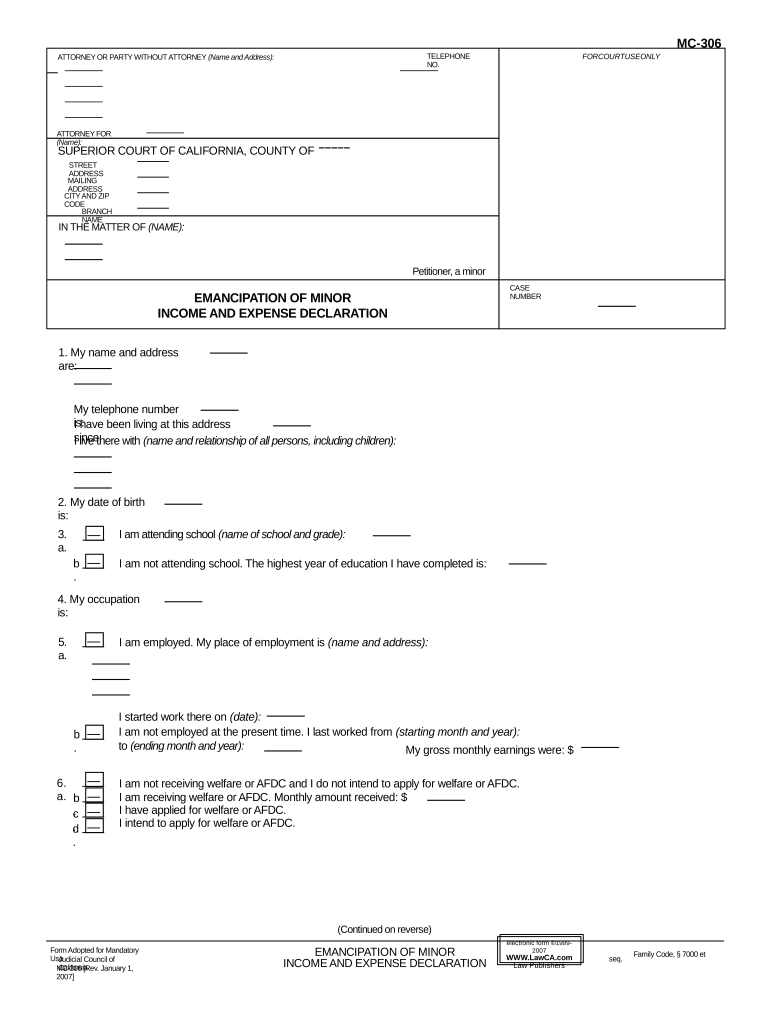

EMANCIPATION of MINOR INCOME and EXPENSE DECLARATION Form

What is the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

The emancipation of minor income and expense declaration is a legal document that allows a minor to declare their income and expenses, typically for purposes related to financial independence or legal proceedings. This form is essential for minors seeking to manage their financial affairs without parental oversight. It outlines the minor's income sources, such as wages or allowances, and details their expenses, which may include education costs, living expenses, or other financial obligations. By completing this declaration, minors can demonstrate their ability to handle their finances responsibly.

Steps to complete the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

Completing the emancipation of minor income and expense declaration involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, pay stubs, and receipts for expenses.

- Fill out the form: Accurately enter your income and expenses in the designated sections of the declaration. Ensure all figures are correct and clearly stated.

- Review the document: Double-check all entries for accuracy. It is crucial that the information provided is truthful and complete.

- Obtain required signatures: Depending on state laws, you may need a parent or guardian's signature, as well as your own, to validate the form.

- Submit the form: Follow the specific submission guidelines for your state, which may include filing online, by mail, or in person.

Legal use of the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

This declaration serves a legal purpose by establishing the minor's financial independence and responsibility. It can be used in various legal contexts, such as court proceedings related to emancipation, child support, or custody arrangements. Courts may require this document to assess the minor's financial situation and determine their ability to support themselves. It is essential to ensure that the declaration is completed accurately and in compliance with state laws to maintain its legal validity.

Eligibility Criteria

To complete the emancipation of minor income and expense declaration, certain eligibility criteria must be met. Generally, the minor must:

- Be at least 16 years old, though this can vary by state.

- Demonstrate financial independence, which may include having a job or other sources of income.

- Show the ability to manage their own financial affairs responsibly.

- Meet any additional state-specific requirements that may apply.

State-specific rules for the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

Each state in the U.S. has its own regulations regarding the emancipation of minors and the associated income and expense declaration. It is important to be aware of these state-specific rules, as they can affect the process and requirements for filing the declaration. Some states may require additional documentation or have specific forms that must be used. Researching your state's laws is crucial to ensure compliance and to understand the implications of the declaration.

How to obtain the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

The emancipation of minor income and expense declaration can typically be obtained through various sources:

- Your local court or family law office may provide the form and any necessary instructions.

- Some state government websites offer downloadable versions of the form.

- Consulting with a legal professional can also help in obtaining the correct form and understanding the requirements for your situation.

Quick guide on how to complete emancipation of minor income and expense declaration

Complete EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION with ease

- Obtain EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

An EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION is a legal document required to demonstrate the minor's income and expenses, which can play a crucial role in court proceedings. This declaration helps in determining the financial responsibility of the minor and their ability to manage their income. Understanding this declaration is essential for parents or guardians involved in the emancipation process.

-

How can airSlate SignNow help with the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

airSlate SignNow streamlines the process of creating and eSigning your EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION. Our platform provides easy templates and a user-friendly interface that simplifies the document preparation and signing. This ensures that the necessary documents are processed efficiently and securely.

-

What are the pricing options for airSlate SignNow for creating an EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

airSlate SignNow offers flexible pricing plans that cater to various needs, starting from a basic plan suitable for individual users to advanced options for businesses. Each plan includes features that can assist you in managing your EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION effectively. Visit our pricing page for detailed information.

-

Is airSlate SignNow compliant with legal standards for the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

Yes, airSlate SignNow complies with all necessary legal standards when it comes to the EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION. Our solution uses advanced encryption and security measures to protect your information and ensure the legality of all signed documents. This provides peace of mind while handling sensitive legal documents.

-

Can I integrate airSlate SignNow with other applications for my EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

Absolutely! airSlate SignNow integrates seamlessly with various applications, helping you to manage your EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION efficiently. Whether it's a CRM tool or cloud storage service, our integrations allow for easy access to documents and improve your overall workflow.

-

What are the benefits of using airSlate SignNow for my EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

Using airSlate SignNow for your EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION offers signNow benefits such as time savings, cost efficiency, and ease of use. You can quickly create, edit, and eSign documents without any hassle, which streamlines the overall process signNowly. Moreover, our platform enhances collaboration by enabling multiple parties to sign the document from anywhere.

-

How does airSlate SignNow ensure the security of my EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION?

airSlate SignNow prioritizes your security with state-of-the-art encryption protocols to safeguard your EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION and personal information. We adhere to strict compliance standards to ensure your documents are safe during storage and transit. This commitment to security allows you to conduct electronic transactions with confidence.

Get more for EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

- Sellers information for appraiser provided to buyer wyoming

- Legallife multistate guide and handbook for selling or buying real estate wyoming form

- Subcontractors agreement wyoming form

- Option to purchase addendum to residential lease lease or rent to own wyoming form

- Wy prenuptial agreement form

- Wyoming prenuptial premarital agreement without financial statements wyoming form

- Amendment to prenuptial or premarital agreement wyoming form

- Financial statements only in connection with prenuptial premarital agreement wyoming form

Find out other EMANCIPATION OF MINOR INCOME AND EXPENSE DECLARATION

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter