Connecticut Non Foreign Affidavit under IRC 1445 Form

What is the Connecticut Non Foreign Affidavit Under IRC 1445

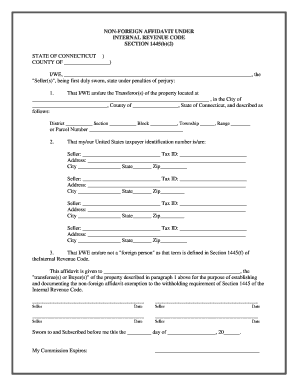

The Connecticut Non Foreign Affidavit Under IRC 1445 is a legal document used primarily in real estate transactions. This affidavit certifies that the seller of the property is not a foreign person, as defined by the Internal Revenue Code. It is essential for ensuring compliance with tax regulations, particularly those related to withholding taxes on the sale of U.S. real property interests. By completing this affidavit, sellers affirm their status, which helps buyers avoid unnecessary tax liabilities. The form must be accurately filled out and submitted during the closing process of a real estate transaction.

How to use the Connecticut Non Foreign Affidavit Under IRC 1445

To use the Connecticut Non Foreign Affidavit Under IRC 1445, sellers must first obtain the form, which can typically be found through state or local government resources. Once acquired, the seller should fill in their personal information, including name, address, and tax identification number. It is crucial to provide accurate details to avoid complications. After completing the form, it should be signed in the presence of a notary public, ensuring that the affidavit is legally binding. The completed affidavit is then submitted as part of the real estate transaction documentation.

Steps to complete the Connecticut Non Foreign Affidavit Under IRC 1445

Completing the Connecticut Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Obtain the affidavit form from a reliable source.

- Fill in the required personal information accurately.

- Indicate your status as a non-foreign person under the IRC.

- Sign the affidavit in front of a notary public.

- Submit the completed affidavit during the closing process of your real estate transaction.

Key elements of the Connecticut Non Foreign Affidavit Under IRC 1445

Several key elements must be included in the Connecticut Non Foreign Affidavit Under IRC 1445 to ensure its validity:

- Full name and address of the seller.

- Tax identification number or Social Security number.

- A declaration affirming the seller's non-foreign status.

- Signature of the seller, notarized to confirm authenticity.

Legal use of the Connecticut Non Foreign Affidavit Under IRC 1445

The legal use of the Connecticut Non Foreign Affidavit Under IRC 1445 is crucial in real estate transactions. By providing this affidavit, sellers help buyers comply with IRS regulations, specifically those related to withholding taxes on sales involving foreign entities. Failure to submit this affidavit when required can result in significant tax implications for both parties. Therefore, understanding the legal ramifications and ensuring timely submission is essential for all involved in the transaction.

IRS Guidelines

The IRS outlines specific guidelines regarding the use of the Connecticut Non Foreign Affidavit Under IRC 1445. These guidelines clarify the definition of a foreign person and the circumstances under which the affidavit must be filed. Sellers must be aware that the IRS requires this affidavit to prevent withholding on the sale of real property interests. It is recommended to review the IRS instructions related to Form 8288 and Form 8288-A for comprehensive understanding and compliance.

Quick guide on how to complete connecticut non foreign affidavit under irc 1445

Prepare Connecticut Non Foreign Affidavit Under IRC 1445 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with everything required to create, edit, and eSign your documents swiftly without delays. Handle Connecticut Non Foreign Affidavit Under IRC 1445 on any system using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to edit and eSign Connecticut Non Foreign Affidavit Under IRC 1445 with ease

- Obtain Connecticut Non Foreign Affidavit Under IRC 1445 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow has developed for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to distribute your form, whether by email, text message (SMS), shared link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Connecticut Non Foreign Affidavit Under IRC 1445 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut Non Foreign Affidavit Under IRC 1445?

A Connecticut Non Foreign Affidavit Under IRC 1445 is a legal document that certifies a foreign seller's tax status when transferring property in Connecticut. This affidavit ensures compliance with federal tax regulations, specifically IRC 1445, helping to avoid unnecessary withholding taxes on the sale. Understanding this document is crucial for both buyers and sellers engaged in real estate transactions in Connecticut.

-

How can airSlate SignNow help me with the Connecticut Non Foreign Affidavit Under IRC 1445?

airSlate SignNow streamlines the process of preparing and eSigning the Connecticut Non Foreign Affidavit Under IRC 1445. Our platform allows users to create professional-grade, legally binding documents effortlessly, ensuring that you meet all necessary legal requirements. With airSlate SignNow, you can manage your contracts and affidavits efficiently without any hassle.

-

What are the pricing options for using airSlate SignNow for Connecticut Non Foreign Affidavit Under IRC 1445?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. Our plans are competitively priced, ensuring that you can access powerful tools for creating and managing the Connecticut Non Foreign Affidavit Under IRC 1445 without breaking the bank. We also provide a free trial, allowing you to explore our features before committing.

-

Are there any specific features in airSlate SignNow for managing the Connecticut Non Foreign Affidavit Under IRC 1445?

Yes, airSlate SignNow includes specific features designed to assist with the Connecticut Non Foreign Affidavit Under IRC 1445, such as customizable templates and easy document sharing. Our intuitive interface also offers real-time tracking of document status, ensuring you never miss a critical deadline. Additionally, the platform allows you to integrate with other tools to further streamline your workflow.

-

Can I integrate airSlate SignNow with other software for handling Connecticut Non Foreign Affidavit Under IRC 1445?

Absolutely! airSlate SignNow supports various integrations with popular software such as CRM systems, project management tools, and cloud storage services. This capability allows you to seamlessly manage documents like the Connecticut Non Foreign Affidavit Under IRC 1445 alongside your existing business applications. Integrating airSlate SignNow into your tech stack will enhance productivity and coherence in document management.

-

What benefits does airSlate SignNow provide for eSigning the Connecticut Non Foreign Affidavit Under IRC 1445?

By using airSlate SignNow to eSign the Connecticut Non Foreign Affidavit Under IRC 1445, you benefit from a quick, secure, and legally recognized signing process. Our electronic signatures meet all federal compliance standards, ensuring that your contracts and affidavits are valid and enforceable. Additionally, the ease of eSigning helps expedite closing processes, improving overall transaction efficiency.

-

Is airSlate SignNow compliant with legal standards for Connecticut Non Foreign Affidavit Under IRC 1445?

Yes, airSlate SignNow is designed to comply with all relevant legal standards, including those governing the Connecticut Non Foreign Affidavit Under IRC 1445. We implement stringent security measures and adhere to federal regulations to ensure documents created and signed using our platform are both safe and compliant. You can rely on airSlate SignNow for legal documentation needs with confidence.

Get more for Connecticut Non Foreign Affidavit Under IRC 1445

- California notice owner form

- Stop payment notice 497298184 form

- California lien construction form

- Quitclaim deed from corporation to individual california form

- Grant deed from corporation to individual california form

- Lien release form

- California owner construction form

- Quitclaim deed from corporation to llc california form

Find out other Connecticut Non Foreign Affidavit Under IRC 1445

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy