Connecticut Trust Form

What is the Connecticut Trust

The Connecticut Trust, commonly referred to as a CT trust, is a legal arrangement that allows individuals to manage and protect their assets during their lifetime and after their death. This type of trust can be revocable or irrevocable, depending on the preferences of the trust creator. A revocable trust allows the creator to retain control over the assets and make changes as needed, while an irrevocable trust typically cannot be altered once established. The Connecticut Trust serves to avoid probate, streamline the distribution of assets, and provide privacy regarding the estate's contents.

Key elements of the Connecticut Trust

Several essential components define a Connecticut Trust. These include:

- Trustee: The individual or entity responsible for managing the trust assets and ensuring compliance with the trust's terms.

- Beneficiaries: The individuals or entities designated to receive the benefits from the trust, which may include income, principal, or both.

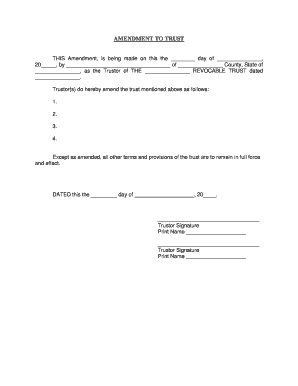

- Trust Document: A legal document outlining the terms, conditions, and provisions of the trust, including how assets are to be managed and distributed.

- Funding: The process of transferring assets into the trust, which is crucial for the trust to be effective.

Steps to complete the Connecticut Trust

Establishing a Connecticut Trust involves several key steps:

- Determine the type of trust: Decide whether a revocable or irrevocable trust best suits your needs.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust.

- Draft the trust document: Work with a legal professional to create a comprehensive trust document that outlines all terms and conditions.

- Fund the trust: Transfer assets into the trust, ensuring that all intended assets are included.

- Review and update: Regularly review the trust to ensure it meets your current needs and make updates as necessary.

Legal use of the Connecticut Trust

The Connecticut Trust is legally recognized and can be used for various purposes, including estate planning, asset protection, and tax benefits. It is important to comply with state laws and regulations when creating and managing a trust. This includes ensuring that the trust document is properly executed and that all assets are appropriately funded into the trust. Legal counsel can provide guidance on the specific requirements and implications of establishing a Connecticut Trust.

Required Documents

To establish a Connecticut Trust, several documents are typically required:

- Trust Agreement: The primary document that outlines the trust's terms and conditions.

- Asset Deeds: Documentation for transferring ownership of assets into the trust.

- Identification: Personal identification for the trust creator and trustee, such as a driver's license or social security number.

- Financial Statements: Statements that detail the assets being placed into the trust.

Who Issues the Form

The Connecticut Trust form is typically created by an attorney specializing in estate planning. While there may not be a specific government agency that issues the form, legal professionals ensure that the trust document complies with state laws and meets the creator's intentions. Engaging a knowledgeable attorney can help navigate the complexities of trust creation and ensure all legal requirements are met.

Quick guide on how to complete connecticut trust

Complete Connecticut Trust effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a seamless eco-friendly substitute to conventional printed and signed documentation, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Connecticut Trust on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Connecticut Trust with ease

- Obtain Connecticut Trust and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Connecticut Trust and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut trust?

A Connecticut trust is a legal arrangement that allows you to manage your assets while providing signNow tax benefits. It can be tailored to meet specific needs, such as protecting assets from creditors or planning for future generations. Understanding the nuances of a Connecticut trust can help you make informed decisions about your estate planning.

-

How can airSlate SignNow facilitate the creation of a Connecticut trust?

With airSlate SignNow, creating documents for a Connecticut trust is streamlined and efficient. Our platform allows you to eSign and send trust documents securely, ensuring that all parties can complete the necessary paperwork without hassle. This user-friendly solution is particularly beneficial for those new to the trust creation process.

-

What are the pricing options for using airSlate SignNow for Connecticut trusts?

airSlate SignNow offers various pricing plans designed to cater to different business needs. Our plans are cost-effective, ensuring that you can manage your Connecticut trust documents without breaking the bank. You can choose a plan that best suits your requirements, whether you're an individual or a business.

-

What features are available for managing Connecticut trusts with airSlate SignNow?

airSlate SignNow includes powerful features such as document templates, integrated workflows, and real-time tracking. These tools make it easy to manage your Connecticut trust documents efficiently, ensuring that you comply with legal standards and keep everything organized. The platform's analytics also help you monitor the signing process seamlessly.

-

What benefits does a Connecticut trust provide?

Establishing a Connecticut trust offers multiple benefits, such as asset protection, privacy, and tax advantages. It can help reduce estate taxes and avoid probate, ensuring that your assets are distributed according to your wishes. By utilizing airSlate SignNow, you can easily implement this trust for peace of mind.

-

Can I integrate airSlate SignNow with other applications for my Connecticut trust planning?

Yes, airSlate SignNow allows integration with various applications, enabling you to streamline your Connecticut trust planning process. Whether you need to connect with CRM systems or document storage solutions, our platform can accommodate your needs to keep everything organized. This flexibility is crucial for efficient document management.

-

Is airSlate SignNow secure for handling documents related to Connecticut trusts?

Absolutely! airSlate SignNow is committed to the security of your documents, especially when dealing with sensitive information related to Connecticut trusts. Our platform employs advanced encryption and compliance features to safeguard your data. You can trust us to protect your legal documents throughout the entire signing process.

Get more for Connecticut Trust

- Newly divorced individuals package kentucky form

- Contractors forms package kentucky

- Ky vehicle enforcement form form 2

- Wedding planning or consultant package kentucky form

- Hunting forms package kentucky

- Identity theft recovery package kentucky form

- Ky advance directive form

- Aging parent package kentucky form

Find out other Connecticut Trust

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself