Financial Account Transfer to Living Trust Arkansas Form

What is the Financial Account Transfer To Living Trust Arkansas

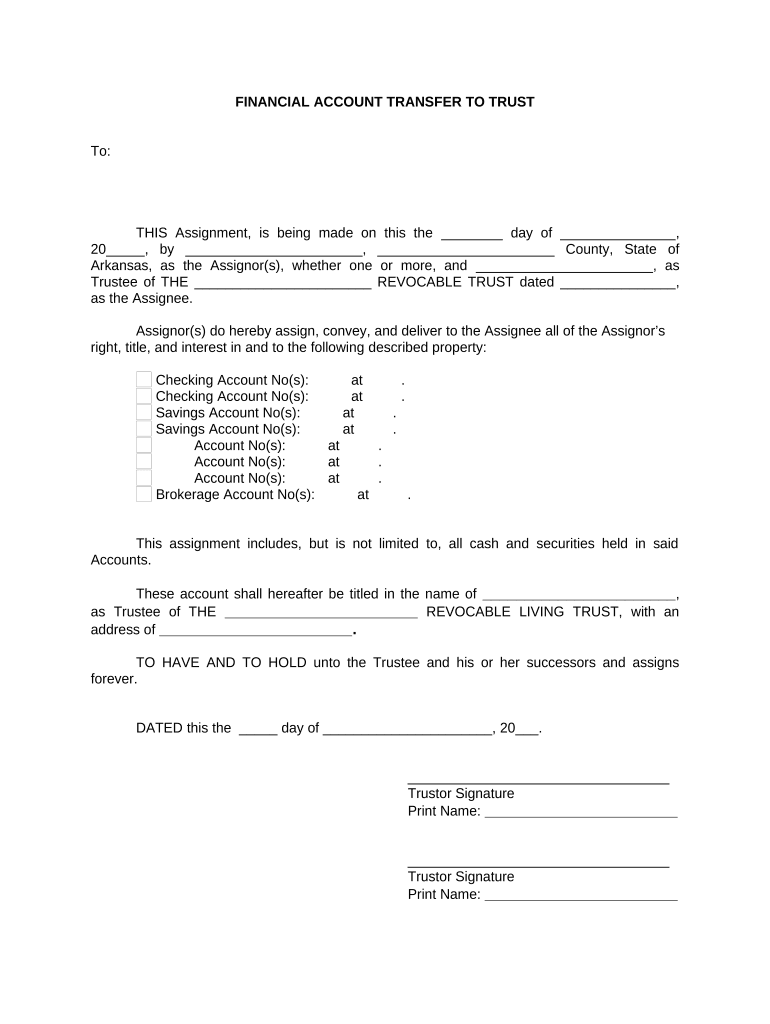

The Financial Account Transfer To Living Trust Arkansas is a legal document used to transfer ownership of financial accounts into a living trust. This process helps individuals manage their assets during their lifetime and ensures a smooth transition of those assets upon their passing. By placing financial accounts into a living trust, individuals can avoid probate, which can be time-consuming and costly. This form is essential for anyone looking to streamline their estate planning in Arkansas.

Steps to Complete the Financial Account Transfer To Living Trust Arkansas

Completing the Financial Account Transfer To Living Trust Arkansas involves several key steps:

- Gather Necessary Information: Collect details about the financial accounts being transferred, including account numbers and the institutions where the accounts are held.

- Review Trust Documents: Ensure that the living trust document is up-to-date and accurately reflects your wishes regarding asset distribution.

- Complete the Transfer Form: Fill out the Financial Account Transfer To Living Trust Arkansas form with the required information, ensuring accuracy to prevent any delays.

- Submit the Form: Present the completed form to the financial institution managing your accounts. This may involve submitting it online, via mail, or in person.

- Confirm the Transfer: Follow up with the financial institution to confirm that the accounts have been successfully transferred into the living trust.

Legal Use of the Financial Account Transfer To Living Trust Arkansas

The legal use of the Financial Account Transfer To Living Trust Arkansas is crucial for ensuring that the transfer of assets complies with state laws. This form must be executed correctly to be valid, which includes having the necessary signatures and adhering to any specific requirements set forth by Arkansas law. It is advisable to consult with a legal professional to confirm that all aspects of the transfer are handled appropriately, thus safeguarding against potential disputes or challenges in the future.

State-Specific Rules for the Financial Account Transfer To Living Trust Arkansas

Arkansas has specific rules governing the transfer of financial accounts to a living trust. These include:

- Ensuring that the living trust is properly established and recognized by the state.

- Adhering to any state-specific requirements for the execution and notarization of the transfer form.

- Understanding tax implications that may arise from transferring assets into a living trust.

Familiarity with these rules helps ensure compliance and protects the interests of all parties involved.

Required Documents for the Financial Account Transfer To Living Trust Arkansas

To complete the Financial Account Transfer To Living Trust Arkansas, several documents are typically required:

- The original living trust document, which outlines the terms and conditions of the trust.

- The Financial Account Transfer To Living Trust Arkansas form, filled out with accurate information.

- Identification documents, such as a driver's license or passport, to verify the identity of the trustor.

- Any additional documents requested by the financial institution, which may vary by bank or investment firm.

Having these documents ready can facilitate a smoother transfer process.

Examples of Using the Financial Account Transfer To Living Trust Arkansas

Utilizing the Financial Account Transfer To Living Trust Arkansas can take various forms, including:

- Transferring checking and savings accounts to ensure they are managed according to the trust's terms.

- Including investment accounts, such as stocks and bonds, to streamline asset management and distribution.

- Transferring retirement accounts, where permitted, to align with estate planning goals.

These examples illustrate how the form can be used to effectively manage and protect assets within a living trust framework.

Quick guide on how to complete financial account transfer to living trust arkansas

Prepare Financial Account Transfer To Living Trust Arkansas effortlessly on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the desired form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Financial Account Transfer To Living Trust Arkansas on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Financial Account Transfer To Living Trust Arkansas effortlessly

- Obtain Financial Account Transfer To Living Trust Arkansas and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Financial Account Transfer To Living Trust Arkansas and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust Arkansas?

The process for Financial Account Transfer To Living Trust Arkansas typically involves drafting the living trust documents, identifying your financial accounts, and officially transferring these assets into the trust. You may need to complete specific forms from your financial institutions to ensure a seamless transfer. It's advisable to consult with a legal professional to ensure compliance with state laws.

-

What are the benefits of transferring my financial accounts to a living trust in Arkansas?

Transferring your financial accounts to a living trust in Arkansas can provide numerous benefits, including avoiding probate court, safeguarding your assets, and ensuring a smoother transition for your heirs. Additionally, it offers privacy since trusts are not public documents. It can also help manage your assets if you become incapacitated.

-

How much does it cost to set up a living trust for Financial Account Transfer To Living Trust Arkansas?

The cost of setting up a living trust for Financial Account Transfer To Living Trust Arkansas can vary widely depending on the complexity of your assets and whether you hire a professional service. Generally, expenses can range from a few hundred to several thousand dollars. It's important to weigh these costs against the long-term benefits and savings of avoiding probate.

-

Can I transfer multiple financial accounts to my living trust in Arkansas?

Yes, you can transfer multiple financial accounts to your living trust in Arkansas. This includes bank accounts, investment accounts, and retirement accounts, provided you follow the necessary legal procedures. It's crucial to ensure that each account is appropriately titled in the name of the trust for successful management.

-

Are there any tax implications when transferring my financial accounts to a living trust in Arkansas?

Generally, there are no immediate tax implications when transferring your financial accounts to a living trust in Arkansas. However, it's important to consult with a tax advisor to understand potential long-term impacts, particularly concerning estate taxes or income tax. The goal is to ensure that your financial strategies align with your overall estate planning.

-

How do I maintain my living trust once my financial accounts are transferred in Arkansas?

Maintaining your living trust in Arkansas requires you to update the trust as your financial accounts or personal circumstances change. This includes ensuring that any new assets are added to the trust and reviewing the trust documents periodically. Regular maintenance helps achieve your estate planning goals efficiently.

-

What integrations does airSlate SignNow offer for managing living trust documents?

airSlate SignNow offers various integrations that streamline the management of your living trust documents. You can easily eSign your trust documents, share them securely, and store them in the cloud. These features support the efficient Financial Account Transfer To Living Trust Arkansas process, making it simpler for you to manage your estate planning needs.

Get more for Financial Account Transfer To Living Trust Arkansas

- Rhode island notice 497325206 form

- Guaranty or guarantee of payment of rent rhode island form

- Letter from landlord to tenant as notice of default on commercial lease rhode island form

- Residential or rental lease extension agreement rhode island form

- Commercial rental lease application questionnaire rhode island form

- Apartment lease rental application questionnaire rhode island form

- Residential rental lease application rhode island form

- Salary verification form for potential lease rhode island

Find out other Financial Account Transfer To Living Trust Arkansas

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free