Notice to Internal Revenue Service of Name Change Alabama Form

What is the Notice to Internal Revenue Service of Name Change in Alabama

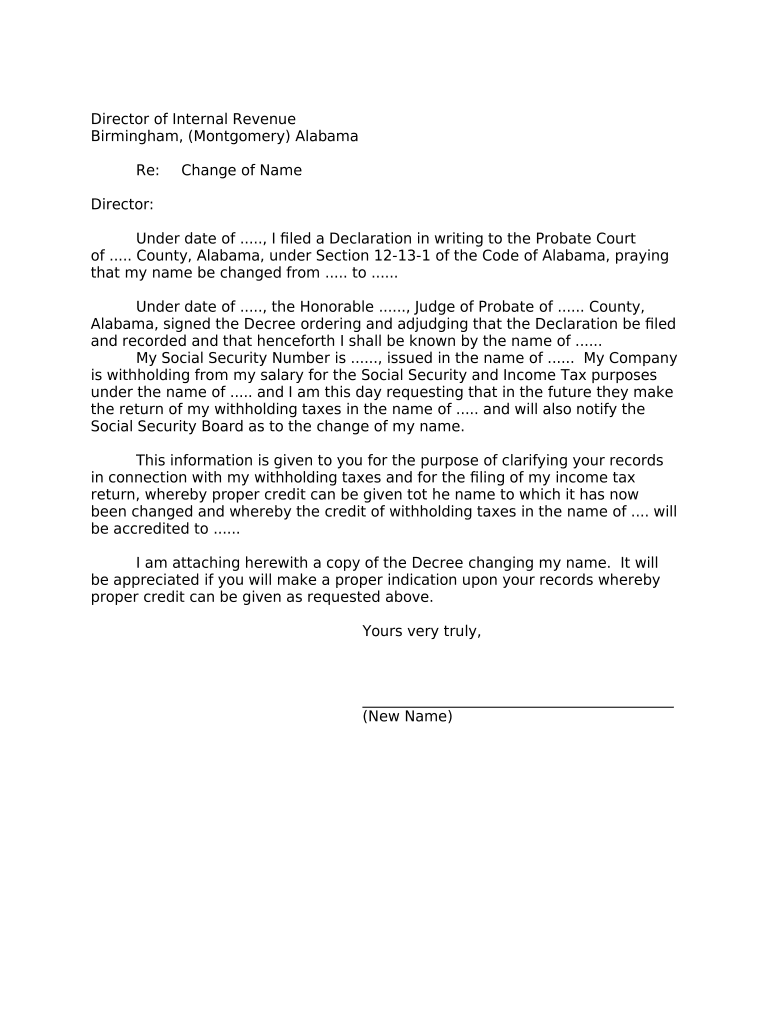

The Notice to Internal Revenue Service of Name Change in Alabama is a formal document used to inform the IRS about a change in an individual's name. This notice is essential for maintaining accurate tax records and ensuring that all tax-related correspondence reflects the individual's current legal name. Failing to notify the IRS of a name change can lead to complications in tax filings and potential issues with tax refunds.

Steps to Complete the Notice to Internal Revenue Service of Name Change in Alabama

Completing the Notice to Internal Revenue Service of Name Change involves several key steps:

- Gather necessary information, including your old name, new name, and Social Security number.

- Obtain the official form from the IRS or relevant state agency.

- Fill out the form accurately, ensuring all information is current and correct.

- Sign and date the form to validate it.

- Submit the form to the IRS either online, by mail, or in person, depending on your preference.

Required Documents for the Notice to Internal Revenue Service of Name Change in Alabama

When filing the Notice to Internal Revenue Service of Name Change, certain documents may be required to support your application:

- A copy of the legal name change document, such as a marriage certificate or court order.

- Identification documents, including a government-issued ID that reflects your new name.

- Any previous tax returns that may need to be amended due to the name change.

IRS Guidelines for Name Change Notifications

The IRS has specific guidelines regarding name change notifications. It is important to follow these to ensure compliance:

- Notify the IRS as soon as possible after a legal name change.

- Use the name that appears on your Social Security card when filing taxes.

- Check for any additional forms or procedures that may apply based on your specific situation.

Filing Deadlines for the Notice to Internal Revenue Service of Name Change

Timely submission of the Notice to Internal Revenue Service of Name Change is crucial. Important deadlines to keep in mind include:

- File the notice before the tax filing deadline for the year in which the name change occurs.

- Be aware of any specific deadlines for amending previous tax returns if applicable.

Form Submission Methods for the Notice to Internal Revenue Service of Name Change

There are several methods available for submitting the Notice to Internal Revenue Service of Name Change:

- Online submission through the IRS website, if applicable.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at a local IRS office, if preferred.

Quick guide on how to complete notice to internal revenue service of name change alabama

Effortlessly Prepare Notice To Internal Revenue Service Of Name Change Alabama on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Notice To Internal Revenue Service Of Name Change Alabama on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Notice To Internal Revenue Service Of Name Change Alabama with ease

- Locate Notice To Internal Revenue Service Of Name Change Alabama and select Get Form to begin.

- Use the tools we provide to fill in your document.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Revise and eSign Notice To Internal Revenue Service Of Name Change Alabama and ensure effective communication at every point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for completing an al name change application using airSlate SignNow?

To complete an al name change application using airSlate SignNow, simply upload the required documents, fill in the necessary information, and add signatures where needed. Our platform guides you through each step, ensuring that your application is filled out correctly. Once completed, you can easily send the application for eSignature.

-

How much does it cost to use airSlate SignNow for an al name change application?

airSlate SignNow offers competitive pricing, with various plans tailored to meet your needs for handling an al name change application. You can choose from monthly or annual subscriptions, which provide excellent value for businesses. Costs vary based on features and the number of users, allowing you to select a plan that suits your budget.

-

What features does airSlate SignNow offer for managing al name change applications?

airSlate SignNow provides a variety of features designed to simplify the management of al name change applications. These include customizable templates, secure cloud storage, and automatic notifications for eSignatures. Additionally, the platform supports multiple file formats, making it easy to work with your existing documents.

-

Can I track the status of my al name change application on airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your al name change application in real-time. You will receive notifications when the document is viewed and signed, providing you with complete visibility throughout the process. This feature helps ensure that your application moves forward without delays.

-

Is airSlate SignNow compliant with legal standards for al name change applications?

Absolutely! airSlate SignNow complies with all necessary legal standards to ensure that your al name change application is secure and valid. Our platform adheres to state and federal regulations for electronic signatures, providing peace of mind for users concerned about legal compliance.

-

Are there any integrations available with airSlate SignNow for my al name change application?

Yes, airSlate SignNow integrates seamlessly with many popular business tools to enhance your workflow for al name change applications. Integrations include platforms like Salesforce, Google Drive, and Dropbox, allowing you to streamline document management and eSignature processes. This connectivity helps improve efficiency and collaboration across your organization.

-

What are the benefits of using airSlate SignNow for an al name change application?

Using airSlate SignNow for an al name change application ensures a fast, cost-effective, and user-friendly experience. The platform saves you time by automating signature collection and document processing. Additionally, its cloud-based nature allows you to access and manage your applications from anywhere.

Get more for Notice To Internal Revenue Service Of Name Change Alabama

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles new jersey form

- Letter from tenant to landlord about landlords failure to make repairs new jersey form

- Nj letter rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession new jersey form

- Letter from tenant to landlord about illegal entry by landlord new jersey form

- Letter from landlord to tenant about time of intent to enter premises new jersey form

- Letter notice rent 497319220 form

- Letter from tenant to landlord about sexual harassment new jersey form

Find out other Notice To Internal Revenue Service Of Name Change Alabama

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document