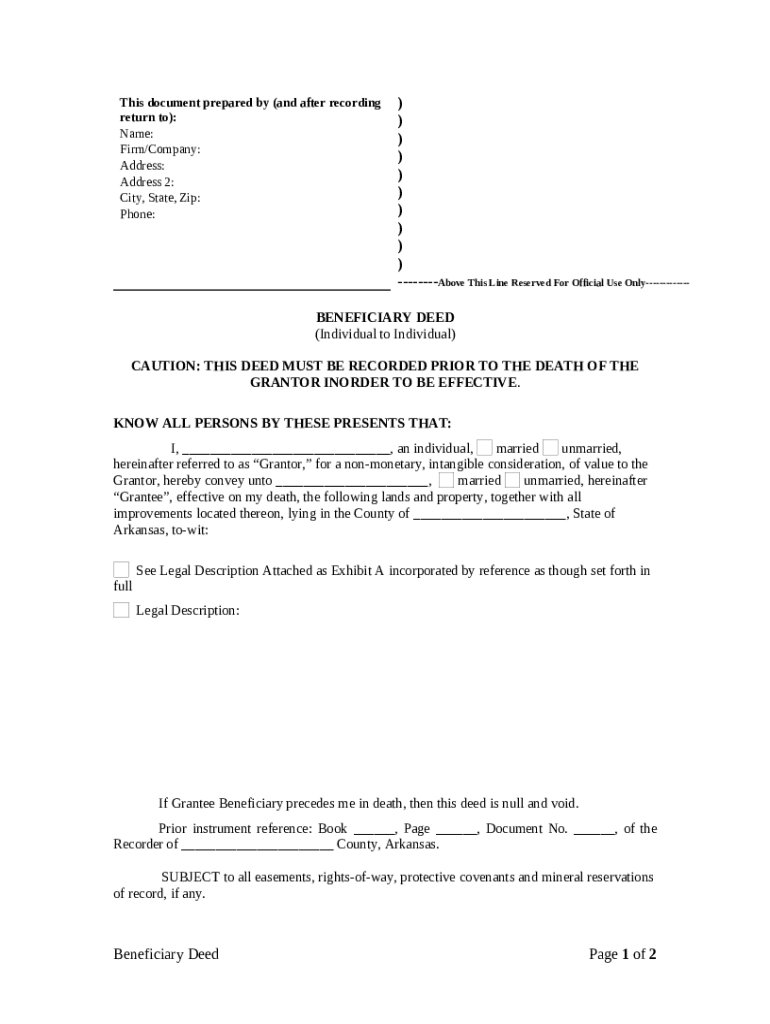

Transfer on Death Deed or TOD Beneficiary Deed for Individual to Individual Arkansas Form

What is the Transfer On Death Deed in Arkansas?

The Transfer On Death (TOD) Deed, also known as a beneficiary deed, is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This type of deed is particularly useful in Arkansas as it bypasses the probate process, allowing for a smoother transition of property ownership. The deed must be executed and recorded during the property owner's lifetime to be effective. It is essential to understand that the beneficiary does not have any rights to the property until the owner's death.

Steps to Complete the Transfer On Death Deed in Arkansas

Completing the Transfer On Death Deed in Arkansas involves several key steps:

- Obtain the Arkansas beneficiary deed form, which is available in PDF format.

- Fill out the form with accurate details, including the property description and beneficiary information.

- Sign the deed in the presence of a notary public to ensure its validity.

- Record the completed deed with the county clerk's office where the property is located.

- Keep a copy of the recorded deed for your records.

Legal Use of the Transfer On Death Deed in Arkansas

The legal framework governing the Transfer On Death Deed in Arkansas is outlined in the Arkansas Code. This deed allows property owners to designate beneficiaries without the need for a will. It is vital to comply with state-specific regulations, including proper execution and recording, to ensure that the deed is legally binding. The deed must explicitly state that it is a Transfer On Death Deed to avoid any confusion regarding its intent.

State-Specific Rules for the Transfer On Death Deed in Arkansas

Arkansas has specific rules regarding the execution and recording of the Transfer On Death Deed. The following points highlight essential state-specific requirements:

- The deed must be signed by the property owner and notarized.

- It must be recorded in the county where the property is located to be effective.

- Beneficiaries must be individuals or entities capable of holding property.

- Property owners can revoke the deed at any time before their death, provided they follow the proper procedures.

How to Obtain the Transfer On Death Deed in Arkansas

To obtain the Transfer On Death Deed in Arkansas, individuals can access the form through various channels:

- Download the form directly from official state resources or legal websites.

- Visit a local county clerk's office to request a physical copy.

- Consult with a legal professional for assistance in drafting the deed according to state laws.

Examples of Using the Transfer On Death Deed in Arkansas

There are various scenarios where the Transfer On Death Deed can be beneficial:

- A homeowner wishes to ensure their property passes to their children without going through probate.

- An individual wants to leave their home to a trusted friend or relative upon their death.

- A property owner is looking for a straightforward way to transfer ownership while retaining full control during their lifetime.

Quick guide on how to complete transfer on death deed or tod beneficiary deed for individual to individual arkansas

Complete Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without any delays. Handle Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas effortlessly

- Find Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas and click on Get Form to begin.

- Use the tools at your disposal to complete your form.

- Select important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Arkansas beneficiary deed PDF?

An Arkansas beneficiary deed PDF is a legal document used to transfer property upon the death of the owner without going through probate. This deed allows the property to be passed directly to the named beneficiaries, simplifying the process. Using airSlate SignNow, you can easily create and eSign this document online.

-

How do I create an Arkansas beneficiary deed PDF using airSlate SignNow?

Creating an Arkansas beneficiary deed PDF with airSlate SignNow is straightforward. You can use our template library to access pre-made deed forms, fill in your information, and eSign the document securely. Our user-friendly interface ensures that you can complete your deed efficiently.

-

Is there a cost associated with downloading an Arkansas beneficiary deed PDF?

Yes, there may be a nominal fee for accessing certain templates or features when using airSlate SignNow to create an Arkansas beneficiary deed PDF. We offer various pricing plans to fit your needs, allowing you to choose an option that meets your budget. Consider our subscription models for more extensive use.

-

What are the benefits of using an Arkansas beneficiary deed PDF?

Using an Arkansas beneficiary deed PDF can save your beneficiaries time and money by avoiding probate fees. This document allows for a smooth transition of property ownership without legal hurdles. airSlate SignNow makes it easy to draft and manage your beneficiary deed conveniently online.

-

Can I integrate airSlate SignNow with other tools for managing my Arkansas beneficiary deed PDF?

Absolutely! airSlate SignNow offers integrations with various business tools and platforms to enhance your document management experience. You can connect with CRM systems, cloud storage services, and more to streamline the process of handling your Arkansas beneficiary deed PDF and other documents.

-

What features does airSlate SignNow provide for managing an Arkansas beneficiary deed PDF?

airSlate SignNow provides several features to manage your Arkansas beneficiary deed PDF effectively, including eSignature capabilities, secure document storage, and workflow automation. Our platform ensures that your documents are legally binding and stored safely, giving you peace of mind.

-

Are Arkansas beneficiary deed PDFs legally recognized?

Yes, Arkansas beneficiary deed PDFs created and executed in accordance with state laws are legally recognized. It is important to ensure that the deed is properly filled out and signed by the property owner. airSlate SignNow assists in maintaining legal compliance by providing accurate templates for your beneficiary deed.

Get more for Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas

- Complex will with credit shelter marital trust for large estates oklahoma form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497323231 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497323232 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497323233 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497323234 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497323236 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497323237 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497323238 form

Find out other Transfer On Death Deed Or TOD Beneficiary Deed For Individual To Individual Arkansas

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form