Final Accounting Form

What is the final accounting form?

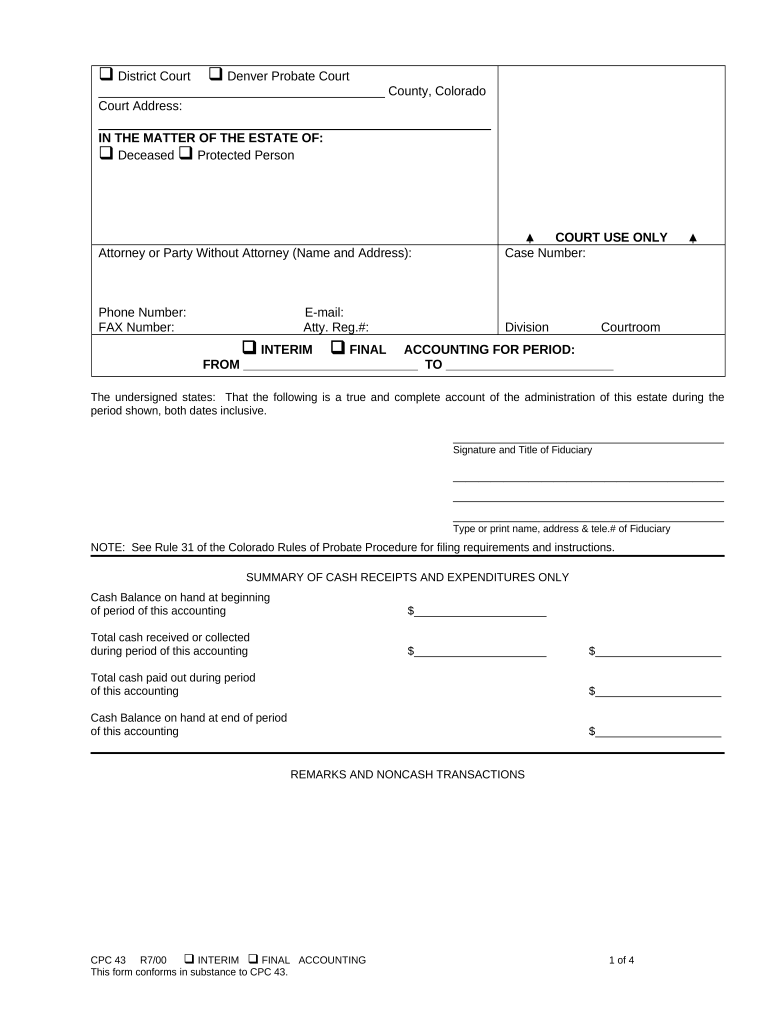

The final accounting form is a crucial document used in various financial transactions and reporting processes. It typically serves as a comprehensive summary of an entity's financial activities over a specified period, ensuring transparency and compliance with regulatory requirements. This form is essential for businesses, individuals, and organizations to accurately report their financial status and obligations. It may encompass details such as income, expenses, assets, and liabilities, providing a clear picture of financial health.

Steps to complete the final accounting form

Completing the final accounting form involves several key steps to ensure accuracy and compliance. These steps include:

- Gathering all relevant financial documents, such as receipts, invoices, and bank statements.

- Organizing the financial data by categorizing income and expenses.

- Calculating totals for each category to ensure all figures are accurate.

- Filling out the form with the organized data, ensuring that all required fields are completed.

- Reviewing the form for any discrepancies or missing information before submission.

Legal use of the final accounting form

The legal use of the final accounting form is paramount for ensuring that all financial reporting adheres to applicable laws and regulations. This form must be completed accurately and submitted within specified deadlines to avoid penalties. Compliance with federal and state laws, including tax regulations, is essential. The form may also need to be notarized or submitted with supporting documents, depending on the jurisdiction and specific requirements of the entity involved.

Key elements of the final accounting form

Understanding the key elements of the final accounting form is vital for accurate completion. Important components typically include:

- Identification Information: This includes the name, address, and tax identification number of the entity.

- Financial Summary: A detailed breakdown of income, expenses, assets, and liabilities.

- Signatures: Required signatures from authorized individuals to validate the form.

- Attachments: Any necessary supporting documentation, such as financial statements or tax returns.

How to obtain the final accounting form

Obtaining the final accounting form is a straightforward process. It can typically be acquired through the following methods:

- Visiting the official website of the relevant regulatory body or financial institution.

- Requesting a physical copy from a local office or branch.

- Accessing online platforms that provide downloadable versions of the form.

Filing deadlines / Important dates

Filing deadlines for the final accounting form vary depending on the type of entity and the specific regulations governing it. It is important to be aware of these dates to ensure timely submission. Common deadlines include:

- Annual filing deadlines for businesses, often aligned with the end of the fiscal year.

- Quarterly reporting deadlines for certain entities, especially those required to file estimated taxes.

- Specific dates for submitting forms to state agencies or regulatory bodies.

Quick guide on how to complete final accounting form

Effortlessly Prepare Final Accounting Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and e-sign your documents without delays. Handle Final Accounting Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and e-sign Final Accounting Form effortlessly

- Obtain Final Accounting Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you prefer to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the anxiety of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and e-sign Final Accounting Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a final accounting form and why is it important?

The final accounting form is a crucial document that summarizes all financial activities at the conclusion of a project or fiscal period. This form ensures transparency and accuracy in financial reporting, helping businesses maintain compliance and make informed decisions based on final figures.

-

How does airSlate SignNow facilitate the completion of a final accounting form?

With airSlate SignNow, users can easily create, send, and eSign final accounting forms online. The platform streamlines the process by allowing for quick document assembly, secure signing, and instant delivery, making it an efficient solution for financial documentation needs.

-

What are the key features of the final accounting form offered by airSlate SignNow?

The final accounting form provided by airSlate SignNow includes customizable templates, seamless integration with accounting software, and automated workflows. These features help improve efficiency and accuracy, making the process of preparing final accounting forms much simpler.

-

Is there a cost associated with using the final accounting form in airSlate SignNow?

Yes, airSlate SignNow offers a range of pricing plans for using their services, including features for managing final accounting forms. Users can choose from various subscription options based on their needs, ensuring they find a cost-effective solution that fits their budget.

-

Can I integrate the final accounting form with other tools?

Absolutely! airSlate SignNow provides integration capabilities with several popular accounting and document management tools. This means you can seamlessly connect your final accounting form with platforms like QuickBooks and Salesforce, enhancing your workflow.

-

What benefits can businesses expect from using the final accounting form on airSlate SignNow?

Businesses can expect increased efficiency, better accuracy, and enhanced compliance when using the final accounting form on airSlate SignNow. The platform minimizes errors by automating calculations and ensures that all necessary signatures are collected without delay.

-

Is there a mobile version of the final accounting form in airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly version of the final accounting form, allowing users to create, send, and sign documents on-the-go. This flexibility ensures that you can manage your financial forms anytime and anywhere, enhancing productivity.

Get more for Final Accounting Form

Find out other Final Accounting Form

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template