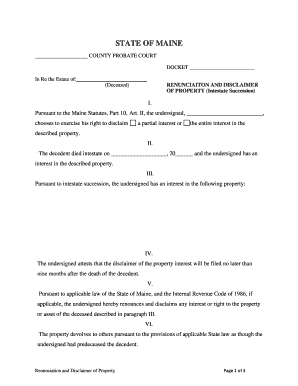

Maine Intestate Form

What is the Maine Intestate?

The Maine intestate refers to the legal process that determines how a deceased person's assets are distributed when they die without a valid will. In such cases, the state laws of intestate succession govern the distribution of the estate. This process ensures that the deceased's assets are allocated according to established legal guidelines, typically prioritizing close relatives such as spouses, children, and parents. Understanding the Maine intestate laws is essential for anyone involved in estate planning or managing an estate after a death.

Steps to Complete the Maine Intestate

Completing the Maine intestate process involves several key steps that must be followed to ensure compliance with state laws. The primary steps include:

- Gathering necessary documents, including the death certificate and any existing financial records.

- Identifying heirs according to Maine's intestate succession laws, which outline the order of inheritance.

- Filing the appropriate forms with the local probate court to initiate the intestate proceedings.

- Notifying all interested parties, including potential heirs and creditors, about the proceedings.

- Administering the estate by managing assets, settling debts, and distributing the remaining property to heirs.

Legal Use of the Maine Intestate

The legal use of the Maine intestate process is crucial for ensuring that the distribution of assets adheres to state laws. When a person dies intestate, the court appoints an administrator to oversee the estate. This administrator is responsible for managing the estate's affairs, including paying debts and distributing assets according to the intestate succession laws. It is important to follow the legal procedures to avoid disputes among heirs and ensure a smooth transition of assets.

Required Documents

To initiate the Maine intestate process, several documents are required. These typically include:

- The death certificate of the deceased individual.

- A list of assets and liabilities of the estate.

- Identification of potential heirs, including their contact information.

- Any relevant financial documents, such as bank statements and property deeds.

Having these documents ready will facilitate a more efficient probate process and help ensure compliance with legal requirements.

State-Specific Rules for the Maine Intestate

Maine has specific rules governing intestate succession that dictate how assets are distributed. For instance, if a person dies with a spouse and children, the spouse typically receives a portion of the estate, while the children inherit the remainder. If there are no immediate family members, the estate may pass to more distant relatives or, in some cases, to the state. Understanding these rules is essential for anyone navigating the intestate process in Maine.

Examples of Using the Maine Intestate

Examples of situations where the Maine intestate process may apply include:

- A single individual passes away without a will, leaving behind a house and savings accounts.

- A married couple has children but never created a will, leading to the distribution of their joint assets according to state laws.

- An individual with no immediate family members dies, prompting the state to claim the estate after identifying distant relatives.

These scenarios illustrate the importance of understanding how intestate succession works in Maine and the potential implications for heirs.

Quick guide on how to complete maine intestate

Prepare Maine Intestate effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents promptly without delays. Handle Maine Intestate on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Maine Intestate without hassle

- Find Maine Intestate and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that mandate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Maine Intestate to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for handling a maine intestate estate?

When dealing with a maine intestate estate, the process typically involves appointing a personal representative who will manage the affairs of the deceased. This representative will gather assets, pay debts, and distribute the remaining property according to Maine state laws. Utilizing airSlate SignNow can simplify these document handling processes.

-

How can airSlate SignNow help with maine intestate document management?

airSlate SignNow can streamline document management for maine intestate cases by allowing users to easily send and eSign essential documents from any device. This platform offers secure storage and access, ensuring that all documents related to the maine intestate estate are organized and easily retrievable. Moreover, its user-friendly interface simplifies communication among all parties involved.

-

What are the costs associated with creating documents for a maine intestate estate using airSlate SignNow?

The cost of using airSlate SignNow for handling maine intestate documents varies based on the chosen plan. However, it generally offers a cost-effective solution compared to traditional methods, eliminating ink, paper, and postal expenses. Additionally, it allows users to complete transactions quickly, thereby potentially saving on legal fees.

-

Are there templates available for maine intestate-related documents on airSlate SignNow?

Yes, airSlate SignNow provides a range of templates specifically designed for maine intestate-related documents. These templates help users quickly create legally compliant documents without needing extensive legal knowledge. This feature is particularly useful for personal representatives managing estates.

-

Can I integrate airSlate SignNow with other applications for my maine intestate processes?

Absolutely! airSlate SignNow integrates seamlessly with various applications that facilitate the management and organization of maine intestate estates. This includes integrations with cloud storage services and project management tools, enhancing your workflow and document tracking capabilities.

-

What are the benefits of using airSlate SignNow for maine intestate signatures?

Using airSlate SignNow for maine intestate signatures offers numerous benefits, including enhanced security and compliance with legal requirements. The electronic signature process speeds up the execution of documents, ensuring timely management of the estate. Additionally, it offers an easy way to track document status and communication among stakeholders.

-

Is airSlate SignNow suitable for both individuals and businesses handling maine intestate matters?

Yes, airSlate SignNow is designed to cater to both individuals and businesses dealing with maine intestate issues. Its versatility and range of features make it ideal for personal representatives, legal professionals, and estate planners alike. This platform can accommodate various needs, whether you're handling a simple estate or a more complex one.

Get more for Maine Intestate

- Ct directives form

- Aging parent package connecticut form

- Sale of a business package connecticut form

- Legal documents for the guardian of a minor package connecticut form

- New state resident package connecticut form

- Como llenar form ct w4p 2021 printable explicamome paso x paso

- Connecticut property 497301291 form

- Connecticut directive form

Find out other Maine Intestate

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast