Chapter 13 Plan Alabama Form

What is the Chapter 13 Plan Alabama

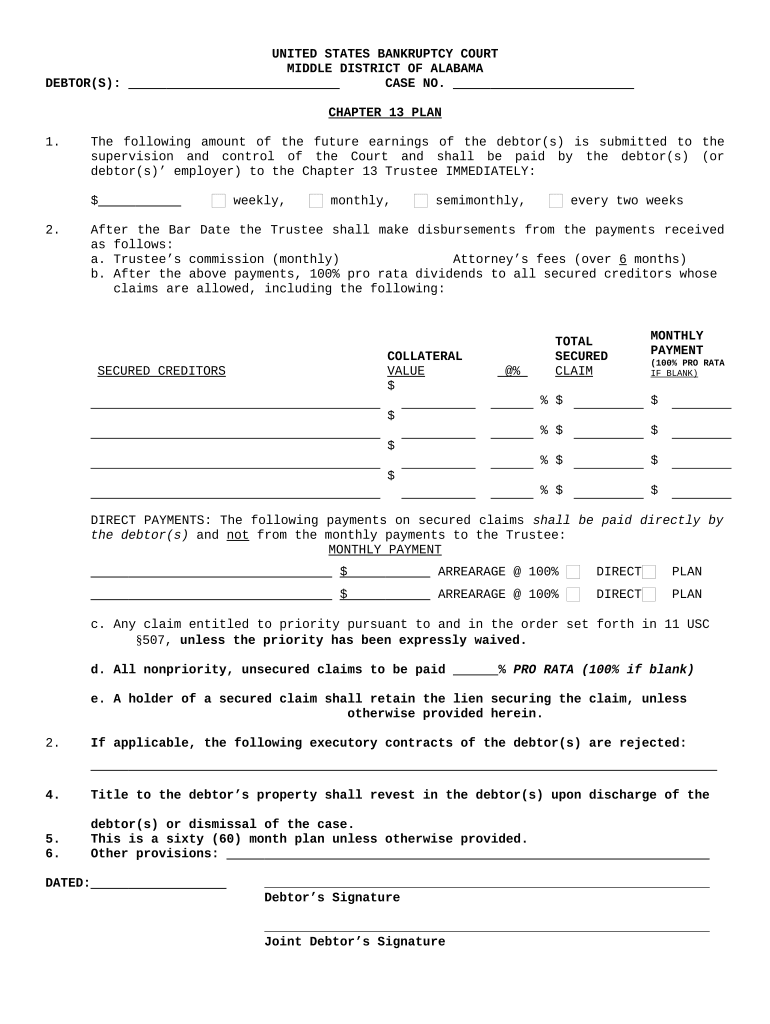

The Chapter 13 Plan in Alabama is a legal framework designed for individuals who are struggling with debt but wish to reorganize their financial obligations. It allows debtors to create a repayment plan to pay back all or part of their debts over a period of three to five years. This plan is particularly beneficial for those who have a regular income and want to retain their assets, such as a home or car, while managing their debts. The plan must be approved by the bankruptcy court, which ensures that it meets legal requirements and is feasible for the debtor.

Steps to Complete the Chapter 13 Plan Alabama

Completing the Chapter 13 Plan in Alabama involves several critical steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, tax returns, and a list of debts.

- Consult with a Bankruptcy Attorney: Seek legal advice to ensure that the plan complies with state and federal laws.

- Draft the Plan: Prepare the repayment plan, detailing how debts will be paid over the specified period.

- File the Plan with the Court: Submit the completed plan along with the bankruptcy petition to the relevant court.

- Attend the Confirmation Hearing: Participate in a court hearing where the judge will review and approve or deny the plan.

Key Elements of the Chapter 13 Plan Alabama

Several key elements must be included in the Chapter 13 Plan in Alabama to ensure its effectiveness:

- Payment Amount: Specify the monthly payment amount to creditors.

- Duration: Indicate the length of the repayment period, typically three to five years.

- Debt Classification: Classify debts into secured and unsecured categories, detailing how each will be addressed.

- Future Income: Outline how future income will be allocated to meet payment obligations.

Legal Use of the Chapter 13 Plan Alabama

The legal use of the Chapter 13 Plan in Alabama requires adherence to specific regulations. The plan must comply with the Bankruptcy Code and be filed in the correct jurisdiction. It is essential to ensure that the repayment terms are fair and feasible based on the debtor's income and expenses. Additionally, all creditors must be notified of the plan, and they have the right to object during the confirmation hearing. A properly executed plan can provide debtors with the opportunity to regain financial stability while avoiding foreclosure or repossession of assets.

Eligibility Criteria for the Chapter 13 Plan Alabama

To qualify for the Chapter 13 Plan in Alabama, individuals must meet certain eligibility criteria:

- Regular Income: Debtors must have a consistent source of income to support the repayment plan.

- Debt Limits: Total unsecured debts must be less than $419,275, and secured debts must be less than $1,257,850.

- Credit Counseling: Completion of a credit counseling course within six months prior to filing is required.

How to Obtain the Chapter 13 Plan Alabama

Obtaining the Chapter 13 Plan in Alabama involves accessing the necessary forms and guidelines. These can typically be found through the local bankruptcy court's website or by consulting with a bankruptcy attorney. The forms must be completed accurately and submitted to the court as part of the bankruptcy filing process. It is advisable to ensure all information is current and complete to avoid delays in the approval of the plan.

Quick guide on how to complete chapter 13 plan alabama

Complete Chapter 13 Plan Alabama seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you require to create, alter, and eSign your documents quickly without delays. Handle Chapter 13 Plan Alabama on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Chapter 13 Plan Alabama effortlessly

- Find Chapter 13 Plan Alabama and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from a device of your choice. Adjust and eSign Chapter 13 Plan Alabama and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chapter 13 Plan in Alabama?

A Chapter 13 Plan in Alabama is a legal framework that allows individuals to consolidate their debts and create a manageable repayment schedule over three to five years. This plan helps you keep your assets while ensuring your creditors are paid in an orderly fashion. Understanding the specifics of the Chapter 13 Plan in Alabama can empower you to regain financial control.

-

How much does it cost to file a Chapter 13 Plan in Alabama?

The cost to file a Chapter 13 Plan in Alabama can vary depending on the complexity of your financial situation and legal fees. On average, you may expect to pay filing fees around $310 and attorney fees which can range signNowly based on case specifics. It's important to budget for these costs when considering a Chapter 13 Plan in Alabama.

-

What are the main benefits of a Chapter 13 Plan in Alabama?

One of the main benefits of a Chapter 13 Plan in Alabama is the ability to stop foreclosure proceedings and keep your home while catching up on missed payments. Additionally, it allows debtors to reduce unsecured debts and potentially discharge certain claims. This plan is designed to offer a more manageable way to overcome financial challenges.

-

What documents do I need to prepare for a Chapter 13 Plan in Alabama?

To prepare for a Chapter 13 Plan in Alabama, you'll need various financial documents such as income statements, tax returns, a list of debts, and information about your assets and liabilities. It's crucial to compile these documents accurately to support your repayment plan. Proper documentation can streamline the Chapter 13 Plan in Alabama process considerably.

-

Can I modify my Chapter 13 Plan in Alabama after it is filed?

Yes, you can modify your Chapter 13 Plan in Alabama if your circumstances change, such as a change in income or unexpected expenses. This flexibility allows you to adapt to your financial situation while still working towards debt repayment. Consulting with a legal expert can help guide you through the modification process effectively.

-

How long does a Chapter 13 Plan last in Alabama?

A Chapter 13 Plan in Alabama typically lasts between three to five years, depending on your disposable income and overall financial situation. During this time, you will make regular payments to your creditors as outlined in your repayment plan. Completing the plan successfully can lead to a discharge of remaining debts.

-

Can I use airSlate SignNow for creating documents related to my Chapter 13 Plan in Alabama?

Yes, airSlate SignNow is an excellent tool for creating, sending, and eSigning documents related to your Chapter 13 Plan in Alabama. It offers an easy-to-use platform that enables you to manage your paperwork efficiently, making the legal process smoother. Utilizing airSlate SignNow can enhance your experience while navigating your Chapter 13 Plan in Alabama.

Get more for Chapter 13 Plan Alabama

- Nj minors form

- New jersey identity form

- New jersey identity 497319650 form

- Identity theft by known imposter package new jersey form

- Nj assets form

- Essential documents for the organized traveler package new jersey form

- Essential documents for the organized traveler package with personal organizer new jersey form

- Post nuptial agreement nj template form

Find out other Chapter 13 Plan Alabama

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template