Ein Change of Address Form 2005-2026

What is the EIN Change of Address Form

The EIN Change of Address Form is a crucial document used by businesses and organizations to officially notify the Internal Revenue Service (IRS) of a change in their address associated with their Employer Identification Number (EIN). This form ensures that the IRS has up-to-date information, which is essential for tax reporting and correspondence. Keeping your address current helps avoid missed communications regarding tax obligations, notices, and other important information.

Steps to Complete the EIN Change of Address Form

Completing the EIN Change of Address Form involves several straightforward steps:

- Obtain the form, which can typically be found on the IRS website or through authorized tax professionals.

- Fill in the required information, including your current address, new address, and EIN.

- Review the form for accuracy to ensure all details are correct.

- Sign and date the form, as required, to validate your submission.

- Submit the completed form to the IRS via the preferred method, which may include online submission, mailing, or in-person delivery.

Legal Use of the EIN Change of Address Form

The EIN Change of Address Form serves a legal purpose by formally notifying the IRS of your address change. This notification is essential for compliance with federal tax laws. Failing to update your address can lead to complications such as missed tax notifications or delays in processing tax returns. It is important to ensure that this form is filled out accurately and submitted in a timely manner to maintain compliance with IRS regulations.

IRS Guidelines for the EIN Change of Address Form

The IRS provides specific guidelines for using the EIN Change of Address Form. These guidelines include:

- Ensuring that the form is submitted within a reasonable timeframe following the address change.

- Providing accurate and complete information to avoid processing delays.

- Understanding that the IRS may require additional documentation or verification depending on the nature of the address change.

Form Submission Methods

The EIN Change of Address Form can be submitted to the IRS using various methods:

- Online: Some forms may be submitted electronically through the IRS website.

- Mail: The completed form can be sent to the appropriate IRS address based on your location.

- In-Person: You may also submit the form at designated IRS offices, though this option may vary by location.

Required Documents for the EIN Change of Address Form

When completing the EIN Change of Address Form, it is important to have certain documents on hand to facilitate the process:

- Your current EIN documentation.

- Proof of the new address, which may include utility bills or lease agreements.

- Any previous correspondence from the IRS that includes your EIN.

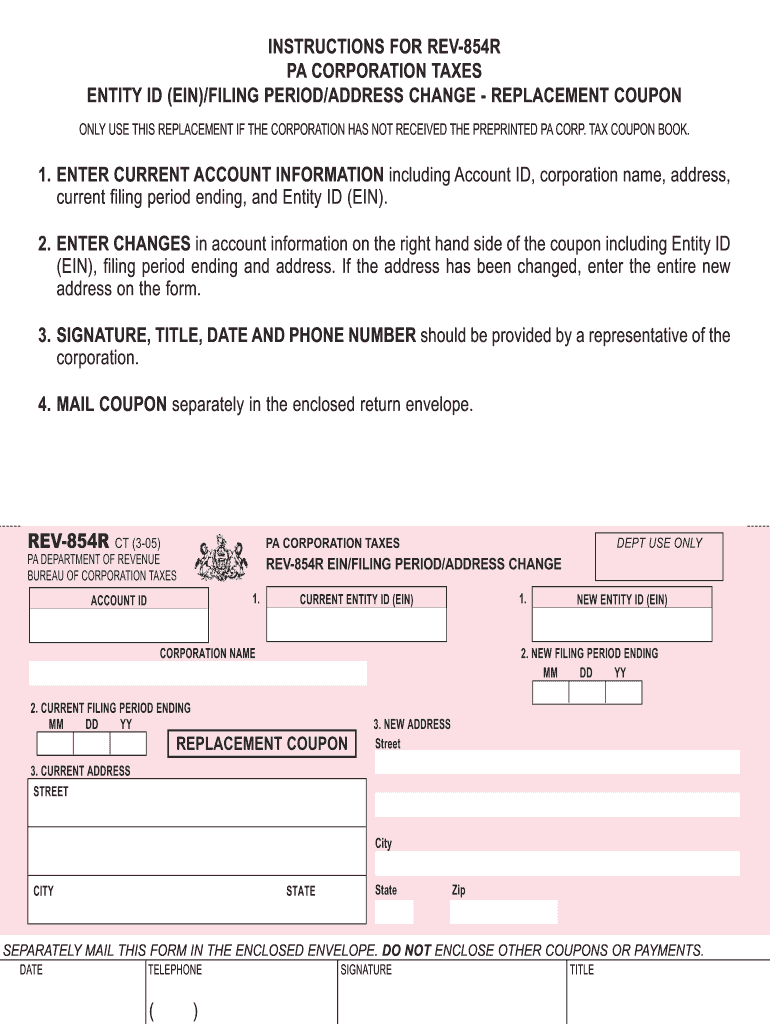

Quick guide on how to complete einfiling periodaddress change rev 854r formsend

Your assistance manual on how to prepare your Ein Change Of Address Form

If you’re uncertain about how to generate and submit your Ein Change Of Address Form, below are some concise guidelines on how to make tax reporting less challenging.

To begin, you simply need to set up your airSlate SignNow account to revolutionize the way you process documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to amend responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Ein Change Of Address Form in no time:

- Establish your account and start working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to launch your Ein Change Of Address Form in our editor.

- Complete the mandatory fillable fields with your data (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Use this manual to file your taxes digitally with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay refunds. Before e-filing your taxes, please verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the einfiling periodaddress change rev 854r formsend

How to make an eSignature for the Einfiling Periodaddress Change Rev 854r Formsend in the online mode

How to generate an eSignature for your Einfiling Periodaddress Change Rev 854r Formsend in Google Chrome

How to create an eSignature for signing the Einfiling Periodaddress Change Rev 854r Formsend in Gmail

How to generate an eSignature for the Einfiling Periodaddress Change Rev 854r Formsend from your mobile device

How to generate an electronic signature for the Einfiling Periodaddress Change Rev 854r Formsend on iOS

How to make an eSignature for the Einfiling Periodaddress Change Rev 854r Formsend on Android devices

People also ask

-

What is the significance of the 854r format in airSlate SignNow?

The 854r format is beneficial for businesses looking to streamline their document processes. It allows users to easily send and eSign documents while maintaining data integrity and compliance. Utilizing the 854r format ensures your documents are processed efficiently, enhancing productivity.

-

How does airSlate SignNow support the 854r document format?

airSlate SignNow fully supports the 854r document format, enabling users to manage their documents effectively. This means you can send, receive, and eSign 854r documents seamlessly. Our platform ensures that the quality and format of your documents remain intact during the signing process.

-

What are the pricing plans for airSlate SignNow that support 854r?

Our pricing plans for airSlate SignNow are designed to be cost-effective and scalable, accommodating businesses of all sizes that utilize the 854r format. We offer various subscription levels to meet your document management needs. Each plan provides comprehensive features that facilitate efficient eSigning and document management.

-

What features does airSlate SignNow offer for the 854r format?

airSlate SignNow offers a range of features for the 854r format, including customizable templates, mobile compatibility, and audit trails. These features ensure that your document workflow is not only efficient but also secure. With airSlate SignNow, managing the 854r format is simpler and more effective.

-

Can airSlate SignNow integrate with other tools for 854r document management?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms to enhance 854r document management. You can connect with popular CRM systems, cloud storage solutions, and more. This integration simplifies your workflow and ensures a comprehensive approach to document handling.

-

What benefits does airSlate SignNow provide for eSigning 854r documents?

Using airSlate SignNow for eSigning 854r documents provides numerous benefits, including time efficiency and cost savings. Our platform enables quick approvals and eliminates the need for physical document handling. This enhances your business agility and helps you stay competitive.

-

Is airSlate SignNow suitable for small businesses dealing with 854r documents?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing 854r documents. Our intuitive interface and affordable pricing make it an ideal solution for smaller teams aiming to streamline their document processes. You'll find that adopting airSlate SignNow signNowly boosts your operational efficiency.

Get more for Ein Change Of Address Form

- Limited partnership agreement of icon oil ampamp gas fund secgov form

- 041b compensation committee information form

- U s vision inc form s 1a received 12021997 100417

- 045 sample agreement with new partner for compensation based on generating form

- 09 mutual nondisclosure agreement form

- 031c form settlement agreement resolving claims of a small general

- Complete rules of professional conductlaw society of form

- Sample announcement of employee leaving company email form

Find out other Ein Change Of Address Form

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast