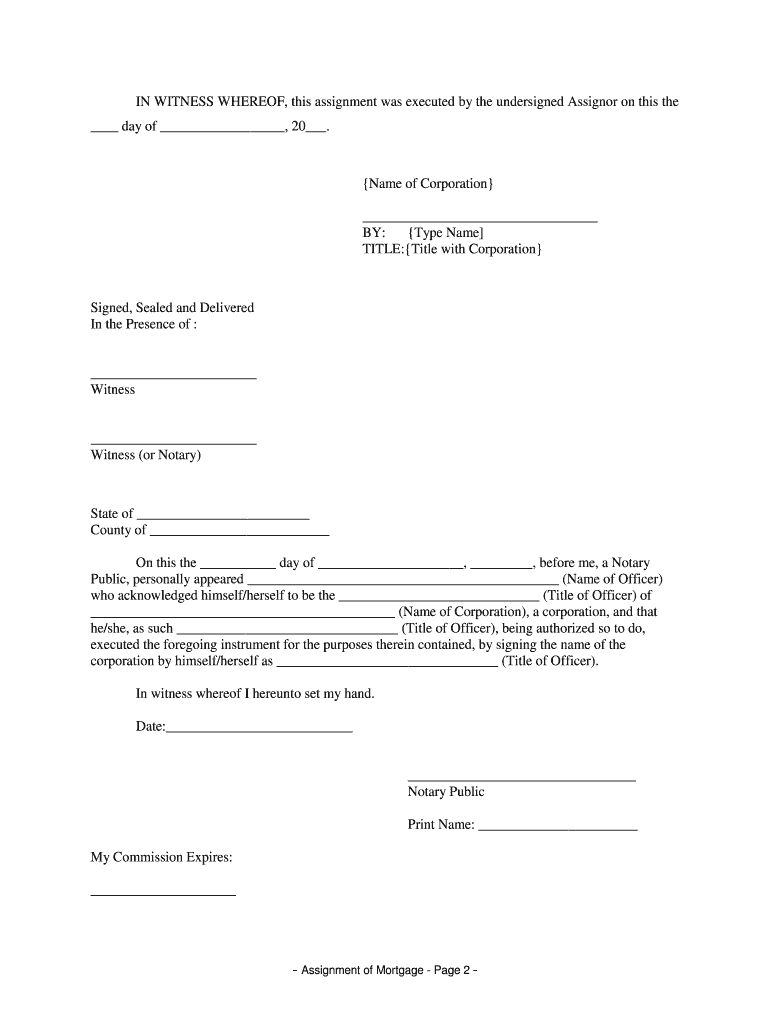

- Have the form signed by authorized representatives of the transferring and receiving corporations.

- Ensure that the signatures are notarized if required by state law.

- Submit the completed form to the appropriate local registry of deeds for recording.

Key elements of the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

Key elements of the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder include:

- The names and addresses of the original mortgage holder and the new mortgage holder.

- A description of the mortgage being assigned, including the property address and loan number.

- The date of the assignment and the effective date of the transfer.

- Signatures of authorized representatives from both corporate entities.

- Notary acknowledgment, if required, to validate the signatures.

Legal use of the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

The legal use of the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder ensures that the transfer of mortgage rights is recognized under state law. This form must comply with Connecticut's legal requirements for mortgage assignments, including proper execution and recording. Failure to adhere to these legal standards may result in disputes over mortgage ownership and the enforceability of the mortgage terms.

State-specific rules for the Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

Connecticut has specific rules governing the Assignment Of Mortgage By Corporate Mortgage Holder. These include requirements for notarization, the necessity of recording the assignment with the local registry of deeds, and adherence to state statutes regarding corporate authority to assign mortgages. Understanding these rules is crucial for ensuring that the assignment is legally binding and enforceable.

Quick guide on how to complete connecticut assignment of mortgage by corporate mortgage holder

Effectively manage Connecticut Assignment Of Mortgage By Corporate Mortgage Holder on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Connecticut Assignment Of Mortgage By Corporate Mortgage Holder on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Connecticut Assignment Of Mortgage By Corporate Mortgage Holder effortlessly

- Locate Connecticut Assignment Of Mortgage By Corporate Mortgage Holder and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark pertinent sections of the files or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tiresome form navigation, or errors that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Connecticut Assignment Of Mortgage By Corporate Mortgage Holder to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder?

A Connecticut Assignment Of Mortgage By Corporate Mortgage Holder is a legal document that transfers the rights and responsibilities of a mortgage from one corporate entity to another. It is often necessary for businesses involved in real estate transactions in Connecticut to complete this process efficiently.

-

How does airSlate SignNow facilitate the process of a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder?

airSlate SignNow streamlines the execution of a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder through its easy-to-use eSignature platform. Users can create, send, and sign documents electronically, which accelerates the overall process and reduces the need for physical paperwork.

-

What are the benefits of using airSlate SignNow for my Connecticut Assignment Of Mortgage By Corporate Mortgage Holder?

Using airSlate SignNow provides several benefits for executing a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder, including cost-effectiveness, security, and enhanced efficiency. The platform allows for secure document storage and quick access, ensuring that all transactions are safeguarded and easy to manage.

-

Is there a free trial available for airSlate SignNow when handling Connecticut Assignment Of Mortgage By Corporate Mortgage Holder?

Yes, airSlate SignNow offers a free trial that allows users to explore its features, including those pertinent to Connecticut Assignment Of Mortgage By Corporate Mortgage Holder. This trial provides an opportunity to assess the platform's capabilities before committing to a subscription.

-

What types of integrations does airSlate SignNow offer for my Connecticut Assignment Of Mortgage By Corporate Mortgage Holder?

airSlate SignNow integrates seamlessly with various popular business applications, making it easier to manage a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder alongside existing software solutions. This includes CRM systems, document storage solutions, and more to ensure a cohesive workflow.

-

How can I ensure compliance when executing a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder with airSlate SignNow?

Compliance when handling a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder can be ensured through airSlate SignNow's robust security measures and compliance-certified processes. The platform adheres to strict legal standards, providing users with the assurance that their documents are handled correctly.

-

Can multiple parties sign a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder using airSlate SignNow?

Absolutely! airSlate SignNow allows for multiple parties to electronically sign a Connecticut Assignment Of Mortgage By Corporate Mortgage Holder simultaneously. This feature enhances collaboration and reduces delays often associated with traditional paper signing.

Get more for Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

- Business credit application louisiana form

- Motion and order to dismiss charges and recall attachment louisiana form

- Individual credit application louisiana form

- Judgment motion form

- Interrogatories to plaintiff for motor vehicle occurrence louisiana form

- Interrogatories to defendant for motor vehicle accident louisiana form

- Llc notices resolutions and other operations forms package louisiana

- Louisiana judgment la form

Find out other Connecticut Assignment Of Mortgage By Corporate Mortgage Holder

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter