Arizona Deed Beneficiary Form

What is the Arizona Deed Beneficiary Form

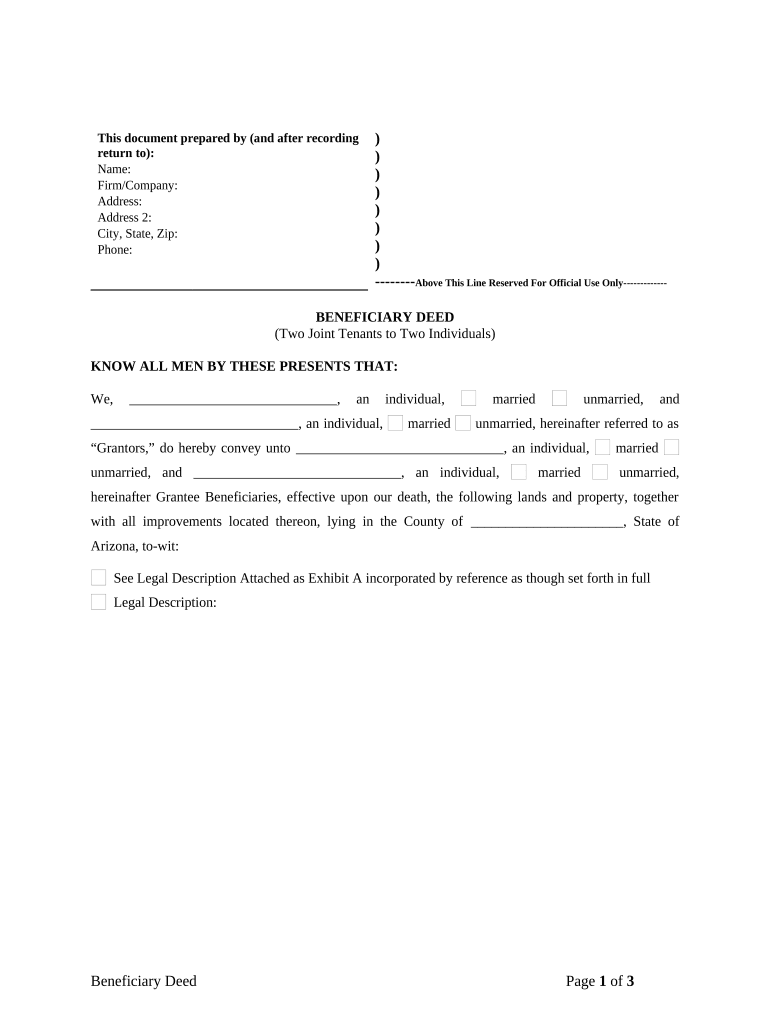

The Arizona beneficiary deed form is a legal document that allows property owners to designate a beneficiary who will receive the property upon their death, bypassing the probate process. This form is particularly useful for individuals who wish to ensure that their property is transferred smoothly and efficiently to their chosen heirs. The form must be properly executed and recorded to be valid. In Arizona, this deed is often referred to as a transfer on death (TOD) deed, which provides a straightforward way to transfer real estate without the complexities associated with wills and probate.

How to use the Arizona Deed Beneficiary Form

Using the Arizona beneficiary deed form involves several key steps. First, the property owner must complete the form, including essential details such as the legal description of the property and the name of the designated beneficiary. After filling out the form, it should be signed in the presence of a notary public to ensure its legality. Once notarized, the form must be recorded with the county recorder's office in the county where the property is located. This recording is crucial, as it makes the deed effective and enforceable upon the owner's death.

Steps to complete the Arizona Deed Beneficiary Form

Completing the Arizona beneficiary deed form requires careful attention to detail. Follow these steps to ensure proper completion:

- Obtain the beneficiary deed form from a reliable source.

- Fill in the property owner's name, address, and the legal description of the property.

- Specify the beneficiary's name and relationship to the owner.

- Sign the form in front of a notary public.

- Record the signed and notarized form with the county recorder's office.

Key elements of the Arizona Deed Beneficiary Form

Several key elements must be included in the Arizona beneficiary deed form to ensure its validity:

- Property Description: A clear legal description of the property being transferred.

- Beneficiary Information: The full name and address of the designated beneficiary.

- Owner's Signature: The property owner's signature, which must be notarized.

- Recording Information: The form must be recorded with the appropriate county office to be effective.

Legal use of the Arizona Deed Beneficiary Form

The Arizona beneficiary deed form is legally binding when executed according to state laws. It allows property owners to retain control of their property during their lifetime while ensuring a seamless transfer upon death. This form is particularly advantageous as it avoids the lengthy probate process, allowing beneficiaries to inherit property directly. It's essential for property owners to understand that any changes to the deed or the beneficiary must be documented with a new form to maintain legal clarity.

How to obtain the Arizona Deed Beneficiary Form

The Arizona beneficiary deed form can be obtained from various sources. Property owners can access the form online through official state or county websites, legal document providers, or by visiting the local county recorder's office. It is important to ensure that the version of the form used is the most current and complies with Arizona state laws. Additionally, consulting with a legal professional can provide guidance on completing the form correctly.

Quick guide on how to complete arizona deed beneficiary form

Prepare Arizona Deed Beneficiary Form easily on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can locate the right template and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Arizona Deed Beneficiary Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Arizona Deed Beneficiary Form with ease

- Obtain Arizona Deed Beneficiary Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you choose. Edit and eSign Arizona Deed Beneficiary Form and ensure smooth communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a printable beneficiary deed form Arizona?

A printable beneficiary deed form Arizona is a legal document that allows property owners to transfer their property to their beneficiaries upon their death without going through probate. This form is designed to simplify the estate planning process and ensure a smooth transfer of assets.

-

How can I obtain a printable beneficiary deed form Arizona?

You can easily obtain a printable beneficiary deed form Arizona by visiting the airSlate SignNow website. Our platform provides customizable templates that can be filled out conveniently and printed for your use.

-

Is there a cost associated with the printable beneficiary deed form Arizona?

Yes, there is a minimal fee for accessing the printable beneficiary deed form Arizona through airSlate SignNow. This fee covers the use of our user-friendly platform, which simplifies the document preparation process and saves you time.

-

Are there any specific requirements for using the printable beneficiary deed form Arizona?

Yes, to use the printable beneficiary deed form Arizona, you must be the legal owner of the property and ensure that the deed complies with Arizona state laws. It's advisable to consult with a legal professional to ensure that the form is filled out correctly.

-

Can I customize the printable beneficiary deed form Arizona?

Absolutely! The printable beneficiary deed form Arizona available on airSlate SignNow can be customized to meet your specific needs. You can add or modify fields to accurately reflect your intentions regarding property transfer.

-

Does airSlate SignNow offer any integrations for the printable beneficiary deed form Arizona?

Yes, airSlate SignNow offers various integrations with popular applications to streamline your document management process. By using our platform, you can integrate with tools like Google Drive and Dropbox to easily store and share your printable beneficiary deed form Arizona.

-

What are the benefits of using the printable beneficiary deed form Arizona?

Using the printable beneficiary deed form Arizona can provide signNow benefits, such as avoiding probate, reducing the time required for asset transfer, and ensuring that your property is passed on to your chosen beneficiaries without complications.

Get more for Arizona Deed Beneficiary Form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497317553 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement north dakota form

- Change other than form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants north dakota form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises north dakota form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat north dakota form

- Unconditional waiver and release of claim of lien upon final payment north dakota form

- Demand that suit be commenced and filed individual north dakota form

Find out other Arizona Deed Beneficiary Form

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed