Ca Probate Form

What is the CA Probate Form

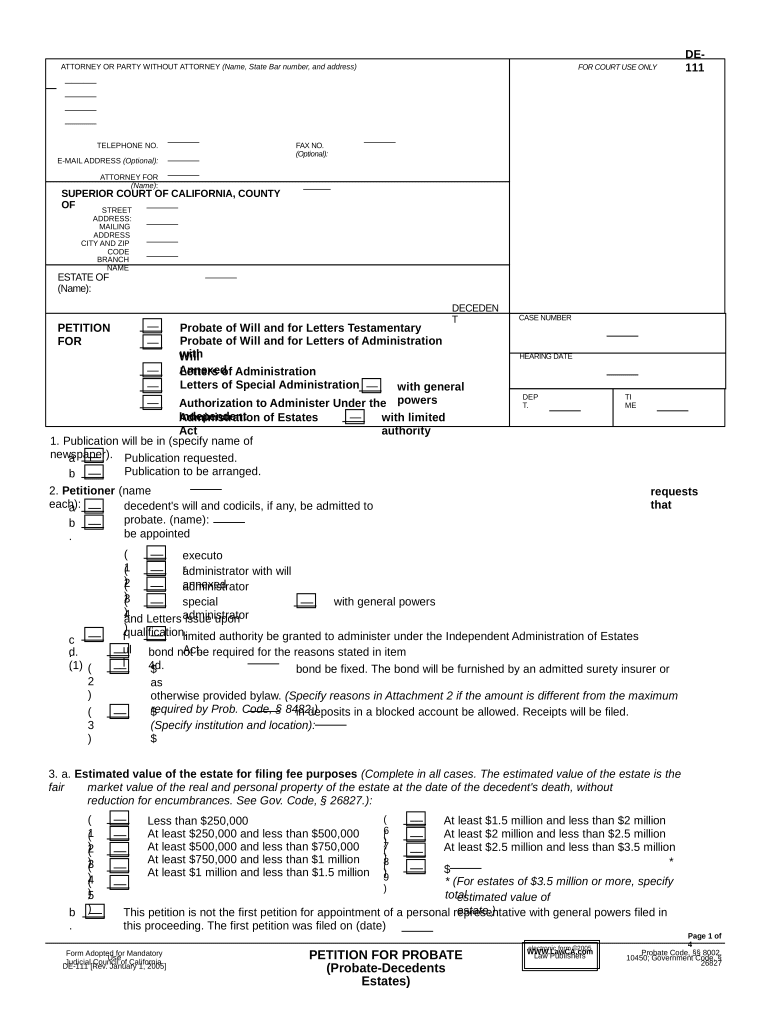

The CA probate form is a legal document used in the state of California to initiate the probate process after an individual passes away. This form is essential for managing the deceased's estate, which includes distributing assets, settling debts, and addressing any claims against the estate. The probate process ensures that the deceased's wishes, as outlined in their will, are honored and that the estate is administered according to state laws.

How to use the CA Probate Form

Using the CA probate form involves several steps. First, it is crucial to gather all necessary information regarding the deceased's assets, debts, and beneficiaries. Once this information is compiled, you can fill out the form accurately, ensuring all details are correct. After completing the form, it must be filed with the appropriate probate court in California. Following submission, the court will review the application and may schedule a hearing to address any issues before granting probate.

Steps to complete the CA Probate Form

Completing the CA probate form requires careful attention to detail. Here are the key steps:

- Gather necessary documents, including the will, death certificate, and a list of assets and debts.

- Fill out the CA probate form with accurate information about the deceased and their estate.

- Review the form for any errors or omissions.

- Submit the completed form to the probate court along with any required filing fees.

- Attend any scheduled court hearings as necessary.

Legal use of the CA Probate Form

The legal use of the CA probate form is critical for ensuring that the probate process is conducted in accordance with California law. This form must be completed accurately and submitted to the court to initiate the probate proceedings. Failure to use the form correctly can result in delays, legal disputes, or even the rejection of the probate application. It is advisable to consult with a legal professional to ensure compliance with all relevant laws and regulations.

Key elements of the CA Probate Form

Several key elements must be included in the CA probate form to ensure its validity:

- Information about the deceased, including full name, date of death, and last known address.

- Details of the deceased's will, if one exists, including the date it was executed.

- A comprehensive list of the deceased's assets and liabilities.

- Information about the proposed executor or administrator of the estate.

- Signature and date from the person filing the form, affirming the accuracy of the information provided.

Form Submission Methods

The CA probate form can be submitted through various methods, depending on the preferences and requirements of the probate court. Common submission methods include:

- Online submission through the court's electronic filing system, if available.

- Mailing the completed form to the appropriate probate court.

- In-person submission at the courthouse, allowing for immediate confirmation of receipt.

Quick guide on how to complete ca probate form

Effortlessly prepare Ca Probate Form on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ca Probate Form from any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

How to modify and electronically sign Ca Probate Form with ease

- Find Ca Probate Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and then click the Done button to store your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your preference. Modify and electronically sign Ca Probate Form and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA probate form?

A CA probate form is a legal document required to initiate the probate process in California. This form helps establish the validity of a will and facilitates the distribution of assets after a person's death. Utilizing airSlate SignNow can streamline the completion and signing of your CA probate form, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with CA probate forms?

AirSlate SignNow provides an efficient platform for completing and electronically signing CA probate forms. Our user-friendly interface allows you to fill out the necessary fields digitally and obtain signatures quickly. With airSlate SignNow, you can manage your CA probate form anywhere, anytime, ensuring a smooth probate process.

-

What are the costs associated with using airSlate SignNow for CA probate forms?

AirSlate SignNow offers various pricing plans tailored to suit different business needs, including options for individuals handling CA probate forms. The subscription includes features that enhance document management and eSigning capabilities without incurring hefty legal fees. You can choose a plan that fits your budget while gaining access to essential tools for CA probate forms.

-

Can I integrate airSlate SignNow with other software for CA probate forms?

Yes, airSlate SignNow easily integrates with various software solutions to help manage your CA probate forms. This includes popular tools like Google Drive, Dropbox, and CRM systems, allowing seamless document collaboration. The integration capabilities ensure that you can store, access, and share your CA probate forms efficiently.

-

What features does airSlate SignNow provide for managing CA probate forms?

AirSlate SignNow comes equipped with features such as customizable templates, real-time collaboration, and secure cloud storage specifically designed to manage CA probate forms. The platform also offers robust tracking capabilities, so you can see when your forms have been viewed and signed. These features enhance the efficiency and security of handling CA probate forms.

-

Is electronic signing of CA probate forms legally binding?

Yes, electronic signing of CA probate forms through airSlate SignNow is legally binding in California. The platform complies with federal and state electronic signature laws, ensuring your signed documents hold up in court. This makes airSlate SignNow a reliable choice for efficiently handling your CA probate forms.

-

How do I get started with airSlate SignNow for my CA probate forms?

Getting started with airSlate SignNow for your CA probate forms is easy. Simply sign up for an account, select the CA probate form template, and begin filling it out. The platform guides you through the process, making it simple to complete and send your CA probate form for signatures.

Get more for Ca Probate Form

- Non marital cohabitation living together agreement utah form

- Paternity law and procedure handbook utah form

- Bill of sale in connection with sale of business by individual or corporate seller utah form

- Utah marriage form

- Office lease agreement utah form

- Utah dissolution form

- Utah service court form

- Utah property form

Find out other Ca Probate Form

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online