Amount Exempt Earnings Form

What is the Amount Exempt Earnings

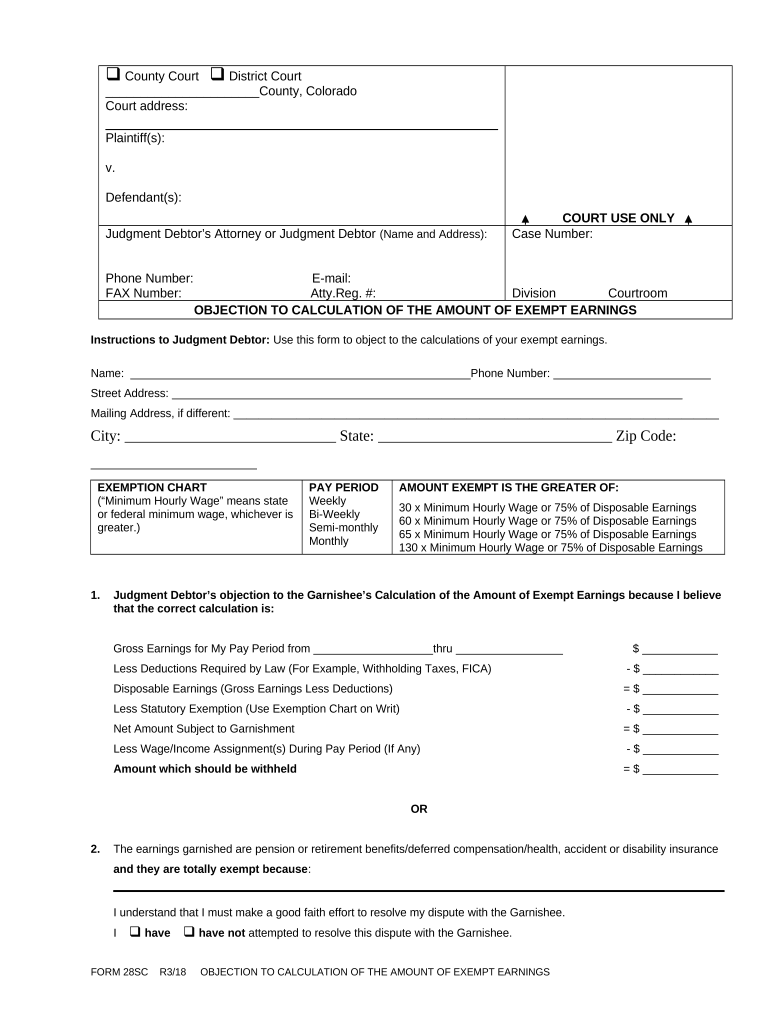

The amount exempt earnings refers to a specific threshold of income that is not subject to taxation or certain deductions. This figure can vary based on various factors, including state regulations and individual circumstances. Understanding this concept is crucial for individuals and businesses alike, as it can significantly impact financial planning and tax obligations. The amount exempt earnings is particularly relevant for self-employed individuals, freelancers, and those with variable income streams.

How to use the Amount Exempt Earnings

Using the amount exempt earnings effectively involves calculating your total income and identifying which portions qualify for exemption. This process typically includes reviewing income sources, such as wages, self-employment income, and other earnings. Once you determine your total earnings, you can subtract the exempt amount to arrive at your taxable income. This calculation is essential for accurate tax reporting and ensuring compliance with IRS guidelines.

Steps to complete the Amount Exempt Earnings

Completing the amount exempt earnings form involves several key steps:

- Gather all relevant financial documents, including income statements and tax returns.

- Identify the specific amount exempt from your total earnings based on current tax laws.

- Fill out the form accurately, ensuring all figures are correct and reflect your financial situation.

- Review the completed form for accuracy before submission.

- Submit the form through the appropriate channels, whether online or via mail.

Legal use of the Amount Exempt Earnings

The legal use of the amount exempt earnings is governed by federal and state tax laws. It is essential to ensure compliance with these regulations to avoid penalties. The IRS provides guidelines on what constitutes exempt earnings and how they should be reported. Individuals must stay informed about any changes in tax legislation that may affect their exempt earnings status.

Examples of using the Amount Exempt Earnings

Examples of using the amount exempt earnings can include various scenarios:

- A freelancer who earns $50,000 in a year may find that $10,000 of that income qualifies as exempt, reducing their taxable income to $40,000.

- A self-employed individual may utilize the exempt amount to offset business expenses, ensuring they only pay taxes on their net income.

IRS Guidelines

The IRS provides specific guidelines regarding the amount exempt earnings, detailing what qualifies for exemption and how to report it. These guidelines help taxpayers understand their obligations and rights when it comes to exempt income. Familiarizing oneself with these regulations is crucial for accurate tax filings and avoiding potential issues with the IRS.

Quick guide on how to complete amount exempt earnings

Prepare Amount Exempt Earnings effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Amount Exempt Earnings on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Amount Exempt Earnings with ease

- Find Amount Exempt Earnings and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Amount Exempt Earnings and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are amount exempt earnings in relation to airSlate SignNow?

Amount exempt earnings refer to income that is not subject to taxation under certain conditions. With airSlate SignNow, you can streamline your documentation for making claims about these exempt earnings. The platform helps you eSign necessary documents easily, ensuring compliance while saving you time.

-

How can airSlate SignNow help businesses manage their amount exempt earnings?

AirSlate SignNow provides a simple solution for businesses to document and sign agreements related to amount exempt earnings. With customizable templates and eSignature features, you can efficiently manage your paperwork, reducing the risk of errors and ensuring accuracy in your financial reporting.

-

Is there a monthly fee for using airSlate SignNow for amount exempt earnings documentation?

AirSlate SignNow offers flexible pricing plans, allowing you to choose the option that best fits your needs when managing your amount exempt earnings. Our pricing is transparent and competitive, designed to accommodate businesses of all sizes. You can try the platform for free to see how it aligns with your requirements.

-

What features does airSlate SignNow offer for handling amount exempt earnings?

AirSlate SignNow boasts a variety of features tailored for handling amount exempt earnings. These include customizable templates, automated workflows, real-time document status tracking, and secure eSigning capabilities. Together, these tools help simplify the management of your financial documents.

-

Can airSlate SignNow integrate with accounting software for amount exempt earnings?

Yes, airSlate SignNow seamlessly integrates with various accounting software to help you track and manage your amount exempt earnings efficiently. These integrations ensure that your financial data is synchronized and readily accessible. This feature simplifies the documentation process, allowing for better financial oversight.

-

What benefits does airSlate SignNow provide for managing taxes related to amount exempt earnings?

Using airSlate SignNow for documenting amount exempt earnings can enhance your tax management efforts. The platform makes it easier to gather necessary signatures and keep your records organized, which is crucial during tax season. Additionally, having a clear audit trail can simplify the process of demonstrating compliance with tax regulations.

-

How does airSlate SignNow ensure the security of documents related to amount exempt earnings?

AirSlate SignNow prioritizes document security by implementing advanced encryption and secure cloud storage for all your documents, including those related to amount exempt earnings. Our platform ensures that your sensitive information is protected from unauthorized access, giving you peace of mind as you manage your paperwork.

Get more for Amount Exempt Earnings

Find out other Amount Exempt Earnings

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast