Quitclaim Deed from Corporation to LLC Connecticut Form

What is the Quitclaim Deed From Corporation To LLC Connecticut

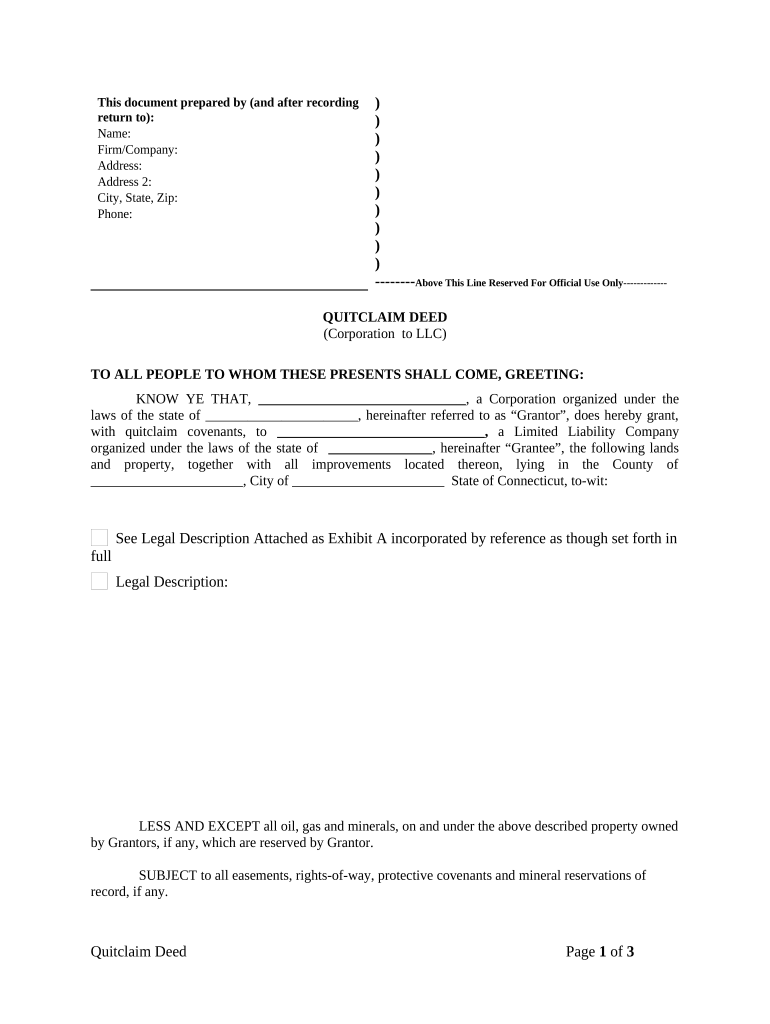

A quitclaim deed from a corporation to an LLC in Connecticut is a legal document that transfers ownership of real property from a corporation to a limited liability company (LLC). This type of deed does not guarantee that the property is free of liens or other claims; it simply conveys whatever interest the corporation has in the property. It is commonly used in business transactions where ownership is changing hands, allowing for a straightforward transfer of property rights.

Steps to Complete the Quitclaim Deed From Corporation To LLC Connecticut

Completing a quitclaim deed in Connecticut involves several key steps:

- Gather Necessary Information: Collect details about the property, including the address, legal description, and the names of the parties involved.

- Draft the Deed: Create the quitclaim deed, ensuring it includes the names of the grantor (corporation) and grantee (LLC), as well as the property description.

- Sign the Deed: The authorized representative of the corporation must sign the deed in the presence of a notary public.

- File with the Town Clerk: Submit the signed and notarized deed to the local town clerk’s office for recording.

- Pay Applicable Fees: Be prepared to pay any recording fees required by the town clerk’s office.

Legal Use of the Quitclaim Deed From Corporation To LLC Connecticut

The quitclaim deed serves a specific legal purpose in Connecticut. It is primarily used for transferring property without warranties, meaning the corporation is not liable for any issues related to the title. This type of deed is often used in business transactions where speed and simplicity are preferred. However, it is essential to ensure that the transfer complies with state laws and that all necessary disclosures are made to avoid future disputes.

State-Specific Rules for the Quitclaim Deed From Corporation To LLC Connecticut

In Connecticut, there are specific regulations governing quitclaim deeds. The deed must be in writing and signed by the grantor. Additionally, it must be notarized and recorded in the town where the property is located. Connecticut law also requires that the property description be clear and accurate to avoid any ambiguity regarding the transfer. Understanding these state-specific rules is crucial for ensuring a valid and enforceable quitclaim deed.

Required Documents for the Quitclaim Deed From Corporation To LLC Connecticut

To successfully execute a quitclaim deed from a corporation to an LLC in Connecticut, several documents are required:

- Quitclaim Deed: The primary document that outlines the transfer of property.

- Notarization: A notarized signature from the corporation’s authorized representative.

- Property Description: A detailed legal description of the property being transferred.

- Identification: Valid identification for the signatory to verify their authority.

Examples of Using the Quitclaim Deed From Corporation To LLC Connecticut

There are various scenarios where a quitclaim deed from a corporation to an LLC may be utilized:

- Business Restructuring: A corporation may transfer property to an LLC as part of a restructuring process.

- Asset Protection: Moving assets into an LLC can provide liability protection for the owners.

- Tax Benefits: Transferring property to an LLC may offer certain tax advantages depending on the business structure.

Quick guide on how to complete quitclaim deed from corporation to llc connecticut

Handle Quitclaim Deed From Corporation To LLC Connecticut seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Quitclaim Deed From Corporation To LLC Connecticut on any platform using airSlate SignNow's Android or iOS applications and streamline any document-dependent task today.

How to modify and electronically sign Quitclaim Deed From Corporation To LLC Connecticut effortlessly

- Obtain Quitclaim Deed From Corporation To LLC Connecticut and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Quitclaim Deed From Corporation To LLC Connecticut to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To LLC in Connecticut?

A Quitclaim Deed From Corporation To LLC in Connecticut is a legal document that allows a corporation to transfer property ownership to a limited liability company (LLC). This process helps in simplifying asset management and can be advantageous for tax purposes. Understanding the nuances of this deed is crucial to ensure proper legal compliance.

-

Why should I use airSlate SignNow for my Quitclaim Deed From Corporation To LLC in Connecticut?

Using airSlate SignNow streamlines the process of handling the Quitclaim Deed From Corporation To LLC in Connecticut. Our easy-to-use platform ensures that you can send, eSign, and manage documents securely and efficiently. Plus, our cost-effective solutions save you time and reduce your paper workload.

-

How much does it cost to create a Quitclaim Deed From Corporation To LLC using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business needs. While the cost may vary based on your selected plan, creating a Quitclaim Deed From Corporation To LLC in Connecticut on our platform is budget-friendly. You can review our pricing page for specific details tailored to your requirements.

-

Are there any specific features for handling Quitclaim Deeds on airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for handling Quitclaim Deeds From Corporation To LLC in Connecticut. These features include customizable templates, advanced eSigning options, and secure document storage. With our robust toolkit, you can ensure compliance and ease of use.

-

Can airSlate SignNow integrate with other software for managing Quitclaim Deeds?

Absolutely! airSlate SignNow offers seamless integration with various software tools that can assist in managing your Quitclaim Deed From Corporation To LLC in Connecticut. This includes CRM systems and document management platforms, allowing for efficient workflow and enhanced productivity.

-

How is the eSigning process for a Quitclaim Deed From Corporation To LLC handled through airSlate SignNow?

The eSigning process for a Quitclaim Deed From Corporation To LLC in Connecticut on airSlate SignNow is simple and secure. Once you upload your document, you can easily send it to signers with just a few clicks. Our platform ensures that each signature is legally binding, providing peace of mind throughout the process.

-

What should I consider before creating a Quitclaim Deed From Corporation To LLC in Connecticut?

Before creating a Quitclaim Deed From Corporation To LLC in Connecticut, consider the ownership details and any potential liabilities associated with the property. It's also essential to ensure that all parties involved are in agreement, as disputes can arise if communication is lacking. Consulting a legal professional can provide further insights and confidence in the process.

Get more for Quitclaim Deed From Corporation To LLC Connecticut

Find out other Quitclaim Deed From Corporation To LLC Connecticut

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now