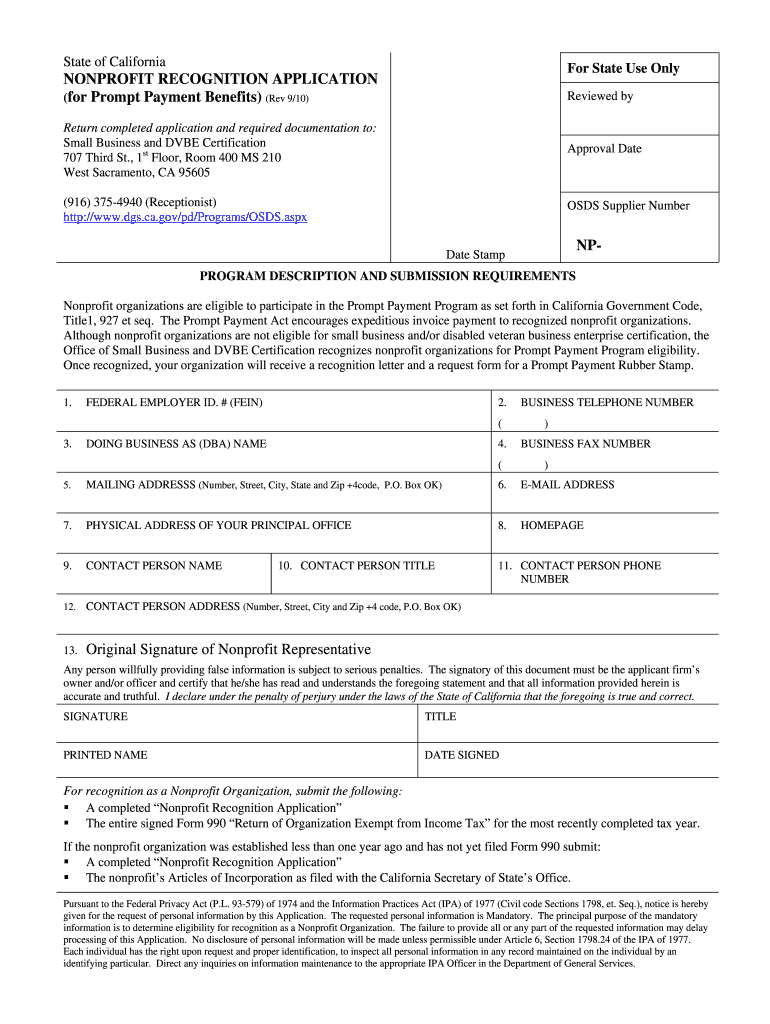

State of California Non Profit Recognition Application Form

Understanding the California DBA Form

The California DBA form, also known as the fictitious business name statement, is essential for businesses operating under a name different from their legal entity name. This form is required to ensure transparency and protect consumers by informing them of the true owners behind a business. Completing the DBA form accurately is vital for compliance with state regulations and to avoid potential legal issues.

Steps to Complete the California DBA Form

Filling out the California DBA form involves several key steps:

- Gather necessary information, including the business name, address, and the owner’s details.

- Check the availability of your chosen business name to ensure it is not already in use.

- Fill out the DBA form completely, providing all required information accurately.

- Submit the form to the appropriate county clerk’s office, either in person or via mail.

- Pay the required filing fee, which may vary by county.

Legal Use of the California DBA Form

The California DBA form serves a legal purpose by allowing businesses to operate under a name that is not their registered entity name. This form must be filed with the county where the business is located, and it helps to protect consumers by ensuring they can identify the true owners of a business. Failing to file a DBA can result in penalties and complications when conducting business.

Required Documents for Filing the California DBA Form

When filing the California DBA form, certain documents may be required:

- A completed DBA form with accurate information.

- Identification documents for the business owner or owners.

- Proof of address for the business location.

It is advisable to check with the local county clerk’s office for any additional requirements specific to your location.

Form Submission Methods for the California DBA Form

The California DBA form can be submitted through various methods:

- In-Person: Visit the local county clerk’s office to file the form directly.

- By Mail: Send the completed form along with the filing fee to the appropriate county office.

- Online: Some counties may offer online filing options through their official websites.

Eligibility Criteria for Filing the California DBA Form

To file a California DBA form, the following eligibility criteria must be met:

- The business must be located in California.

- The chosen business name must not be misleading or already in use by another registered entity.

- All owners of the business must be identified on the form.

Understanding these criteria ensures that the filing process goes smoothly and complies with state regulations.

Quick guide on how to complete state of california non profit recognition application form

Prepare State Of California Non Profit Recognition Application Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the features you require to create, edit, and eSign your documents swiftly without delays. Handle State Of California Non Profit Recognition Application Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign State Of California Non Profit Recognition Application Form with ease

- Find State Of California Non Profit Recognition Application Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of California Non Profit Recognition Application Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms does a non-resident need to fill to file state returns for California? Also, can an international student file state returns in California online using TurboTax as a non-resident?

What "resident" means for California taxes is different from what it means for federal taxes, which is in turn different from what it means in other contexts. You are generally a "resident" for California tax purposes if you live in California.California full-year residents use Form 540 (or 540 2EZ). California nonresidents and part-year residents use Form 540NR (long form or short form).

-

Is Bingo limited to non-profit organizations in the state of California?

California ConstitutionArticle IV, Legislative, Sec. 19.(c) Notwithstanding subdivision (a), the Legislature by statute may authorize cities and counties to provide for bingo games, but only for charitable purposes.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

What would be involved in setting up a non-profit to give money to other non-profits in the state of California?

If all you want to do is set up a non-profit corporation but don't want donations to the non-profit to be tax deductible, and are ok with paying taxes should the non-profit happen to turn a profit in a particular year, then you can file incorporation papers just with the state and get it taken care of fairly quickly, probably within a week or two max.However, if you want to be tax-exempt as well as non-profit, you will need to apply to the IRS as well. A determination on tax-exempt status, once your application is filed and complete, will typically take several months.

Create this form in 5 minutes!

How to create an eSignature for the state of california non profit recognition application form

How to generate an electronic signature for your State Of California Non Profit Recognition Application Form online

How to generate an electronic signature for your State Of California Non Profit Recognition Application Form in Google Chrome

How to make an electronic signature for signing the State Of California Non Profit Recognition Application Form in Gmail

How to generate an electronic signature for the State Of California Non Profit Recognition Application Form right from your mobile device

How to create an electronic signature for the State Of California Non Profit Recognition Application Form on iOS

How to create an eSignature for the State Of California Non Profit Recognition Application Form on Android OS

People also ask

-

What is a California DBA form PDF?

A California DBA form PDF is a document that allows businesses to register a fictitious business name in California. This form is essential for any company operating under a name that differs from its legal name and helps establish brand identity and credibility.

-

How can I obtain a California DBA form PDF?

You can obtain a California DBA form PDF from the California Secretary of State's website or through your local county clerk's office. Additionally, airSlate SignNow provides a convenient platform where you can easily download and fill out the form online.

-

Is there a fee for filing the California DBA form PDF?

Yes, there is typically a filing fee associated with submitting your California DBA form PDF. The fee varies by county, so it's important to check with your local county clerk for the exact amount before filing.

-

How does airSlate SignNow help with the California DBA form PDF process?

airSlate SignNow streamlines the California DBA form PDF process by allowing you to complete, eSign, and submit the document online. This eliminates the need for physical paperwork and ensures a hassle-free experience when registering your business name.

-

What features does airSlate SignNow offer for eSigning documents like the California DBA form PDF?

AirSlate SignNow offers features such as in-person signing, customizable templates, and secure cloud storage. These features make it easy to manage and eSign your California DBA form PDF and any other important business documents.

-

Can I integrate airSlate SignNow with other applications while managing my California DBA form PDF?

Yes, airSlate SignNow integrates seamlessly with various applications, such as Google Drive, Salesforce, and Microsoft Office. This integration simplifies the management of your California DBA form PDF alongside your other business tools.

-

What are the benefits of using airSlate SignNow for the California DBA form PDF?

Using airSlate SignNow for your California DBA form PDF offers numerous benefits, including a cost-effective solution, enhanced security, and ease of use. You can quickly move from document creation to eSigning without any friction.

Get more for State Of California Non Profit Recognition Application Form

Find out other State Of California Non Profit Recognition Application Form

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template