California Claim Exemption Form

What is the California Claim Exemption

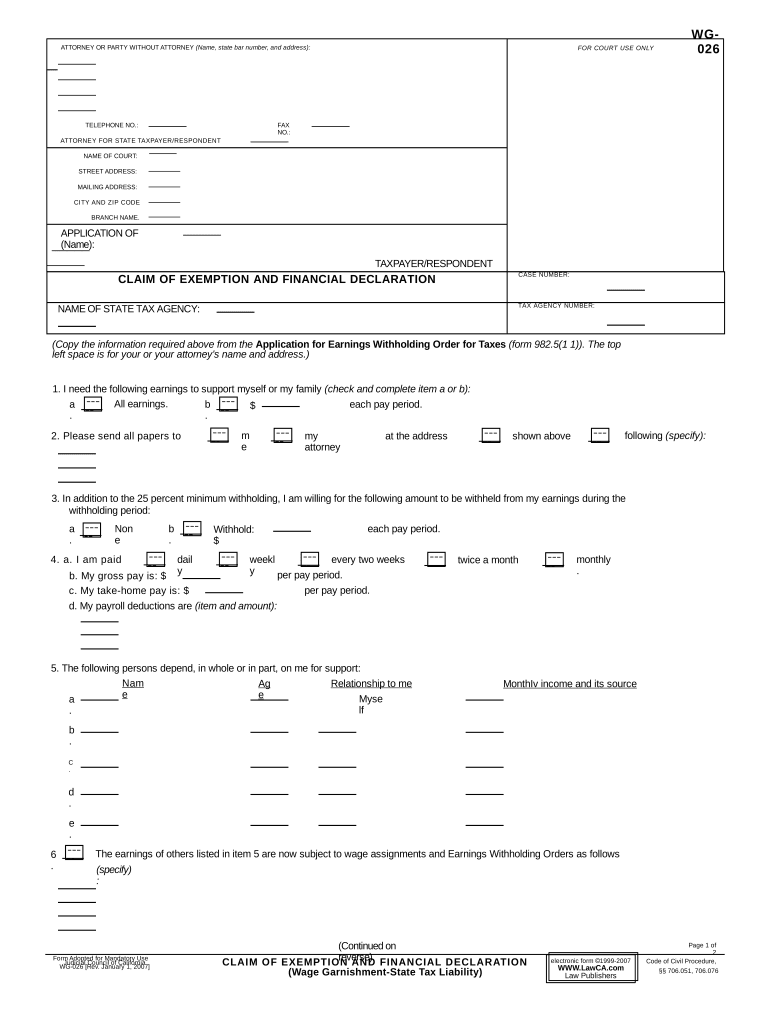

The California claim exemption is a legal declaration that allows eligible individuals to exempt certain income or assets from taxation. This exemption is particularly relevant for specific groups, such as low-income taxpayers or those meeting particular criteria set forth by the state. Understanding the purpose of this exemption can help taxpayers manage their financial obligations effectively and ensure compliance with California tax laws.

Eligibility Criteria

To qualify for the California claim exemption, individuals must meet specific eligibility requirements. Generally, these criteria include income thresholds, residency status, and other factors that may vary based on individual circumstances. Taxpayers should review the guidelines provided by the California Franchise Tax Board to determine their eligibility and ensure they can properly complete the exemption form.

Steps to Complete the California Claim Exemption

Completing the California claim exemption form involves several important steps. First, gather all necessary documentation, which may include income statements and identification. Next, accurately fill out the form, ensuring all information is complete and correct. After completing the form, review it for accuracy before submitting it. Finally, choose a submission method, whether online, by mail, or in person, to ensure it reaches the appropriate tax authority.

Legal Use of the California Claim Exemption

The legal use of the California claim exemption is governed by state tax laws. To ensure that the exemption is recognized, taxpayers must comply with all applicable regulations and submit the form within the designated time frame. This compliance not only protects taxpayers from potential penalties but also ensures that they can benefit from the tax relief the exemption provides.

Required Documents

When applying for the California claim exemption, certain documents are typically required. These may include proof of income, residency verification, and any other documentation specified by the California Franchise Tax Board. Having these documents ready can facilitate a smoother application process and help ensure that the exemption is granted without unnecessary delays.

Form Submission Methods

Taxpayers have several options for submitting the California claim exemption form. The form can be submitted online through the California Franchise Tax Board's website, mailed directly to the appropriate address, or delivered in person at designated tax offices. Each method has its advantages, and taxpayers should choose the one that best fits their needs and circumstances.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the California claim exemption can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand these consequences and ensure that they complete and submit the exemption form accurately and on time to avoid any negative repercussions.

Quick guide on how to complete california claim exemption

Complete California Claim Exemption effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without interruptions. Manage California Claim Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign California Claim Exemption without hassle

- Find California Claim Exemption and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from a device of your choice. Modify and eSign California Claim Exemption to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the California claim exemption form?

The California claim exemption form is a document that allows individuals to claim certain exemptions under California law. This form is crucial for managing your finances effectively, as it determines your eligibility for various tax benefits and exemptions.

-

How can I fill out the California claim exemption form using airSlate SignNow?

You can easily fill out the California claim exemption form using airSlate SignNow's user-friendly interface. Simply upload the form, fill in your information, and sign digitally. The process is streamlined, ensuring accuracy and efficiency.

-

Is airSlate SignNow secure for handling the California claim exemption form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for managing your California claim exemption form. With encryption and secure servers, your data is protected during the eSignature and document management processes.

-

What are the benefits of using airSlate SignNow for my California claim exemption form?

Using airSlate SignNow for your California claim exemption form provides numerous benefits, such as faster processing times and improved accuracy. The platform eliminates paper-based processes, reducing errors and delays, and enabling you to access your documents from anywhere.

-

Can I integrate airSlate SignNow with other software for managing my California claim exemption form?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your ability to manage your California claim exemption form efficiently. By connecting with tools like CRM platforms, you can automate workflows and improve productivity.

-

What pricing options does airSlate SignNow offer for using it to handle the California claim exemption form?

airSlate SignNow provides flexible pricing plans tailored to fit different business needs, including those who frequently need to handle documents like the California claim exemption form. You can choose a plan that suits your volume of usage, ensuring cost-effectiveness.

-

Is there customer support available for assistance with the California claim exemption form on airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding the California claim exemption form. Whether you need help with filling out the form or technical support, our team is here to help you navigate the process smoothly.

Get more for California Claim Exemption

Find out other California Claim Exemption

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online