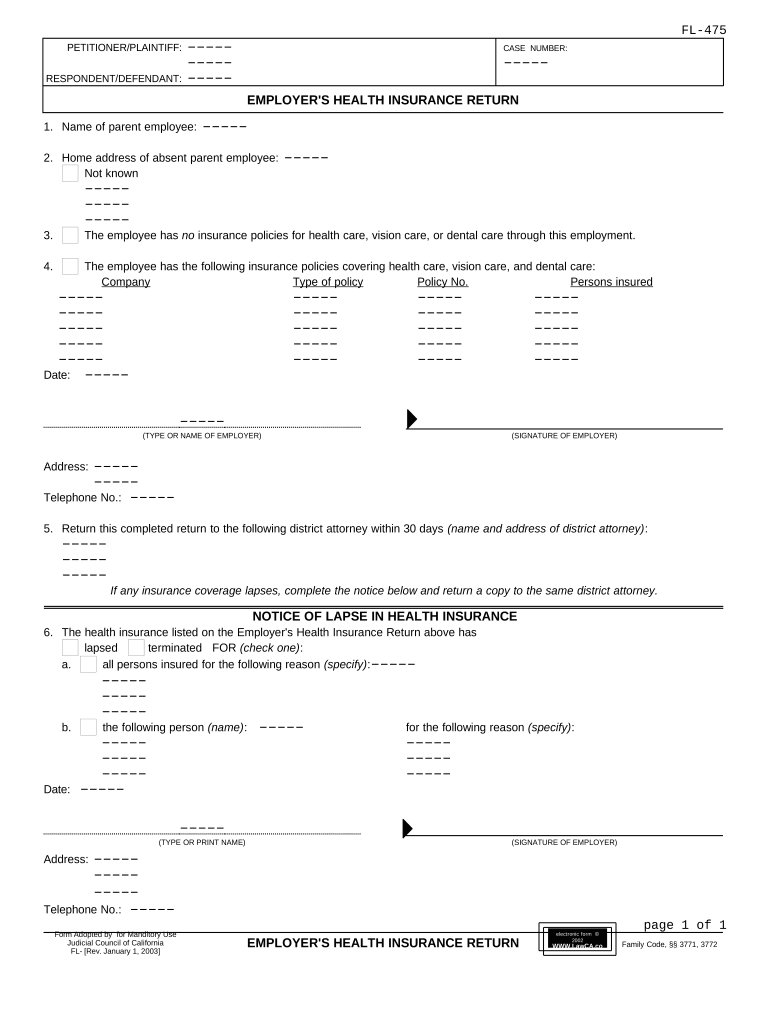

Employer's Health Insurance Return California Form

What is the Employer's Health Insurance Return California

The Employer's Health Insurance Return in California is a crucial document that employers must file to report health insurance coverage provided to employees. This form is designed to ensure compliance with state regulations regarding health insurance, particularly under the Affordable Care Act (ACA). It captures essential information about the health plans offered, the number of employees covered, and any applicable penalties for non-compliance. Understanding this form is vital for employers to maintain legal compliance and avoid potential fines.

Steps to complete the Employer's Health Insurance Return California

Completing the Employer's Health Insurance Return involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your health insurance plans, including coverage details and employee enrollment data. Next, access the appropriate form, which can typically be downloaded from the California state website or obtained through your payroll software. Fill out the form meticulously, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form by the designated deadline, either electronically or by mail, depending on the submission guidelines provided by the state.

Legal use of the Employer's Health Insurance Return California

The legal use of the Employer's Health Insurance Return is governed by various regulations that ensure the protection of employee rights and compliance with health insurance mandates. Employers must adhere to the guidelines set forth by the ACA and California state laws when completing and submitting this form. Failure to comply can result in penalties, including fines or legal action. It is essential for employers to understand their obligations under the law and to maintain accurate records of health insurance coverage to support their filings.

Key elements of the Employer's Health Insurance Return California

Several key elements must be included in the Employer's Health Insurance Return to ensure it meets legal requirements. These elements typically include:

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Employee Information: Details about each employee covered under the health plan, including names, Social Security numbers, and coverage months.

- Health Plan Details: Information about the health insurance plans offered, including plan types and coverage levels.

- Compliance Statements: Affirmations that the employer complies with ACA requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Employer's Health Insurance Return are critical for compliance. Generally, employers must submit this form annually, with specific deadlines set by the California state government. It is essential to stay informed about these dates to avoid penalties. For instance, the deadline typically aligns with the tax filing deadline, which is usually April 15. Employers should also be aware of any extensions or changes to deadlines that may occur due to legislative updates or other factors.

Form Submission Methods (Online / Mail / In-Person)

The Employer's Health Insurance Return can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online Submission: Many employers opt to file electronically through designated state portals or payroll software that supports e-filing.

- Mail Submission: Employers can print the completed form and send it via postal mail to the appropriate state agency.

- In-Person Submission: Some employers may choose to deliver the form in person at designated state offices, although this method is less common.

Quick guide on how to complete employers health insurance return california

Complete Employer's Health Insurance Return California effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Employer's Health Insurance Return California across any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest way to edit and eSign Employer's Health Insurance Return California without hassle

- Obtain Employer's Health Insurance Return California and then click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow caters to your document management needs in a few clicks from any device you prefer. Edit and eSign Employer's Health Insurance Return California while ensuring exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Employer's Health Insurance Return California?

The Employer's Health Insurance Return California refers to the necessary document that employers must submit to report health insurance coverage. This return is a crucial aspect of compliance with state regulations. By understanding its requirements, employers can ensure they are providing the necessary information about health benefits to the state.

-

How does airSlate SignNow support the Employer's Health Insurance Return California process?

airSlate SignNow simplifies the process of submitting the Employer's Health Insurance Return California by allowing businesses to sign and send documents electronically. This easy-to-use platform ensures that all documents are securely eSigned, reducing the risk of errors and ensuring timely submissions. Its features streamline compliance, making it an efficient solution for businesses.

-

Are there any pricing plans for using airSlate SignNow for the Employer's Health Insurance Return California?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, providing cost-effective solutions for managing the Employer's Health Insurance Return California. With flexible options, businesses can choose the plan that best fits their volume of document handling. Competitive pricing ensures that all businesses, regardless of size, can utilize this service.

-

What features does airSlate SignNow offer for handling health insurance documentation?

airSlate SignNow includes features such as customizable templates, secure eSignature options, and document tracking for submitting the Employer's Health Insurance Return California. These features ensure that businesses can create, manage, and store necessary paperwork efficiently. Enhanced collaboration tools also allow multiple stakeholders to participate in the process seamlessly.

-

Is airSlate SignNow compliant with California health insurance regulations?

Yes, airSlate SignNow is designed to comply with California health insurance regulations, including those related to the Employer's Health Insurance Return California. The platform prioritizes data security and confidentiality, which is vital for sensitive health information. Businesses can trust that their compliance needs are met with this solution.

-

Can airSlate SignNow integrate with other software for managing health insurance documents?

Absolutely! airSlate SignNow integrates seamlessly with various software programs, enhancing your process for handling the Employer's Health Insurance Return California. Integration capabilities allow for easier data transfer and better management of health-related documents across different platforms. This ensures a streamlined workflow for businesses.

-

What are the benefits of using airSlate SignNow for the Employer's Health Insurance Return California?

Using airSlate SignNow for the Employer's Health Insurance Return California offers several benefits, such as increased efficiency, reduced turnaround times, and lower administrative costs. The electronic signing process enhances the user experience, making it simpler to complete necessary documentation. Additionally, businesses can maintain compliance with less hassle through organized document management.

Get more for Employer's Health Insurance Return California

- Flood zone statement and authorization washington form

- Name affidavit of buyer washington form

- Name affidavit of seller washington form

- Non foreign affidavit under irc 1445 washington form

- Owners or sellers affidavit of no liens washington form

- Washington affidavit form 497429907

- Complex will with credit shelter marital trust for large estates washington form

- Washington jury form

Find out other Employer's Health Insurance Return California

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF