Individual Credit Application Arizona Form

What is the Individual Credit Application Arizona

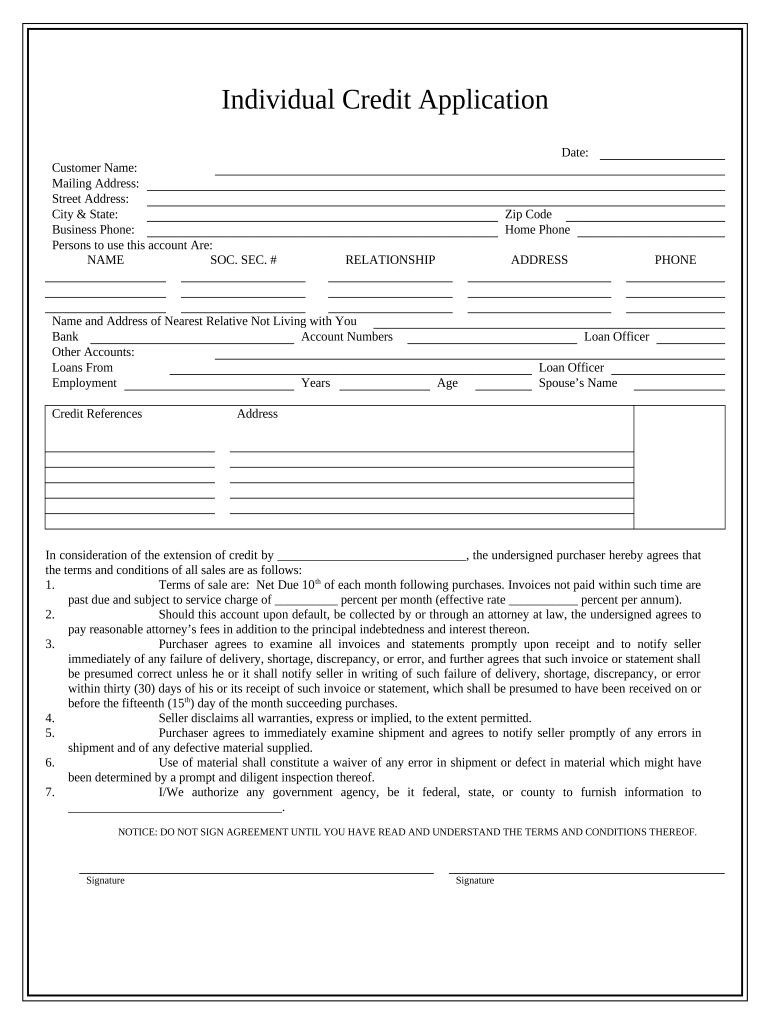

The Individual Credit Application Arizona is a formal document used by individuals seeking credit from financial institutions or lenders within the state of Arizona. This application collects essential personal and financial information to assess the applicant's creditworthiness. Typically, it includes details such as the applicant's name, address, Social Security number, employment information, and financial history. The information gathered helps lenders make informed decisions regarding loan approvals and credit limits.

Steps to complete the Individual Credit Application Arizona

Completing the Individual Credit Application Arizona involves several straightforward steps to ensure accuracy and completeness. Here is a concise guide:

- Gather personal information, including your full name, address, and Social Security number.

- Provide employment details, including your current employer, job title, and income.

- List your financial obligations, such as existing loans, credit cards, and monthly expenses.

- Review the application for any errors or omissions before submission.

- Submit the application electronically or in person, depending on the lender's requirements.

How to obtain the Individual Credit Application Arizona

The Individual Credit Application Arizona can typically be obtained directly from the lender's website or at their physical locations. Many financial institutions offer downloadable versions of the application for convenience. Additionally, some lenders may provide the option to fill out the application online. It is advisable to check the specific lender's guidelines to ensure you have the correct form and understand any additional requirements they may have.

Legal use of the Individual Credit Application Arizona

The Individual Credit Application Arizona is legally binding when completed and submitted according to the lender's policies. To ensure its legal standing, the application must be filled out truthfully and accurately. Misrepresentation or falsification of information can lead to serious consequences, including denial of credit or legal action. Moreover, lenders must comply with federal and state regulations, such as the Fair Credit Reporting Act, which governs the collection and use of consumer credit information.

Key elements of the Individual Credit Application Arizona

Understanding the key elements of the Individual Credit Application Arizona is crucial for successful completion. Important components include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and income information.

- Financial History: Existing debts, credit accounts, and payment history.

- Requested Credit Amount: The amount of credit or loan being sought.

- Consent for Credit Check: Authorization for the lender to obtain credit reports.

State-specific rules for the Individual Credit Application Arizona

Arizona has specific regulations governing the Individual Credit Application that applicants must adhere to. These rules ensure consumer protection and fair lending practices. For instance, lenders are required to provide clear disclosures regarding interest rates, fees, and terms of credit. Additionally, Arizona law mandates that lenders evaluate the applicant's ability to repay the credit requested, promoting responsible lending practices. Familiarizing yourself with these state-specific rules can enhance your application experience and protect your rights as a borrower.

Quick guide on how to complete individual credit application arizona

Effortlessly Prepare Individual Credit Application Arizona on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Individual Credit Application Arizona on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to Modify and eSign Individual Credit Application Arizona Stress-Free

- Obtain Individual Credit Application Arizona and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that require you to print new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Credit Application Arizona and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Arizona process using airSlate SignNow?

The Individual Credit Application Arizona process with airSlate SignNow streamlines the way you send and sign documents. By using our platform, individuals can easily fill out credit applications online, ensuring a quick and secure submission. Additionally, the eSigning feature allows for instant approval, reducing wait times traditionally associated with paper applications.

-

How much does it cost to use airSlate SignNow for an Individual Credit Application Arizona?

Pricing for using airSlate SignNow for your Individual Credit Application Arizona varies based on the features you need. We offer flexible plans that are cost-effective for both small businesses and large organizations. You can start with a free trial to assess how our solutions meet your needs without any upfront investment.

-

What features does airSlate SignNow offer for Individual Credit Application Arizona?

airSlate SignNow provides several key features for processing the Individual Credit Application Arizona, including customizable templates, automated workflows, and secure eSigning. These features ensure that your application process is not only efficient but also compliant with legal standards. Furthermore, our platform’s user-friendly interface simplifies the entire procedure for both businesses and applicants.

-

What are the benefits of using airSlate SignNow for Individual Credit Application Arizona?

Using airSlate SignNow for your Individual Credit Application Arizona offers numerous benefits, including faster processing times and improved user experience. Our platform allows for real-time tracking and notifications, ensuring that you stay updated on the application's status. Ultimately, this leads to higher customer satisfaction and increased acceptance rates.

-

Can I integrate airSlate SignNow with other applications for my Individual Credit Application Arizona?

Absolutely! airSlate SignNow supports integrations with a variety of applications that are popular in the financial industry, which can enhance your Individual Credit Application Arizona process. These integrations enable automatic data transfer and efficient management of workflows, allowing for a seamless experience across various platforms.

-

Is airSlate SignNow secure for handling Individual Credit Application Arizona?

Yes, airSlate SignNow is designed with security in mind, making it a safe platform for handling your Individual Credit Application Arizona. We implement robust encryption standards and compliance measures to protect sensitive information. This ensures that your data remains confidential and secure throughout the application process.

-

How long does it take to complete an Individual Credit Application Arizona using airSlate SignNow?

The time it takes to complete an Individual Credit Application Arizona using airSlate SignNow can be signNowly reduced, often taking only a few minutes. The platform's intuitive design allows applicants to fill out required fields easily and sign documents quickly. This efficiency means faster responses from lenders, improving the overall application experience.

Get more for Individual Credit Application Arizona

- Nj occupational interrogatories form

- New jersey change registered form

- New resident guide new jersey form

- Satisfaction cancellation release of mortgage by corporate lender new jersey form

- Mortgage holder form

- Partial release of property from mortgage for corporation new jersey form

- Partial release of property from mortgage by individual holder new jersey form

- Nj discrimination form

Find out other Individual Credit Application Arizona

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online