Louisiana Trust Form

What is the Louisiana Trust

A Louisiana living trust is a legal arrangement that allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust can help avoid probate, simplify the transfer of assets, and provide privacy regarding the estate. In Louisiana, the trust is governed by specific state laws, making it essential to understand the local regulations that apply to its creation and management.

Key elements of the Louisiana Trust

Several key elements define a Louisiana living trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets. The grantor can serve as the initial trustee.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

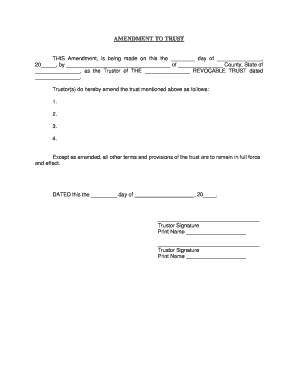

- Trust Document: A legal document that outlines the terms of the trust, including how assets are to be managed and distributed.

Steps to complete the Louisiana Trust

Creating a Louisiana living trust involves several important steps:

- Determine the assets: Identify which assets you want to place in the trust.

- Choose a trustee: Decide who will manage the trust, whether it's yourself, a family member, or a professional.

- Draft the trust document: Work with a legal professional to create a trust document that meets Louisiana requirements.

- Transfer assets: Legally transfer ownership of the chosen assets into the trust.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Legal use of the Louisiana Trust

The legal use of a Louisiana living trust is primarily to manage and distribute assets according to the grantor's wishes. It can provide benefits such as avoiding probate, reducing estate taxes, and ensuring privacy. However, it is crucial to comply with Louisiana laws governing trusts to ensure their validity and enforceability. Consulting with a qualified attorney can help navigate these legal requirements effectively.

State-specific rules for the Louisiana Trust

Louisiana has unique laws regarding trusts that differ from many other states. For instance, Louisiana recognizes both revocable and irrevocable trusts. The state also has specific rules about the rights of beneficiaries and the duties of trustees. Understanding these state-specific rules is essential for anyone considering setting up a living trust in Louisiana to ensure compliance and effectiveness.

How to obtain the Louisiana Trust

Obtaining a Louisiana living trust typically involves consulting with an attorney who specializes in estate planning. They can help draft the trust document according to state laws and your specific needs. Once the document is prepared, you will need to sign it in accordance with Louisiana's legal requirements, which may include notarization. After signing, assets can be transferred into the trust to activate it.

Quick guide on how to complete louisiana trust

Effortlessly prepare Louisiana Trust on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Louisiana Trust on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Louisiana Trust with ease

- Obtain Louisiana Trust and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Edit and eSign Louisiana Trust and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana living trust?

A Louisiana living trust is a legal document that allows you to manage and control your assets during your lifetime and after your death. Unlike a will, a living trust helps avoid the probate process, making it easier and faster for your heirs to inherit your assets. By establishing a Louisiana living trust, you can ensure that your wishes are honored while maintaining privacy regarding your estate.

-

How much does it cost to create a Louisiana living trust?

The cost of creating a Louisiana living trust can vary signNowly based on the complexity of your estate and whether you choose to work with an attorney or use an online platform. Typically, professional legal services can range from a few hundred to several thousand dollars. Using an efficient eSignature solution like airSlate SignNow may help cut costs and simplify the process of establishing a Louisiana living trust.

-

What are the main benefits of a Louisiana living trust?

One of the primary benefits of a Louisiana living trust is that it helps avoid probate, which can be time-consuming and costly. Additionally, a living trust allows for greater control over your assets, privacy, and potentially lower taxes. If you have minor children, a Louisiana living trust can also provide a framework for their financial security.

-

Can I change or revoke my Louisiana living trust?

Yes, one of the key features of a Louisiana living trust is its flexibility. You can modify or revoke your living trust at any time, as long as you are competent and not under undue influence. This ability allows you to adapt the trust as your circumstances, family situation, or financial status change.

-

How does a Louisiana living trust work with beneficiaries?

In a Louisiana living trust, you can specify who will inherit your assets, who will manage the trust, and how the assets will be distributed among beneficiaries. By clearly outlining these details within the trust document, you can help ensure that your wishes are respected after your passing. Using airSlate SignNow's eSignature capabilities can help facilitate the process of getting this trust signed by all necessary parties.

-

Is a living trust essential for everyone in Louisiana?

While a Louisiana living trust offers many benefits, it is not essential for everyone. Individuals with smaller estates or straightforward distribution plans may find that a will suffices. However, if you have signNow assets or complex family dynamics, creating a Louisiana living trust could be a smart decision to ensure your wishes are honored.

-

What documents do I need to set up a Louisiana living trust?

To set up a Louisiana living trust, you typically need documentation that includes a list of your assets, documents proving ownership of those assets, and your desired trust structure, including beneficiaries and trustee details. If you're using an online tool, services like airSlate SignNow can help streamline the paperwork and ensure everything is legally binding through eSignature.

Get more for Louisiana Trust

- Mutual wills package with last wills and testaments for married couple with adult children colorado form

- Will married couple 497300841 form

- Mutual wills package with last wills and testaments for married couple with minor children colorado form

- Colorado will form

- Legal last will and testament form for married person with adult and minor children from prior marriage colorado

- Legal last will and testament form for domestic partner with adult and minor children from prior marriage colorado

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage colorado

- Legal last will and testament form for married person with adult and minor children colorado

Find out other Louisiana Trust

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer