Ca Income Form

What is the California Income Form?

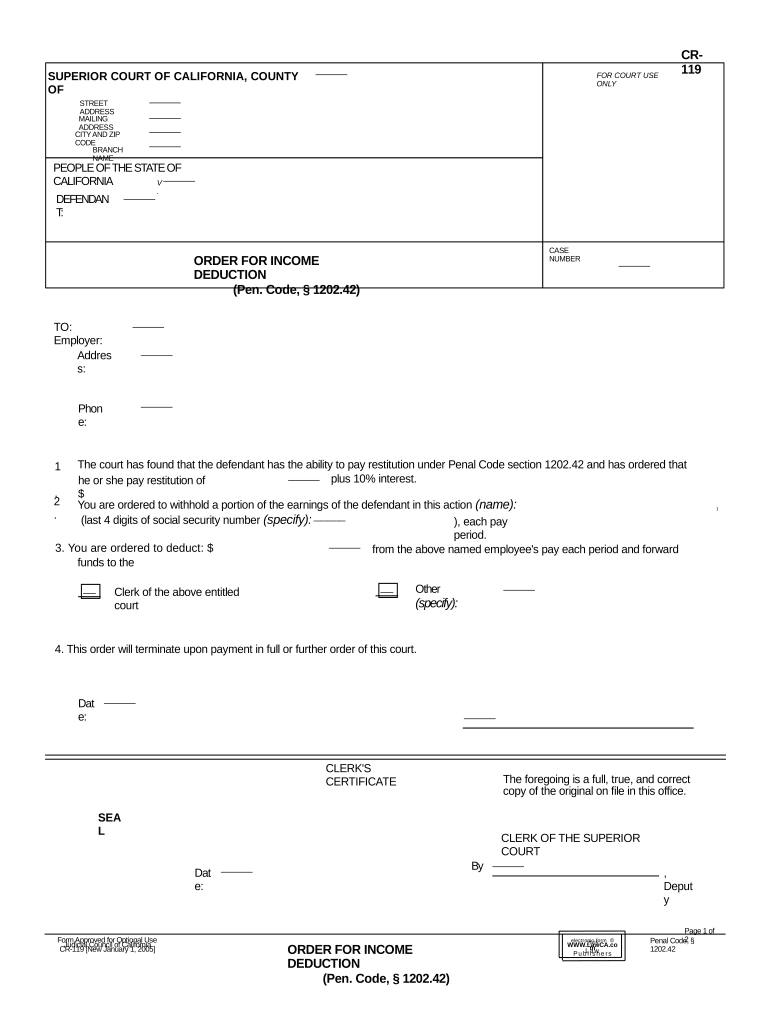

The California Income Form is a crucial document used for reporting income and deductions to the state tax authorities. This form is essential for individuals and businesses to ensure compliance with California tax regulations. It captures various income sources, including wages, self-employment income, and interest, while also allowing for deductions that can reduce taxable income. Understanding the purpose and requirements of this form is vital for accurate tax filing and avoiding penalties.

Steps to Complete the California Income Form

Completing the California Income Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and records of any other income sources. Next, fill out personal information, including your name, address, and Social Security number. Then, report your total income by entering figures from your gathered documents. After that, apply any eligible deductions to lower your taxable income. Finally, review the form for accuracy before submitting it to the California tax authorities.

Legal Use of the California Income Form

The California Income Form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be filled out truthfully and accurately. Misrepresentation or omission of income can lead to penalties, including fines or legal action. It is important to understand the legal implications of this form and to maintain compliance with California tax laws to avoid complications.

Required Documents

To complete the California Income Form, you will need several supporting documents. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income, such as rental income or dividends

- Receipts for deductible expenses, such as medical costs or business expenses

Having these documents ready will streamline the process and help ensure that your tax filing is accurate and complete.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for timely submission of the California Income Form. Generally, the deadline for filing state income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any updates or changes to deadlines, as they can vary from year to year. Filing on time helps avoid penalties and interest on unpaid taxes.

Form Submission Methods

The California Income Form can be submitted through various methods, offering flexibility for taxpayers. These methods include:

- Online submission through the California Franchise Tax Board website

- Mailing a paper form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method depends on personal preference and the complexity of your tax situation.

Quick guide on how to complete ca income form

Complete Ca Income Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, amend, and electronically sign your documents quickly and without delays. Handle Ca Income Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and electronically sign Ca Income Form without hassle

- Obtain Ca Income Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ca Income Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is order deduction in the context of airSlate SignNow?

Order deduction refers to the process of managing and documenting discounts or reductions on invoices using airSlate SignNow. This feature allows businesses to easily apply deductions on customer orders, ensuring accurate records and facilitating smoother transactions.

-

How can airSlate SignNow help streamline order deduction processes?

airSlate SignNow streamlines order deduction by providing user-friendly templates for creating and signing documents. With electronic signatures, businesses can quickly finalize agreements regarding order deductions, reducing paperwork and saving valuable time.

-

What are the pricing options for using airSlate SignNow for order deduction?

airSlate SignNow offers various pricing plans designed to accommodate different business needs. Each plan includes features essential for managing order deductions efficiently, providing a cost-effective solution for businesses of all sizes.

-

Is it possible to integrate airSlate SignNow with other software for order deduction?

Yes, airSlate SignNow supports multiple integrations with popular business applications that can assist in managing order deductions. By connecting with your existing software, you can enhance your workflows and streamline the documentation process.

-

What benefits do electronic signatures provide for order deduction?

Electronic signatures simplify the order deduction process by allowing instant approval and secure documentation. This enhances efficiency, reduces the likelihood of errors, and ensures that all parties maintain clear records of the agreed deductions.

-

Can airSlate SignNow help with compliance related to order deduction?

Absolutely! airSlate SignNow ensures that all documents related to order deduction comply with legal standards by providing best practices for electronic signatures and document management. This helps businesses stay compliant while performing their operations smoothly.

-

How does airSlate SignNow enhance collaboration for order deduction processes?

airSlate SignNow enhances collaboration by allowing multiple stakeholders to access and review documents related to order deduction in real-time. This cohesion reduces delays and promotes better communication among teams, ensuring timely agreement and execution.

Get more for Ca Income Form

- Excavation contractor package utah form

- Renovation contractor package utah form

- Concrete mason contractor package utah form

- Demolition contractor package utah form

- Security contractor package utah form

- Insulation contractor package utah form

- Paving contractor package utah form

- Site work contractor package utah form

Find out other Ca Income Form

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form