Ca Section Form

What is the Ca Section

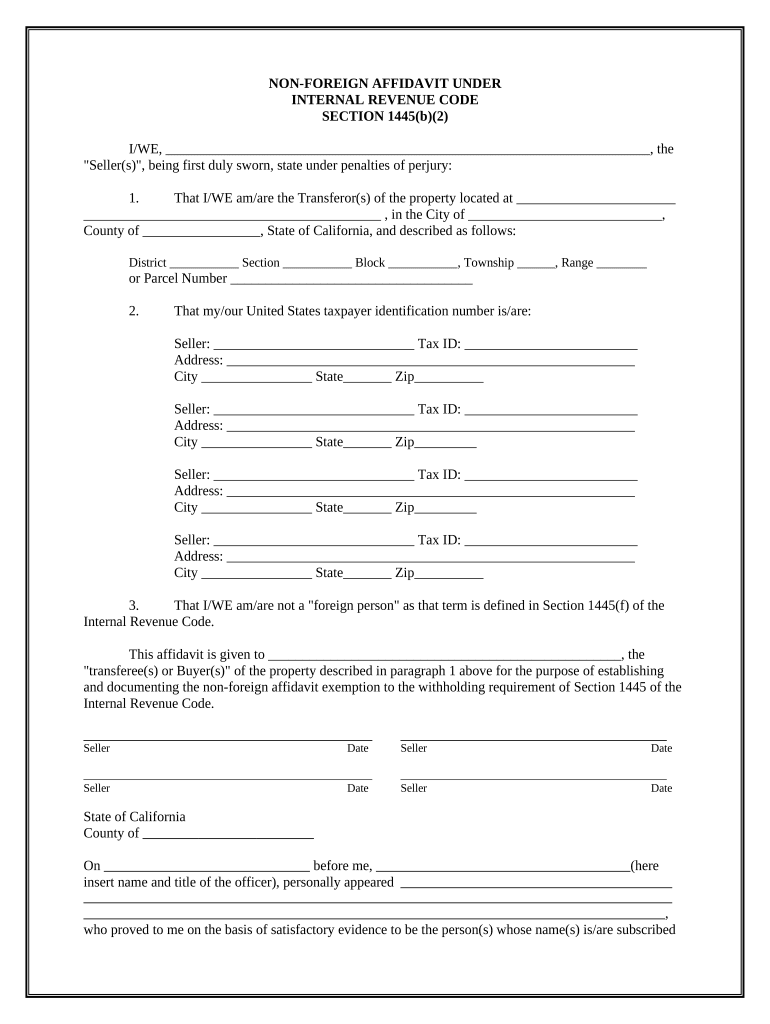

The Ca Section is a specific form used primarily for tax purposes in the United States. It is designed to collect essential information from individuals or businesses regarding their financial activities. Understanding the Ca Section is crucial for ensuring compliance with state and federal tax regulations. This form may include details about income, deductions, and other pertinent financial data that the Internal Revenue Service (IRS) requires for accurate tax reporting.

How to use the Ca Section

Using the Ca Section involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, such as income statements and expense records. Next, fill out the form accurately, ensuring that all sections are completed as required. If filing electronically, utilize a reliable eSignature solution to sign the document securely. Finally, submit the completed Ca Section through the designated method, whether online or via mail, to ensure timely processing.

Steps to complete the Ca Section

Completing the Ca Section requires careful attention to detail. Follow these steps for successful submission:

- Gather all relevant financial documents, including W-2s and 1099s.

- Review the instructions provided with the form to understand each section.

- Fill out the form, ensuring accuracy in all entries.

- Utilize an eSignature solution for signing the document if submitting electronically.

- Double-check all information before submission to avoid errors.

- Submit the form through the appropriate channel, either online or by mail.

Legal use of the Ca Section

The legal use of the Ca Section is governed by various tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Compliance with federal and state guidelines is essential to avoid penalties. Using a trusted eSignature platform can enhance the legal validity of the document, as it provides an electronic certificate and maintains compliance with laws such as ESIGN and UETA.

Required Documents

When preparing to complete the Ca Section, certain documents are essential. These may include:

- Income statements, such as W-2 forms for employees and 1099 forms for independent contractors.

- Records of any deductions, such as receipts for business expenses or charitable contributions.

- Previous tax returns, which can provide context and necessary information.

- Identification documents, if required, to verify your identity.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for successful submission of the Ca Section. Typically, the deadline for filing tax forms falls on April fifteenth each year. However, extensions may be available under certain circumstances. It is important to check for any updates regarding deadlines, as they can vary based on specific tax situations or changes in legislation.

Quick guide on how to complete ca section

Complete Ca Section seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Ca Section on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Ca Section effortlessly

- Locate Ca Section and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ca Section and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ca section feature in airSlate SignNow?

The ca section feature in airSlate SignNow allows users to collaborate on document signing by enabling secure validation processes. This ensures that all parties can confirm their identity before signing, adding an extra layer of security to important documents.

-

How much does airSlate SignNow cost for accessing the ca section?

Pricing for airSlate SignNow varies based on the plan you choose, with affordable options for businesses of all sizes. Each plan offers access to the ca section feature, ensuring that you can manage your document signing needs without breaking the bank.

-

Can I integrate the ca section with other tools?

Yes, airSlate SignNow offers integrations with a variety of business tools such as CRMs, project management software, and more. This seamless integration allows users to utilize the ca section feature effectively within their existing workflows.

-

What are the benefits of using the ca section in airSlate SignNow?

The ca section in airSlate SignNow streamlines the signing process while enhancing security and compliance. This not only saves time but also helps businesses maintain trust with their clients by ensuring that signatures are verified and authentic.

-

Is the ca section suitable for all business types?

Absolutely! The ca section is designed to cater to businesses of all types, from small startups to large enterprises. Its flexibility allows various organizations to incorporate secure document signing into their operations effortlessly.

-

What features are included with the ca section in airSlate SignNow?

Along with the ca section, airSlate SignNow includes features such as document templates, real-time tracking, and customizable workflows. These functionalities enhance the overall user experience by simplifying document management.

-

How does airSlate SignNow ensure the security of the ca section?

airSlate SignNow employs advanced encryption and security protocols to protect documents signed through the ca section. This robust security framework helps ensure that sensitive information remains confidential and secure throughout the signing process.

Get more for Ca Section

- Waiver release liability agreement 497427210 form

- Release participation form

- Waiver and release from liability for adult for rally participation form

- Waiver release participation form

- Liability paragliding form

- Waiver and release from liability for adult for sorority function form

- Waiver and release from liability for minor child for sorority function form

- Waiver and release from liability for adult for fraternity event form

Find out other Ca Section

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe