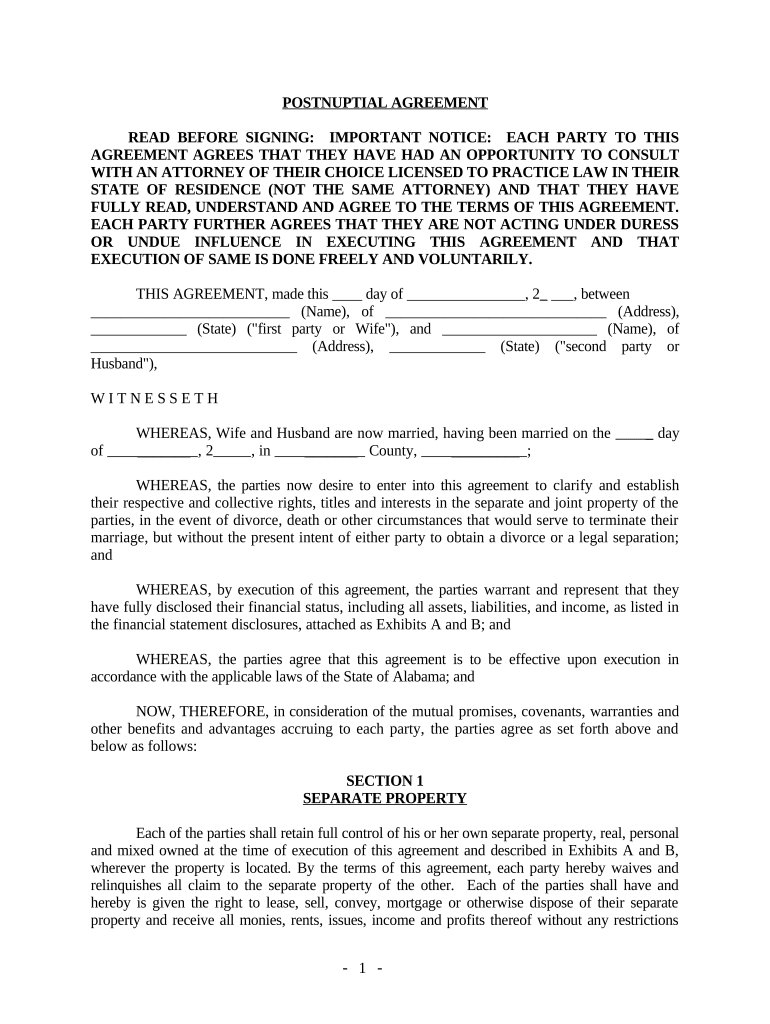

Alabama Property Form

What is the Alabama Property

The Alabama property refers to real estate assets located within the state of Alabama. This includes residential, commercial, and industrial properties. Understanding the classification and value of these properties is crucial for various legal and financial transactions, including buying, selling, or leasing. The Alabama property is subject to state laws and regulations that govern property ownership, taxation, and transfer processes.

How to use the Alabama Property

Utilizing Alabama property effectively involves understanding its legal implications and financial responsibilities. Property owners can use their assets for personal residence, investment, or business purposes. It is essential to comply with local zoning laws and regulations, which dictate how the property can be used. Additionally, property owners should be aware of their rights and obligations under Alabama law, including maintenance responsibilities and tenant rights if the property is rented out.

Steps to complete the Alabama Property

Completing transactions involving Alabama property typically involves several key steps:

- Conduct thorough research on the property, including its history and current market value.

- Prepare necessary documentation, such as purchase agreements, disclosures, and financing details.

- Engage with a licensed real estate agent or attorney to ensure compliance with state laws.

- Submit required forms to local authorities for property transfer or registration.

- Finalize the transaction by signing the necessary documents and completing any financial arrangements.

Legal use of the Alabama Property

The legal use of Alabama property is governed by state laws that dictate ownership rights, usage regulations, and transfer processes. Property owners must adhere to zoning laws, which specify how land can be utilized, whether for residential, commercial, or agricultural purposes. Additionally, owners should be aware of property tax obligations and any local ordinances that may affect their property rights. Compliance with these legal requirements helps avoid disputes and ensures smooth ownership.

Required Documents

When dealing with Alabama property, several documents are typically required to facilitate transactions. These may include:

- Property deed: This legal document proves ownership of the property.

- Title report: This outlines the legal status of the property, including any liens or encumbrances.

- Purchase agreement: A contract between the buyer and seller detailing the terms of the sale.

- Disclosure statements: These inform buyers of any known issues with the property.

- Financing documents: If applicable, these include mortgage agreements or loan applications.

Form Submission Methods

Submitting forms related to Alabama property can be done through various methods, depending on the specific requirements of the transaction. Common submission methods include:

- Online: Many forms can be submitted electronically through state or local government websites.

- Mail: Physical copies of forms can be sent to the appropriate government office.

- In-person: Some transactions may require visiting local offices to submit documents directly.

Penalties for Non-Compliance

Failure to comply with Alabama property laws can result in various penalties. These may include fines, legal disputes, or even loss of property rights. Common issues leading to penalties include failure to pay property taxes, not adhering to zoning regulations, or neglecting to file necessary documents during property transactions. Understanding and following the legal requirements can help property owners avoid these complications.

Quick guide on how to complete alabama property 497295507

Complete Alabama Property effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Alabama Property on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Alabama Property without effort

- Obtain Alabama Property and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind worries of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Alabama Property and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit my alabama property transactions?

airSlate SignNow is an electronic signature solution that streamlines the signing process for important documents. For your alabama property transactions, it allows you to send, sign, and manage documents efficiently, ensuring compliance and reducing turnaround time. This can help you close deals faster and enhance the overall customer experience.

-

How much does airSlate SignNow cost for managing alabama property documents?

The pricing for airSlate SignNow varies based on the plan you choose, starting with a cost-effective option tailored for small businesses. For managing alabama property documents, consider the Premium or Business plans which offer additional features like advanced integrations and more comprehensive document management tools. Investing in SignNow can save you time and ensure smooth transactions.

-

Does airSlate SignNow integrate with other tools commonly used for alabama property management?

Yes, airSlate SignNow offers integrations with various tools popular among alabama property managers, including CRM systems and cloud storage services. This seamless integration allows you to centralize your property management operations, making document handling and communication more efficient. You can easily connect with platforms like Google Drive and Salesforce.

-

Is airSlate SignNow secure for signing alabama property contracts?

Absolutely! airSlate SignNow takes security seriously, with features like encryption, secure data storage, and compliance with industry standards. When signing alabama property contracts, you can trust that your sensitive information is protected against unauthorized access, ensuring a safe transaction process for all parties involved.

-

Can I use airSlate SignNow for mobile signing of alabama property documents?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to sign alabama property documents on the go. Whether you’re in the office or out in the field, you can easily manage and sign documents from your smartphone or tablet. This mobility enhances efficiency, especially for busy property managers.

-

What features does airSlate SignNow offer for alabama property management?

airSlate SignNow provides a variety of features tailored for alabama property management, including customizable templates, automated reminders, and real-time tracking of document status. These features help ensure that all parties are on the same page and that important deadlines are met. Streamlining your document workflow can signNowly improve your operational efficiency.

-

How does airSlate SignNow improve the workflow for alabama property deals?

By implementing airSlate SignNow into your workflow, you can automate the signing process and eliminate the delays associated with traditional paper-based methods. This improvement can accelerate alabama property deals, resulting in faster closings and satisfied clients. An efficient workflow also reduces the risk of errors, enhancing overall transaction quality.

Get more for Alabama Property

- Refrigeration contractor package indiana form

- Indiana drainage 497307184 form

- Tax free exchange package indiana form

- Landlord tenant sublease package indiana form

- Buy sell agreement package indiana form

- Option to purchase package indiana form

- Amendment of lease package indiana form

- Annual financial checkup package indiana form

Find out other Alabama Property

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now