Individual Credit Application Colorado Form

What is the Individual Credit Application Colorado

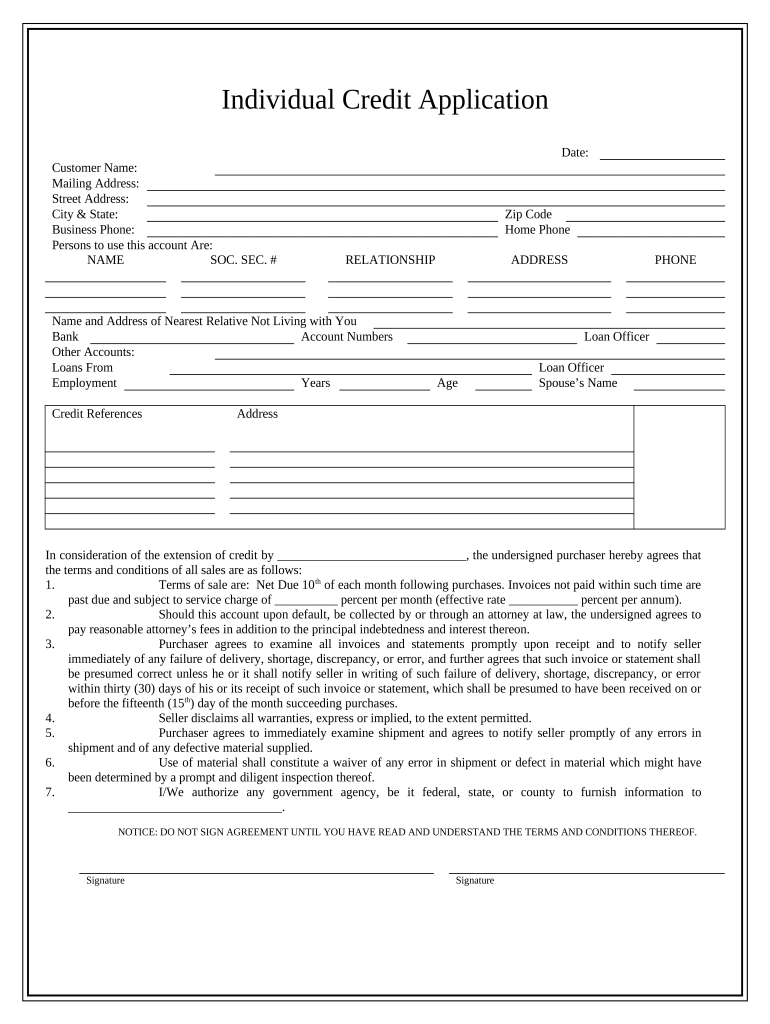

The Individual Credit Application Colorado is a formal document used by individuals seeking credit from lenders or financial institutions within the state. This application typically collects essential personal information, including the applicant's name, address, social security number, income details, and employment history. The purpose of the application is to assess the creditworthiness of the individual, enabling lenders to make informed decisions regarding loan approvals.

Steps to Complete the Individual Credit Application Colorado

Completing the Individual Credit Application Colorado involves several straightforward steps:

- Gather necessary documents: Collect your identification, proof of income, and any other relevant financial information.

- Fill out personal information: Provide your full name, address, social security number, and contact details accurately.

- Detail your financial status: Include information about your income, expenses, and any existing debts.

- Review the application: Ensure all information is accurate and complete to avoid delays in processing.

- Submit the application: Send the completed form to the lender through the preferred submission method.

Legal Use of the Individual Credit Application Colorado

The Individual Credit Application Colorado is legally binding when completed and submitted according to state regulations. It must comply with the Fair Credit Reporting Act (FCRA), which ensures that lenders use accurate and up-to-date information when evaluating credit applications. Additionally, the application process must respect the privacy rights of applicants, safeguarding their personal information against unauthorized access.

Key Elements of the Individual Credit Application Colorado

Several key elements are essential to the Individual Credit Application Colorado:

- Personal identification: Full name, address, and social security number.

- Employment information: Current employer, job title, and duration of employment.

- Financial details: Monthly income, expenses, and existing debts.

- Consent for credit checks: Authorization for lenders to obtain credit reports.

Eligibility Criteria

To apply using the Individual Credit Application Colorado, applicants typically must meet certain eligibility criteria, including:

- Being at least eighteen years old.

- Having a valid social security number.

- Demonstrating a stable source of income.

- Possessing a reasonable credit history, although some lenders may consider applicants with limited credit history.

Form Submission Methods

The Individual Credit Application Colorado can be submitted through various methods, providing flexibility for applicants:

- Online submission: Many lenders offer an online application process for convenience.

- Mail: Applicants can print the form and send it via postal service.

- In-person: Submitting the application directly at the lender’s office is also an option.

Quick guide on how to complete individual credit application colorado

Finish Individual Credit Application Colorado effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Individual Credit Application Colorado on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and electronically sign Individual Credit Application Colorado with ease

- Obtain Individual Credit Application Colorado and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Individual Credit Application Colorado and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application for Colorado?

An Individual Credit Application in Colorado is a document that prospective borrowers fill out to apply for credit. This application collects essential personal and financial information to help lenders assess creditworthiness. Utilizing airSlate SignNow enhances the process by providing a secure and efficient way to eSign these applications.

-

How can airSlate SignNow simplify the Individual Credit Application process in Colorado?

airSlate SignNow simplifies the Individual Credit Application process in Colorado by allowing users to fill out, sign, and send documents electronically. This leads to faster processing times, reduced paper usage, and enhanced security. The platform is designed for ease of use, making it ideal for individuals and businesses alike.

-

What are the costs associated with using airSlate SignNow for Individual Credit Applications in Colorado?

The pricing for airSlate SignNow varies based on subscription plans, which are designed to accommodate different business needs. For those specifically focused on Individual Credit Applications in Colorado, airSlate offers competitive rates without sacrificing features. You can choose a plan that aligns with your expected document volume and usage.

-

What features does airSlate SignNow offer for Individual Credit Applications in Colorado?

AirSlate SignNow provides features such as customizable templates, in-app signing, and real-time tracking for Individual Credit Applications in Colorado. These features help streamline the application process, ensuring that all documents are filled out correctly and signed promptly. Additionally, you can integrate with other tools to enhance functionality.

-

Is airSlate SignNow compliant with Colorado state laws for Individual Credit Applications?

Yes, airSlate SignNow is designed to comply with Colorado state laws regarding Individual Credit Applications. The platform incorporates built-in compliance features, ensuring that all eSigned documents meet legal requirements. This compliance helps protect both the lender and the borrower during the application process.

-

Can airSlate SignNow integrate with other software for processing Individual Credit Applications in Colorado?

Absolutely! airSlate SignNow offers seamless integrations with various software tools, making it easy to enhance the processing of Individual Credit Applications in Colorado. Whether you use CRM systems, accounting software, or other document management solutions, these integrations help streamline workflows and improve efficiency.

-

What benefits does using airSlate SignNow provide for Individual Credit Applications in Colorado?

Using airSlate SignNow for Individual Credit Applications in Colorado offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced security. The platform equips users with tools to automate their workflows and manage documents from anywhere. This ultimately leads to a better experience for both applicants and lenders.

Get more for Individual Credit Application Colorado

Find out other Individual Credit Application Colorado

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple