Arkansas Trust Form

What is the Arkansas Trust

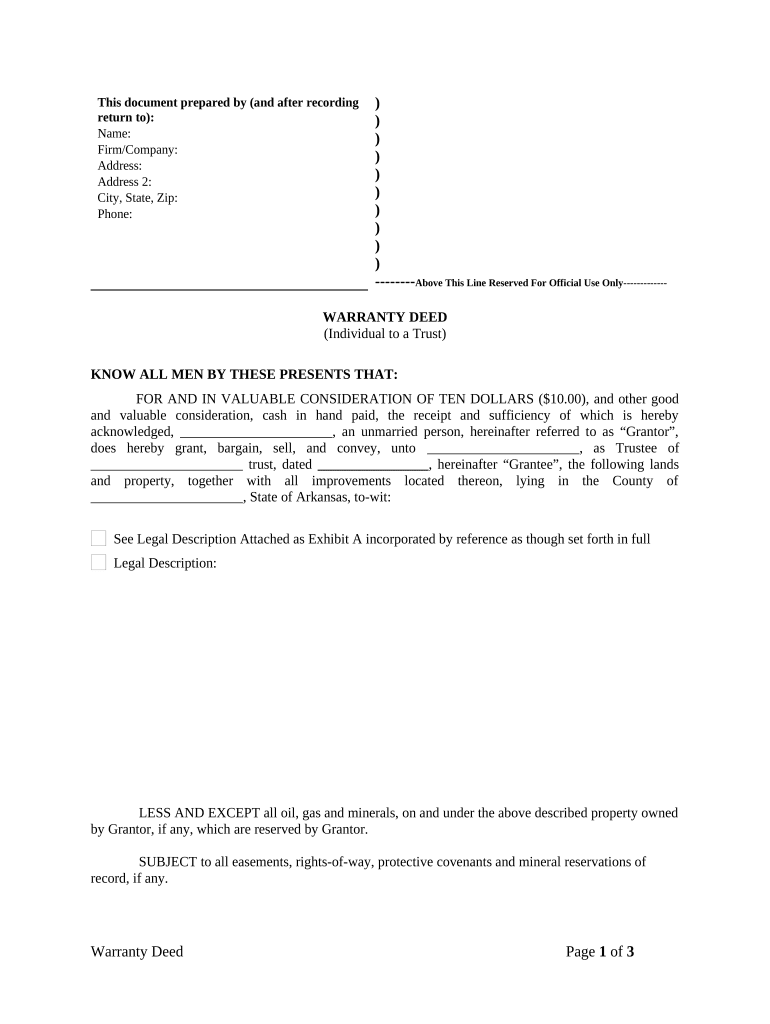

The Arkansas Trust is a legal arrangement that allows individuals to manage their assets and property for the benefit of designated beneficiaries. This type of trust can be used for various purposes, including estate planning, asset protection, and tax efficiency. By establishing an Arkansas Trust, individuals can ensure that their assets are distributed according to their wishes after their passing, while also potentially reducing estate taxes and avoiding probate.

How to use the Arkansas Trust

Using the Arkansas Trust involves several key steps. First, an individual must decide on the type of trust that best suits their needs, whether it's a revocable or irrevocable trust. Next, they will need to draft a trust document that outlines the terms and conditions of the trust, including the trustee's powers and the beneficiaries' rights. Once the trust is established, assets can be transferred into the trust, and the trustee will manage these assets according to the trust's provisions.

Steps to complete the Arkansas Trust

Completing the Arkansas Trust involves a series of methodical steps:

- Determine the purpose of the trust and the type of trust needed.

- Draft the trust document, including all necessary terms and conditions.

- Choose a trustee who will manage the trust assets.

- Transfer assets into the trust, ensuring all legal requirements are met.

- Review and update the trust periodically to reflect any changes in circumstances or laws.

Legal use of the Arkansas Trust

The legal use of the Arkansas Trust is governed by state laws and regulations. It is essential to ensure that the trust complies with the Arkansas Uniform Trust Code, which outlines the rights and responsibilities of trustees and beneficiaries. Properly executed, an Arkansas Trust can provide legal protection for assets, facilitate smoother transitions of wealth, and ensure compliance with applicable tax laws.

Key elements of the Arkansas Trust

Key elements of the Arkansas Trust include:

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: Those who will receive benefits from the trust, either during the grantor's lifetime or after their death.

- Trust Document: The legal document that outlines the terms of the trust, including how assets are to be managed and distributed.

- Assets: Property or financial assets placed into the trust for management and distribution.

Eligibility Criteria

Eligibility criteria for establishing an Arkansas Trust typically include:

- The grantor must be of legal age and mentally competent.

- There must be identifiable assets to fund the trust.

- The trust must have at least one beneficiary who is legally recognized.

Quick guide on how to complete arkansas trust

Prepare Arkansas Trust with ease on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Arkansas Trust on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Arkansas Trust effortlessly

- Obtain Arkansas Trust and click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Arkansas Trust and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Arkansas trust, and how can it benefit my estate planning?

An Arkansas trust is a legal arrangement that allows you to manage your assets while providing for your beneficiaries. Establishing an Arkansas trust can help minimize estate taxes, avoid probate, and ensure your assets are distributed according to your wishes. It's a valuable tool for effective estate planning.

-

How much does it cost to set up an Arkansas trust?

The cost to set up an Arkansas trust varies depending on the complexity of the trust and the fees charged by legal professionals. Generally, you can expect to pay between $500 to $3,000 for establishing an Arkansas trust. It's advisable to consult with a lawyer to understand the potential costs involved based on your specific needs.

-

What types of Arkansas trusts can I establish?

There are several types of Arkansas trusts, including revocable trusts, irrevocable trusts, and special needs trusts. Each type serves different purposes and offers varying degrees of control over your assets. Educating yourself about these options will help you choose the most suitable Arkansas trust for your financial goals.

-

Can I make changes to my Arkansas trust after it's established?

Yes, if you set up a revocable Arkansas trust, you can modify or revoke it at any time while you are alive. However, irrevocable trusts, once established, cannot be easily changed. It’s important to understand the implications of the trust type you choose.

-

How does an Arkansas trust work with digital signatures?

You can utilize airSlate SignNow’s eSignature platform to facilitate the signing of documents related to your Arkansas trust. This allows you to streamline the process, ensuring that all documents are signed securely and efficiently. Digital signatures add a level of convenience that traditional methods cannot match.

-

What are the tax benefits of an Arkansas trust?

An Arkansas trust can provide tax benefits, such as potential exemptions from estate taxes and avoiding probate fees. This can help preserve more of your estate for your beneficiaries. Consulting a tax advisor can provide more personalized insights regarding tax implications and advantages.

-

Is there a limit to the assets I can place in an Arkansas trust?

Generally, there are no specific limits on the amount or types of assets you can place in an Arkansas trust. However, it’s essential to evaluate how the trust aligns with your overall financial plan and the implications for tax and estate management. Working with a legal expert can help you navigate these considerations.

Get more for Arkansas Trust

- Legal last will and testament form for single person with adult children ohio

- Legal last will and testament for married person with minor children from prior marriage ohio form

- Legal last will and testament form for married person with adult children from prior marriage ohio

- Legal last will and testament form for divorced person not remarried with adult children ohio

- Legal last will and testament form for divorced person not remarried with no children ohio

- Legal last will and testament form for divorced person not remarried with minor children ohio

- Legal last will and testament form for divorced person not remarried with adult and minor children ohio

- Mutual wills package with last wills and testaments for married couple with adult children ohio form

Find out other Arkansas Trust

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now