Alabama Failure Form

What is the Alabama Failure

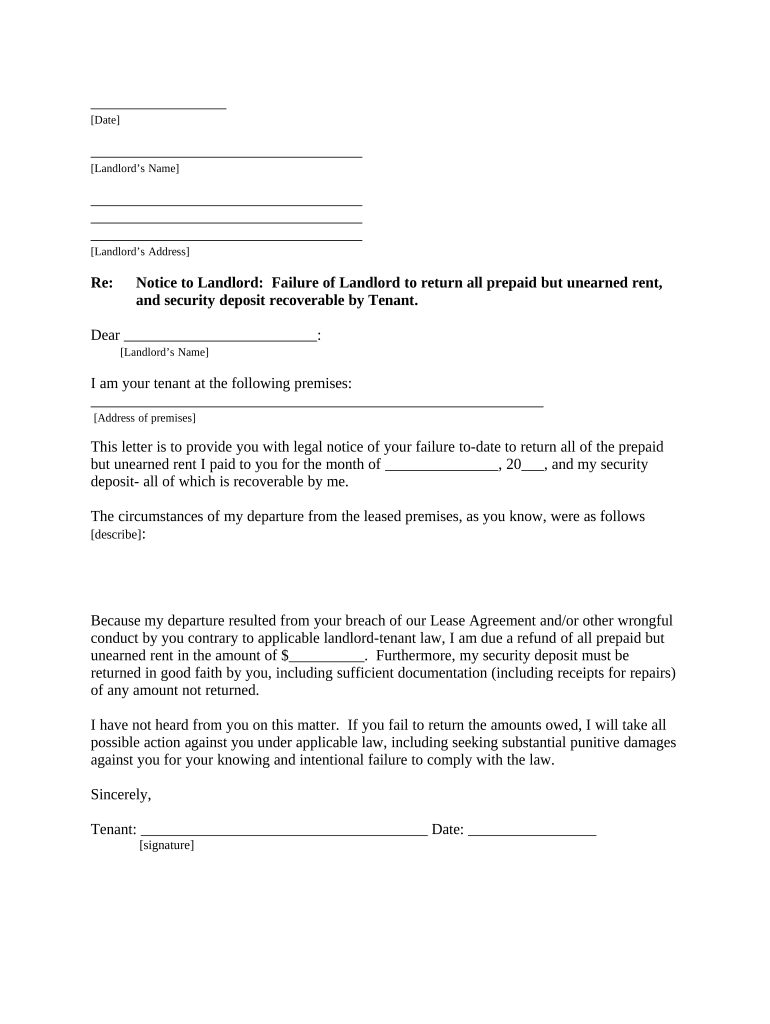

The Alabama Failure form is a specific document used in the state of Alabama, primarily related to tax filings and compliance. This form is essential for individuals and businesses that have encountered issues with their tax obligations. It serves as a means to report failures in fulfilling certain tax requirements, which may include underreporting income or failing to pay taxes on time. Understanding the purpose and implications of this form is crucial for maintaining compliance with state tax laws.

How to use the Alabama Failure

Using the Alabama Failure form involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents, including income statements and previous tax returns. Next, carefully fill out the form, providing detailed information about the tax failures being reported. It is important to clearly outline the reasons for the failure and any corrective actions taken. After completing the form, review it for accuracy before submission to the appropriate state tax authority.

Steps to complete the Alabama Failure

Completing the Alabama Failure form requires attention to detail. Follow these steps to ensure proper submission:

- Collect necessary documentation, such as income records and prior tax filings.

- Fill out the form, ensuring all sections are completed accurately.

- Provide a clear explanation of the tax failure and any efforts made to rectify the situation.

- Review the form for any errors or omissions.

- Submit the completed form to the designated Alabama tax office, either electronically or by mail.

Legal use of the Alabama Failure

The legal use of the Alabama Failure form is governed by state tax laws. It is important to ensure that the form is used in compliance with these regulations to avoid potential penalties. The form must be submitted within the designated timeframes and should accurately reflect the taxpayer's situation. Failure to adhere to these legal requirements may result in additional fines or legal repercussions.

Key elements of the Alabama Failure

Key elements of the Alabama Failure form include detailed sections that require specific information. Important components typically include:

- Taxpayer identification information, such as name and Social Security number.

- A description of the failure, including dates and amounts.

- Supporting documentation that validates the claims made in the form.

- Signature and date to certify the accuracy of the information provided.

Penalties for Non-Compliance

Non-compliance with the Alabama Failure form requirements can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand the risks associated with failing to report tax issues accurately and to submit the necessary forms in a timely manner.

Quick guide on how to complete alabama failure

Effortlessly Prepare Alabama Failure on Any Device

Managing documents online has gained tremendous traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Alabama Failure on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-centric process today.

How to Modify and eSign Alabama Failure with Ease

- Obtain Alabama Failure and click Get Form to begin.

- Use our tools to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with features specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Alabama Failure to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Alabama failure?

AirSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents effortlessly. If you've faced challenges like Alabama failure in document workflows, SignNow offers a reliable and streamlined approach to ensure your processes run smoothly.

-

How can airSlate SignNow help prevent issues related to Alabama failure?

By using airSlate SignNow, you can eliminate the common pitfalls that lead to Alabama failure by centralizing document management. The platform ensures that every step of the signing process is efficiently tracked and managed, reducing the chances of error.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans tailored to different business needs, starting from a cost-effective solution to more advanced options. This flexibility ensures that whatever your needs—related to Alabama failure or other document challenges—there’s a suitable plan for you.

-

What features does airSlate SignNow provide that assist with document security?

AirSlate SignNow is designed with advanced security features to guard against potential issues like Alabama failure. These features include encryption, audit trails, and secure cloud storage, ensuring that your documents remain protected throughout the signing process.

-

Can airSlate SignNow integrate with other tools to combat Alabama failure?

Yes, airSlate SignNow seamlessly integrates with various tools and software, enhancing your workflow and reducing the risk of Alabama failure. Whether it’s CRM systems or project management software, these integrations allow for a smooth document management experience.

-

How does airSlate SignNow enhance the efficiency of signing documents?

With airSlate SignNow, businesses can send documents for eSignature in a matter of seconds, signNowly speeding up the process. This efficiency directly counters issues like Alabama failure by reducing turnaround times and ensuring timely responses.

-

What benefits can businesses expect from using airSlate SignNow in light of Alabama failure?

By adopting airSlate SignNow, businesses not only streamline their document signing processes but also minimize the potential for Alabama failure. Benefits include enhanced collaboration, increased speed of transactions, and improved compliance with legal standards.

Get more for Alabama Failure

- Lease purchase agreements package nebraska form

- Satisfaction cancellation or release of mortgage package nebraska form

- Premarital agreements package nebraska form

- Painting contractor package nebraska form

- Framing contractor package nebraska form

- Foundation contractor package nebraska form

- Plumbing contractor package nebraska form

- Brick mason contractor package nebraska form

Find out other Alabama Failure

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free