Ca Withholding Form

What is the California Withholding Form

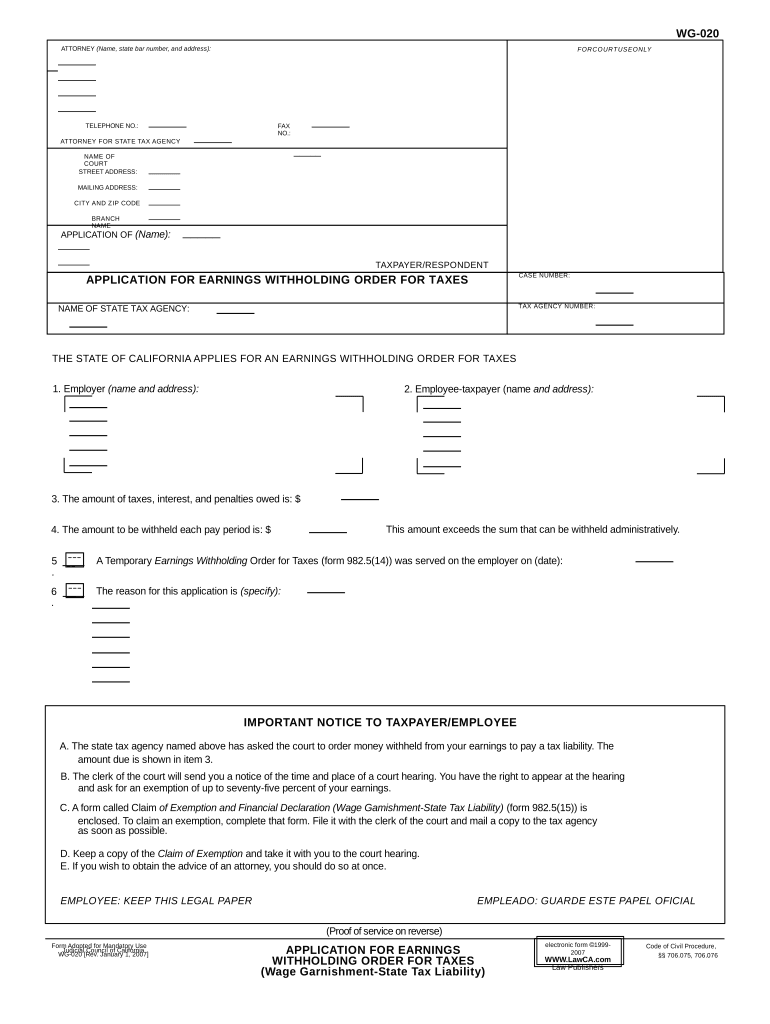

The California withholding form, often referred to as the CA withholding form, is a crucial document used by employers to determine the amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with California's tax regulations. It collects information regarding an employee's filing status, allowances, and any additional withholding amounts requested by the employee. Proper completion of this form helps both employers and employees manage their tax obligations effectively.

How to Use the California Withholding Form

Using the California withholding form involves several steps to ensure accurate completion. First, employees should gather necessary personal information, including their Social Security number and filing status. Next, they should review the withholding allowances they qualify for, which can reduce the amount withheld from their paycheck. After filling out the form, employees should submit it to their employer, who will use the provided information to calculate the appropriate withholding amount for state taxes.

Steps to Complete the California Withholding Form

Completing the California withholding form requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the California withholding form from a reliable source.

- Fill in personal details, including your name, address, and Social Security number.

- Select your filing status, such as single or married, and indicate the number of allowances you are claiming.

- If applicable, specify any additional amount you wish to withhold from each paycheck.

- Review the form for accuracy before submitting it to your employer.

Legal Use of the California Withholding Form

The legal use of the California withholding form is governed by state tax laws. Employers are required to provide this form to employees for accurate tax withholding. The form must be completed and submitted to ensure compliance with California's income tax regulations. Failure to use the form correctly can result in penalties for both employers and employees, making it essential to understand its legal implications.

Key Elements of the California Withholding Form

Several key elements are included in the California withholding form that are essential for accurate tax withholding:

- Personal Information: Name, address, and Social Security number of the employee.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed, which affects the withholding amount.

- Additional Withholding: Option to specify any extra amount to be withheld from paychecks.

Form Submission Methods

The California withholding form can be submitted through various methods, ensuring convenience for both employees and employers. Employees typically submit the completed form directly to their employer. Employers may then retain the form for their records and use the information to adjust payroll systems accordingly. Additionally, some employers may allow electronic submission of the form, streamlining the process further.

Quick guide on how to complete ca withholding form

Complete Ca Withholding Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without any issues. Manage Ca Withholding Form on any device using airSlate SignNow's Android or iOS apps and enhance any document-based process today.

The simplest way to update and eSign Ca Withholding Form without stress

- Find Ca Withholding Form and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Leave behind the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Ca Withholding Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the California withholding form and why is it important?

The California withholding form is a crucial document that determines the amount of state income tax that employers must withhold from employees' wages. It's important for both employers and employees to accurately complete this form to ensure compliance with state tax laws and avoid any penalties.

-

How can airSlate SignNow help with the California withholding form?

airSlate SignNow simplifies the process of filling out and submitting the California withholding form. Our platform allows users to easily eSign and send the form securely, making document handling intuitive and efficient for all parties involved.

-

Is there a cost associated with using airSlate SignNow for the California withholding form?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By choosing our service, you gain access to features that streamline the completion of the California withholding form while ensuring cost-effectiveness for your organization.

-

What features does airSlate SignNow offer for handling the California withholding form?

airSlate SignNow provides a user-friendly interface for creating, editing, and eSigning the California withholding form. Additional features include templates, document tracking, and the ability to integrate with your existing business tools for a seamless experience.

-

How secure is the airSlate SignNow platform for completing the California withholding form?

Security is a priority at airSlate SignNow. Our platform employs advanced encryption and data protection measures to ensure that your completed California withholding forms and sensitive information are kept safe and secure from unauthorized access.

-

Can I integrate airSlate SignNow with other applications for managing the California withholding form?

Absolutely! airSlate SignNow allows for integration with various business applications, making it easier to manage your California withholding forms alongside other important documents. This integration capability enhances workflow efficiency for your team.

-

What benefits can I expect when using airSlate SignNow for the California withholding form?

Using airSlate SignNow for the California withholding form offers numerous benefits, including reduced processing time and increased accuracy. The platform also provides templates, which minimize errors and streamline document management, leading to greater overall efficiency.

Get more for Ca Withholding Form

Find out other Ca Withholding Form

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free