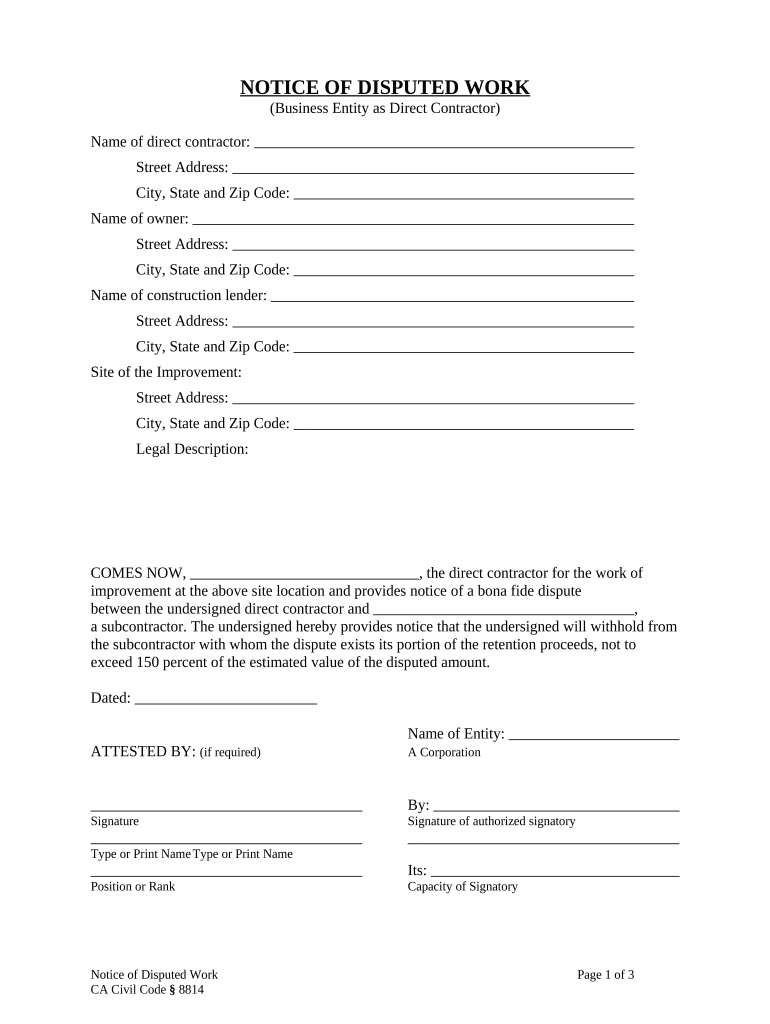

Business Entity Form

What is the Business Entity

A business entity is a legal structure that allows individuals to conduct business. It can take various forms, including a corporation, limited liability company (LLC), partnership, or sole proprietorship. Each type of business entity has distinct legal and tax implications. Understanding the differences is crucial for compliance and operational efficiency. For example, an LLC offers liability protection for its owners, while a sole proprietorship does not. Choosing the right business entity is essential for protecting personal assets and optimizing tax obligations.

How to Obtain the Business Entity

To obtain a business entity, you must first choose the appropriate structure based on your business needs. After selecting a type, you will need to register with the appropriate state authorities. This typically involves filing specific forms and paying a registration fee. Additionally, you may need to obtain an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes. Each state has its own requirements, so it is important to check local regulations and guidelines to ensure compliance.

Steps to Complete the Business Entity

Completing the business entity registration involves several key steps:

- Choose the type of business entity that aligns with your goals.

- Conduct a business entity search to ensure the name you want is available.

- Prepare the necessary documents, including articles of incorporation or organization.

- File the required forms with your state’s business registration office.

- Pay any applicable fees associated with the registration process.

- Obtain an EIN from the IRS, if applicable.

Following these steps carefully will help ensure a smooth registration process and establish your business entity legally.

Legal Use of the Business Entity

The legal use of a business entity involves adhering to state and federal regulations. This includes maintaining proper records, filing annual reports, and paying taxes. Each business entity type has specific compliance requirements that must be met to maintain its legal status. For instance, corporations are required to hold annual meetings and keep minutes, while LLCs may have fewer formalities. Understanding these legal obligations is vital to avoid penalties and ensure the longevity of your business.

Required Documents

When registering a business entity, several documents are typically required. These may include:

- Articles of Incorporation or Organization

- Operating Agreement (for LLCs)

- Bylaws (for corporations)

- Business licenses and permits

- Employer Identification Number (EIN) application

Gathering these documents in advance can streamline the registration process and help ensure compliance with legal requirements.

Business Entity Types

There are several common types of business entities, each with unique characteristics:

- Sole Proprietorship: Owned by one individual, easy to set up, but offers no personal liability protection.

- Partnership: Owned by two or more individuals, sharing profits and liabilities.

- Corporation: A separate legal entity that provides liability protection to its owners, subject to more regulations.

- Limited Liability Company (LLC): Combines the benefits of a corporation and a partnership, offering liability protection with fewer formalities.

Choosing the right type of business entity is crucial for legal protection and tax efficiency.

Quick guide on how to complete business entity

Easily Prepare Business Entity on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Business Entity on any platform using the airSlate SignNow apps available for Android or iOS and simplify any document-related process today.

How to Edit and eSign Business Entity Effortlessly

- Find Business Entity and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional signature.

- Review all the information carefully and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Edit and eSign Business Entity and maintain excellent communication throughout your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a business entity, and how can airSlate SignNow help?

A business entity is a legally recognized organization that conducts business. airSlate SignNow provides tools to streamline the signing process of important documents associated with your business entity, ensuring efficiency and compliance.

-

What pricing plans are available for airSlate SignNow for my business entity?

airSlate SignNow offers flexible pricing plans tailored to your business entity's needs. Different tiers provide various features, so you can choose a plan that best fits your budget and operational requirements.

-

What features does airSlate SignNow offer for managing business entity documents?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage for your business entity's documents. These features help enhance workflow efficiency while ensuring your documents are stored safely and are easily accessible.

-

How can airSlate SignNow benefit my business entity?

By using airSlate SignNow, your business entity can signNowly streamline document workflows, reducing turnaround times for important agreements. This platform also ensures that all transactions are secure and compliant with legal standards, enhancing your business operations.

-

Can airSlate SignNow integrate with other tools for my business entity?

Yes, airSlate SignNow integrates seamlessly with various popular tools and platforms, helping your business entity maintain an efficient workflow. Whether connecting with CRM systems or project management tools, the integration capabilities enhance productivity.

-

Is airSlate SignNow compliant with regulations for my business entity?

airSlate SignNow adheres to legal regulations, such as e-signature laws, which makes it a reliable solution for your business entity. This compliance ensures that your electronically signed documents are legally binding and can be used in court if necessary.

-

How is the customer support for airSlate SignNow tailored to business entities?

Customer support for airSlate SignNow is dedicated to helping business entities navigate their document management. With 24/7 support, your business can receive timely assistance on any issues or inquiries related to the software.

Get more for Business Entity

Find out other Business Entity

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad