It 209 Form

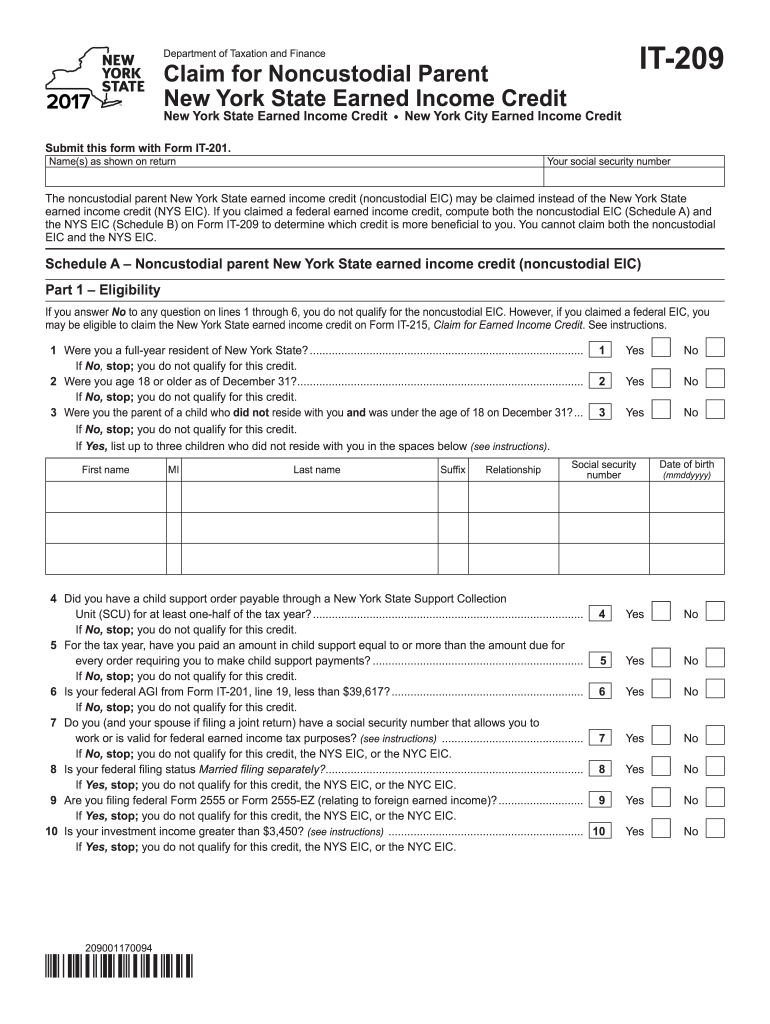

What is the IT-209?

The IT-209 is a tax form used in the United States, specifically for reporting certain tax-related information to state authorities. This form is essential for individuals and businesses that need to comply with state tax regulations. It captures crucial financial data that helps determine tax liabilities and eligibility for various credits or deductions. Understanding the purpose and requirements of the IT-209 is vital for accurate tax reporting and compliance.

Steps to Complete the IT-209

Completing the IT-209 involves several key steps to ensure accuracy and compliance. Here’s a detailed breakdown:

- Gather Required Information: Collect all necessary financial documents, including income statements, previous tax returns, and any relevant deductions or credits.

- Fill Out Personal Information: Start by entering your name, address, and Social Security number on the form.

- Report Income: Accurately input all sources of income, including wages, self-employment income, and any other taxable earnings.

- Claim Deductions and Credits: Identify and apply any deductions or credits you are eligible for, as these can significantly affect your tax liability.

- Review for Accuracy: Double-check all entries to ensure there are no errors or omissions that could lead to complications.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in person, as specified by state guidelines.

Legal Use of the IT-209

The IT-209 must be completed in compliance with state tax laws to be considered legally binding. This means that all information provided must be accurate and truthful, as any discrepancies can lead to penalties or audits. Additionally, the form must be signed and dated by the taxpayer, affirming that the information is correct to the best of their knowledge. Understanding the legal implications of submitting the IT-209 is essential for avoiding potential legal issues.

Form Submission Methods

There are several methods available for submitting the IT-209, allowing taxpayers to choose the most convenient option for their needs:

- Online Submission: Many states offer an electronic filing option, which allows taxpayers to submit the IT-209 directly through a secure online portal.

- Mail: Taxpayers can print the completed form and send it via postal mail to the designated state tax office. Ensure that you use the correct address to avoid delays.

- In-Person: Some individuals may prefer to deliver the form in person at their local tax office, where they can receive immediate confirmation of submission.

Key Elements of the IT-209

The IT-209 contains several key elements that are crucial for accurate tax reporting. These include:

- Personal Identification: Information such as your name, address, and Social Security number.

- Income Reporting: Sections dedicated to reporting various types of income, including wages and self-employment earnings.

- Deductions and Credits: Areas to claim any applicable deductions or tax credits that can reduce your overall tax liability.

- Signature Section: A place for the taxpayer to sign and date the form, affirming the accuracy of the information provided.

IRS Guidelines

While the IT-209 is a state-specific form, it is important to be aware of IRS guidelines that may affect its completion. Taxpayers should ensure that their reporting aligns with federal tax laws and regulations, as discrepancies between state and federal filings can lead to complications. Familiarizing oneself with IRS requirements can help ensure that the IT-209 is completed correctly and in compliance with all applicable laws.

Quick guide on how to complete where to send form it 209

Complete It 209 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Handle It 209 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to alter and eSign It 209 with ease

- Obtain It 209 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Edit and eSign It 209 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Who do I send this W9 form to after I fill it out? Then what happens?

Send the W-9 to the business that asked you to complete it.Then the business will have your social security number or employer identification number so it can prepare a 1099 to report the income it gave you after year end.

-

Does it cost money to fill out a form to send money to a military person on active duty overseas?

No, scammers will try to tell you it costs money for everything pertaining to the military but it does not.

-

After filling out the PAN card form online, which address do I need to send it to?

If you have e-verify done for your PAN card then you dont need to send it as a hard copy.else send a hard copy with required docs attached with to below address :INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited)5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997 /8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

-

Do I need to fill out a custom form (specifically PSForm 2976) to send my letter from USA to China (is it optional)?

Letters do not need a customs form. The forms are for when you are sending merchandise that has value. Do not put items in letter envelopes. The machines that process letters are likely to destroy them.

Create this form in 5 minutes!

How to create an eSignature for the where to send form it 209

How to create an eSignature for your Where To Send Form It 209 online

How to make an eSignature for your Where To Send Form It 209 in Chrome

How to generate an eSignature for putting it on the Where To Send Form It 209 in Gmail

How to generate an electronic signature for the Where To Send Form It 209 from your smartphone

How to generate an electronic signature for the Where To Send Form It 209 on iOS devices

How to create an electronic signature for the Where To Send Form It 209 on Android

People also ask

-

What is airSlate SignNow and how does it relate to It 209?

airSlate SignNow is a powerful document signing solution that helps businesses streamline their signing processes. Specifically, the It 209 feature allows users to efficiently manage electronic signatures, ensuring compliance and ease of use. With airSlate SignNow, you can send and eSign documents securely, making it a vital tool for businesses looking to enhance their workflow.

-

How much does airSlate SignNow cost for users interested in It 209?

The pricing for airSlate SignNow is designed to be cost-effective, especially for businesses utilizing the It 209 feature. Plans vary based on the number of users and features needed, with options for monthly or annual billing. For specific pricing details related to It 209, it’s best to visit the airSlate SignNow pricing page to find the plan that suits your business needs.

-

What are the key features of airSlate SignNow related to It 209?

Key features of airSlate SignNow that enhance the It 209 experience include customizable templates, real-time tracking of document status, and secure cloud storage. These features empower users to manage their electronic signatures effectively while ensuring compliance with legal standards. Additionally, robust mobile access allows for document signing on the go, enhancing business efficiency.

-

Can airSlate SignNow integrate with other software for managing It 209?

Yes, airSlate SignNow offers seamless integration with various applications, enhancing its functionality for managing It 209. You can connect it with popular tools such as CRM systems, project management software, and cloud storage services. This integration ensures that your document signing process is streamlined and fits perfectly into your existing workflow.

-

What benefits does airSlate SignNow provide for businesses using It 209?

Businesses using airSlate SignNow for It 209 enjoy numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform’s user-friendly interface simplifies the signing process, allowing for quicker approvals and decision-making. Ultimately, this leads to improved productivity and cost savings for your organization.

-

Is airSlate SignNow secure for handling sensitive documents related to It 209?

Absolutely, airSlate SignNow prioritizes security, especially for sensitive documents managed through It 209. The platform employs advanced encryption protocols and complies with industry standards to protect your data. With features like two-factor authentication and secure cloud storage, you can confidently send and eSign documents without worrying about data bsignNowes.

-

How easy is it to get started with airSlate SignNow for It 209?

Getting started with airSlate SignNow for It 209 is incredibly easy. Simply sign up for an account, choose a plan that fits your business needs, and start creating templates for your documents. The intuitive interface and helpful onboarding resources ensure that even users with minimal technical experience can quickly learn how to utilize the It 209 features effectively.

Get more for It 209

Find out other It 209

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will