Business Credit Application Alabama Form

What is the Business Credit Application Alabama

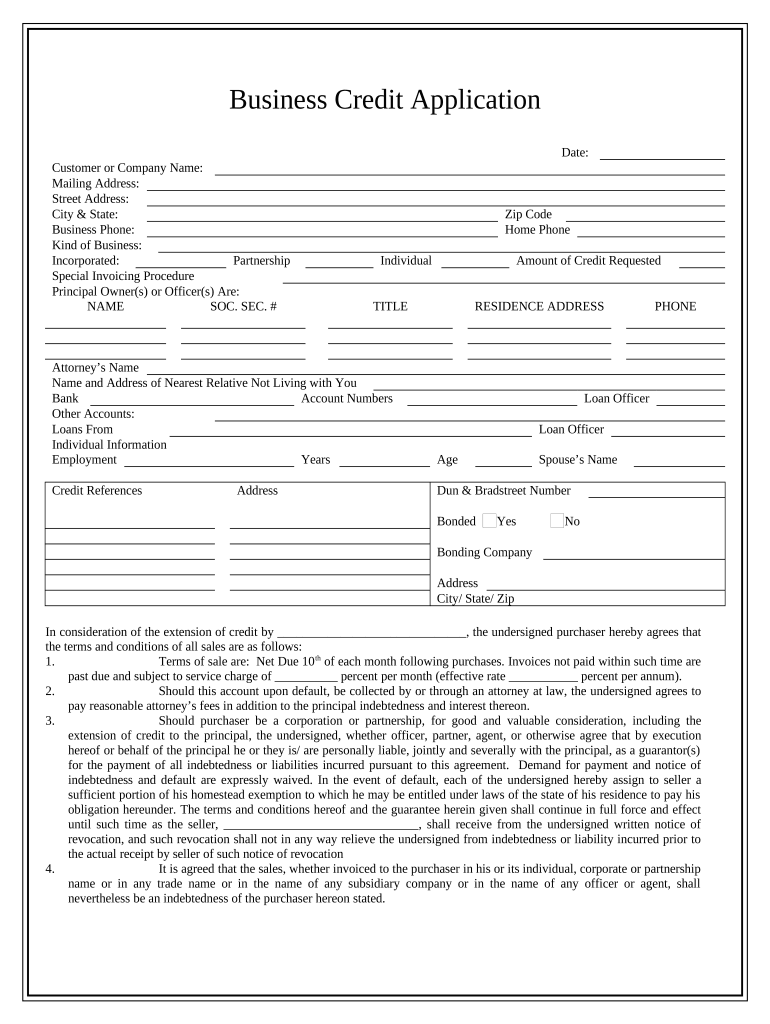

The Business Credit Application Alabama is a formal document that businesses in Alabama use to apply for credit from financial institutions or suppliers. This application collects essential information about the business, including its legal structure, financial history, and creditworthiness. It serves as a critical tool for lenders to assess the risk associated with extending credit to a business. Completing this application accurately is vital for increasing the likelihood of approval.

Steps to complete the Business Credit Application Alabama

Completing the Business Credit Application Alabama involves several key steps:

- Gather necessary information: Collect all relevant details about your business, including its legal name, address, and tax identification number.

- Financial documentation: Prepare financial statements, including profit and loss statements, balance sheets, and cash flow projections.

- Credit history: Provide information regarding the business's credit history, including any existing loans or credit lines.

- Complete the application: Fill out the application form accurately, ensuring all sections are completed and correct.

- Review and submit: Double-check the application for accuracy before submitting it to the lender or supplier.

Key elements of the Business Credit Application Alabama

Several key elements are typically included in the Business Credit Application Alabama:

- Business Information: Details such as the business name, address, and contact information.

- Ownership Structure: Information about the owners, including their names and ownership percentages.

- Financial Information: Financial statements and credit history that demonstrate the business's financial health.

- Purpose of Credit: A description of how the requested credit will be used, which helps lenders understand the business's needs.

- Signature: A section for authorized representatives to sign, confirming the accuracy of the information provided.

Legal use of the Business Credit Application Alabama

The Business Credit Application Alabama is legally binding once submitted and signed by the appropriate parties. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to legal repercussions or denial of credit. The application must comply with state and federal regulations governing lending practices, ensuring that the rights of both the lender and the borrower are protected.

How to obtain the Business Credit Application Alabama

Businesses can obtain the Business Credit Application Alabama through various channels. Many financial institutions and suppliers provide the application directly on their websites for download. Additionally, businesses may request a physical copy from their bank or credit provider. It is important to ensure that the correct version of the application is used, as different lenders may have specific requirements or formats.

Eligibility Criteria

To qualify for credit through the Business Credit Application Alabama, businesses typically must meet certain eligibility criteria. These may include:

- Established Business: The business should be legally registered and operational for a specific period, often at least one year.

- Creditworthiness: A satisfactory credit history with no significant delinquencies or bankruptcies.

- Financial Stability: Demonstrated ability to generate revenue and manage expenses effectively.

- Business Plan: A clear outline of how the credit will be utilized to support business growth.

Quick guide on how to complete business credit application alabama

Effortlessly prepare Business Credit Application Alabama on any device

The management of online documents has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Business Credit Application Alabama on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Business Credit Application Alabama with ease

- Locate Business Credit Application Alabama and select Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Business Credit Application Alabama and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Alabama?

A Business Credit Application Alabama is a document that allows businesses to apply for credit with lenders in Alabama. This application provides necessary details about the business, its financial status, and its credit history to assess eligibility for credit.

-

How can I create a Business Credit Application Alabama using airSlate SignNow?

You can easily create a Business Credit Application Alabama using airSlate SignNow by utilizing our customizable templates. Simply log in, select the template, fill in the required information, and send it for eSignature, making the process fast and efficient.

-

Is there a cost for using airSlate SignNow for a Business Credit Application Alabama?

airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. Whether you are a small business or a larger enterprise, you can choose a plan that suits your needs for handling Business Credit Applications Alabama and other documents.

-

What features does airSlate SignNow provide for Business Credit Applications Alabama?

airSlate SignNow provides features such as customizable templates, robust eSignature capabilities, and secure storage of documents for Business Credit Applications Alabama. Additionally, it supports real-time tracking to keep you updated on the status of your application.

-

Can airSlate SignNow integrate with other applications for Business Credit Applications Alabama?

Yes, airSlate SignNow integrates seamlessly with various software applications such as CRMs, accounting software, and cloud storage services. This integration facilitates easy management and sharing of your Business Credit Application Alabama within your existing workflows.

-

What are the benefits of using airSlate SignNow for a Business Credit Application Alabama?

Using airSlate SignNow for a Business Credit Application Alabama streamlines the process, reduces paperwork, and enhances efficiency. The platform offers a secure and user-friendly interface that signNowly speeds up the application process while maintaining compliance.

-

How secure is airSlate SignNow for handling Business Credit Applications Alabama?

airSlate SignNow prioritizes security and utilizes advanced encryption methods to protect your Business Credit Applications Alabama. All documents are stored securely, ensuring that sensitive business information remains confidential and protected against unauthorized access.

Get more for Business Credit Application Alabama

Find out other Business Credit Application Alabama

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple