Alabama Installments Fixed Rate Promissory Note Secured by Personal Property Alabama Form

What is the Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

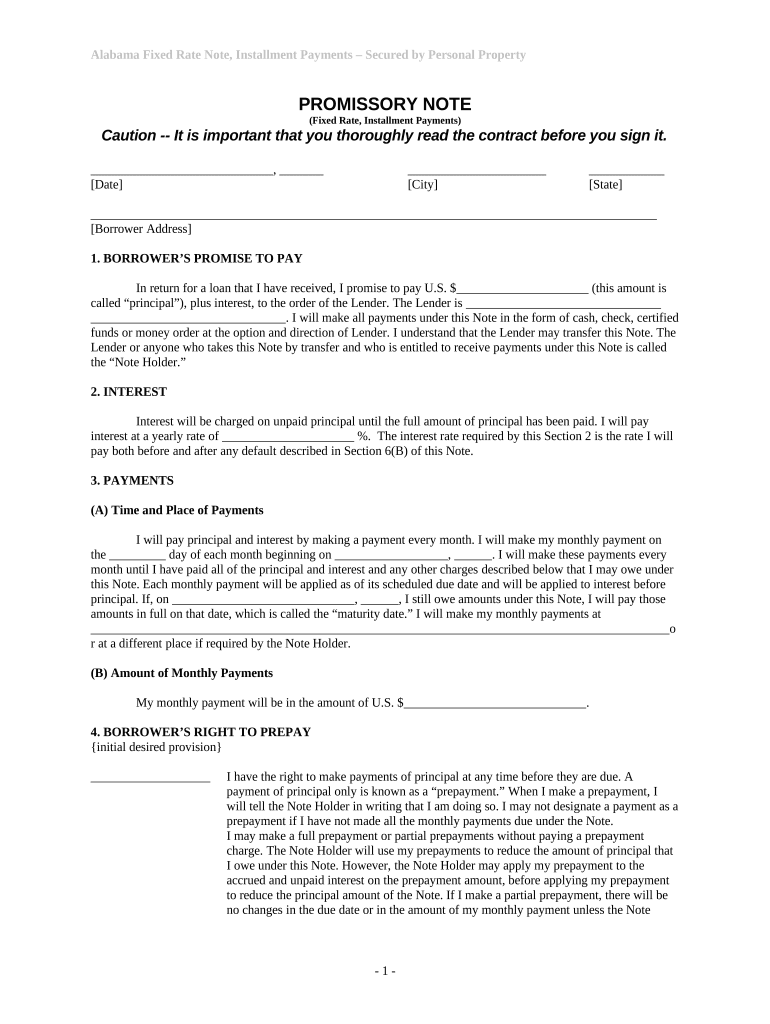

The Alabama Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document used in the state of Alabama to outline the terms of a loan that is repaid in fixed installments over a specified period. This note is secured by personal property, meaning that the borrower pledges personal assets as collateral for the loan. The document includes essential details such as the loan amount, interest rate, payment schedule, and the rights and responsibilities of both the lender and the borrower. This form is crucial for ensuring that both parties have a clear understanding of the loan agreement and the consequences of default.

How to use the Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

Using the Alabama Installments Fixed Rate Promissory Note involves several steps to ensure it is legally binding and properly executed. First, both parties should review the terms of the note, including the interest rate and repayment schedule. Next, the borrower must provide information about the personal property being used as collateral. Once all details are confirmed, both parties should sign the document. It's advisable to have the signatures witnessed or notarized to enhance the document's legal standing. After signing, each party should retain a copy for their records.

Steps to complete the Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

Completing the Alabama Installments Fixed Rate Promissory Note involves the following steps:

- Gather necessary information, including the borrower's and lender's names, addresses, and contact details.

- Specify the loan amount and the fixed interest rate.

- Outline the repayment schedule, including the number of installments and due dates.

- Identify the personal property being pledged as collateral, including a detailed description.

- Include any additional terms or conditions relevant to the loan agreement.

- Both parties should sign and date the document, and consider having it notarized.

Key elements of the Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

Several key elements must be included in the Alabama Installments Fixed Rate Promissory Note to ensure its effectiveness:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Payment Schedule: Details on how and when payments will be made.

- Collateral Description: A clear description of the personal property securing the loan.

- Default Terms: Conditions under which the lender can take possession of the collateral.

- Signatures: Required signatures of both the borrower and lender.

Legal use of the Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

The legal use of the Alabama Installments Fixed Rate Promissory Note is governed by state laws that dictate how such agreements should be structured and enforced. This document serves as a legally binding contract that outlines the obligations of both parties. It is important for both the lender and borrower to understand their rights under this agreement, including the implications of default. Proper execution, including notarization, can enhance the enforceability of the note in a court of law.

State-specific rules for the Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

In Alabama, specific rules apply to the creation and enforcement of the Installments Fixed Rate Promissory Note. These include:

- Compliance with Alabama's Uniform Commercial Code (UCC) regarding secured transactions.

- Proper description of collateral to ensure enforceability.

- Adherence to state interest rate limits, which may vary depending on the type of loan.

- Requirements for notarization or witness signatures to validate the document.

Quick guide on how to complete alabama installments fixed rate promissory note secured by personal property alabama

Complete Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents promptly without delays. Handle Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama without hassle

- Find Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama?

An Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama is a legally binding agreement where a borrower promises to pay back a loan in fixed installments, using personal property as collateral. This type of note is commonly used for personal loans and can help ensure the lender's security in the transaction.

-

What are the benefits of using an Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama?

The benefits include predictable payment schedules, lower interest rates compared to unsecured loans, and protection for lenders through collateral. This type of promissory note allows both parties to have a clear understanding of repayment terms, enhancing trust in the borrowing process.

-

How does airSlate SignNow facilitate the creation of Alabama Installments Fixed Rate Promissory Notes?

airSlate SignNow provides an intuitive platform that enables users to create customized Alabama Installments Fixed Rate Promissory Notes securely and efficiently. With our templates and eSigning capabilities, you can easily generate, send, and manage your documents from anywhere.

-

What features does airSlate SignNow offer for Alabama Installments Fixed Rate Promissory Notes?

Key features of airSlate SignNow include customizable document templates, automatic reminders for payments, secure eSigning, and integrations with various applications. These features streamline the process of handling Alabama Installments Fixed Rate Promissory Notes, making it easier for users to stay organized and compliant.

-

Is there a cost associated with using airSlate SignNow to manage Alabama Installments Fixed Rate Promissory Notes?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features designed to simplify the management of documents like Alabama Installments Fixed Rate Promissory Notes, ensuring a cost-effective solution for any size organization.

-

Can I integrate airSlate SignNow with other tools for managing Alabama Installments Fixed Rate Promissory Notes?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business tools such as CRM systems, cloud storage platforms, and project management software. This compatibility enhances your ability to manage Alabama Installments Fixed Rate Promissory Notes alongside other important business processes.

-

What security measures does airSlate SignNow have for Alabama Installments Fixed Rate Promissory Notes?

airSlate SignNow employs industry-standard security protocols, including encryption and secure data storage, to protect your Alabama Installments Fixed Rate Promissory Notes. Additionally, our platform ensures compliance with legal standards, providing peace of mind for both borrowers and lenders.

Get more for Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

Find out other Alabama Installments Fixed Rate Promissory Note Secured By Personal Property Alabama

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free